Unicorns are privately owned business valued at $1 billion or more. The billion dollar tech start up, the stuff of which myths were made, may now be more of a reality. A quick look at the list of the world’s most valuable brands today tells the story of how Google, Facebook, Amazon, Tencent and Alibaba built successful brands and floated them for billions of dollars in a period of twenty years or less.

Unicorns are privately owned business valued at $1 billion or more. The billion dollar tech start up, the stuff of which myths were made, may now be more of a reality. A quick look at the list of the world’s most valuable brands today tells the story of how Google, Facebook, Amazon, Tencent and Alibaba built successful brands and floated them for billions of dollars in a period of twenty years or less.

Fortune’s list of the top 50 unicorns also shows that billion dollar tech start-ups are here to stay. Snap went public this year valued at $3billion, and any one of Uber, Xiaomi, Airbnb or Pinterest could be next. So how are these unicorn brands born – how does one go from an embryonic idea to floating for billions of dollars to creating a valuable brand?

The most successful unicorns rarely begin life as money making machines. They often start as a brilliant technology solution to an unmet consumer need or they purposefully or inadvertently tap into a changing consumer trend. Take BlaBlaCar as an example. Valued at $1.6 billion BlaBlaCar is the world’s largest long-distance carpooling community. It was founded on the understanding that Millennials value access more than ownership, and it uses technology to connect drivers willing to take on passengers to share the cost of the journey.

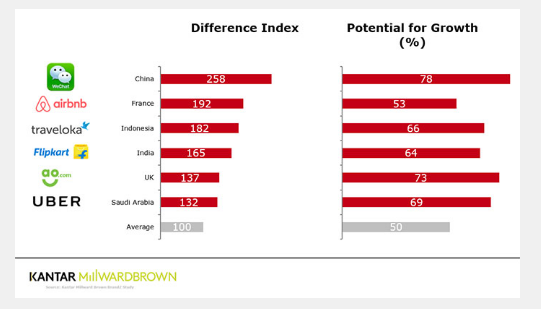

Contrast BlaBlaCar to ChaCha which was a free mobile answer service for people on the go. It was a human based search engine formed just before the smartphone era, when internet search engines could match keywords but were not so good at answering questions. Advancements in technology destroyed the consumer need the service was meeting and as a result ChaCha failed. So the first step on the road to being a global and financially viable brand is to ensure consumers think your brilliant solution for meeting an unmet need is different. This creates potential for value share growth.

Instagram significantly increased its level of spontaneous awareness in both the UK and US. However, in both markets Instagram’s Salience Index, which is the intensity of awareness in relation to its competitors, was largely unchanged. An emerging brand can and should maximise marketing budgets by running effective advertising so that it builds salience efficiently. A good example is Bukalapak, an e-commerce brand in Indonesia that managed to close the Google search gap on its more established competitor Lazada in this way.

The Ehrenberg Bass ‘laws of growth’ suggest that success from this point forward is now purely dependent on continuing to drive physical availability (distribution) and mental availability (salience). This may be true to a point but is not the entire truth. First, over emphasising salience ignores the contribution that premium margins make to brand growth. BrandZ™ data shows that the ability to command a premium is driven by meaningful difference not salience. This can be an important route to growth for an emerging brand. In the music streaming business, margins are very thin which requires high volume to be viable. This is a race that few can win and the success of brands like Spotify is at the expense of competitors such as Rdio.

Second, although salience is the biggest driver of growth in short term purchase cycle categories, BrandZ data shows that being meaningful is a bigger driver of volume growth in longer term purchase cycles. Being meaningful is about meeting consumer needs either functionally or emotionally. In this respect, product or service experience plays a crucial role. If done well, experience drives conversion, turning saliency into sales. Amazon Prime is a fantastic example of the importance of experience. 63% of Amazon Prime members convert on the site in the same session – five times the rate of non-Prime members.

Inevitably, an emerging brand reaches a stage where growth slows or stalls when technology moves on or is copied as larger competitors with more resources figure out how they can respond to meeting the same consumer need. It could also be that increasing scale brings new challenges that a business struggles to manage. It’s at this stage that building a brand becomes even more important. An emerging business must make a transition from being product and salience focused to building a meaningful consumer driven brand that appeals to more consumers. In addition, building a brand improves staff engagement, keeps a business focused and drives consistency. Aligning a business around serving a single-minded purpose, beyond making money, can be a nice way of shifting to a more consumer and brand centric business model. Of course this has to be done credibly and would ideally link to the consumer need that drove the business to begin with. Airbnb’s online marketplace and hospitality service has built rapidly around the purpose of helping people belong and feel at home anywhere. The challenge as Airbnb expands into ‘experiences’ and ‘places’ is to not lose sight of this purpose.

The final challenge as a brand grows is to build understanding of different consumer and market contexts so that a brand can subtly flex itself to local needs that are critical growth barriers or facilitators. It may require a fundamentally different business model, a tailored product offering or more nuanced advertising. For example, e-commerce retailers in India have to adapt to cash on delivery payment models driven by the financial infrastructure in the country. A non-tech example is the failure of Subway in Indonesia, where the brand didn’t recognise that any meal without rice is considered a snack. Subway was unable to translate its bread based product proposition, eventually closing. KFC did recognise this and offers rice on its menu to this day.

Action Points:

Build awareness smartly by maximising advertising ROI.

Balance saliency with meaningful difference – especially if you want to sustain long term margins.

Great product and service experience builds meaning and drives conversion.

Don’t wait too long to adopt a consumer centric, brand building model.

Understand the why of consumer and market context and adapt to local needs.

Written by Mark Chamberlain,Sector Managing Director Kantar Millward Brown