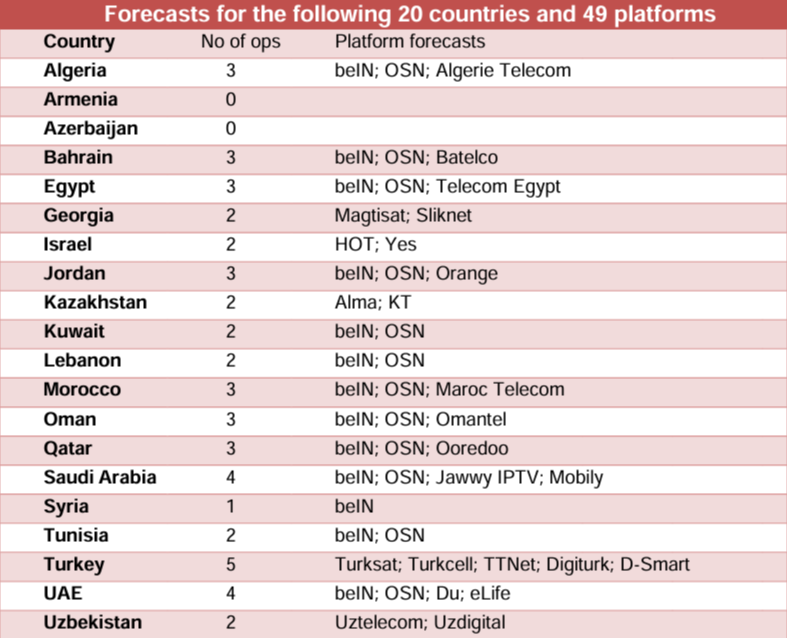

Middle East and North Africa Pay TV Forecasts

MENA’s pay TV revenues will fall by $1.6 billion between peak year 2016 and 2029, mainly due to the OTT push and widespread piracy. Pay TV revenues for 20 MENA countries will drop by 43% between 2016 ($3.8 billion) and 2029 ($2.2 billion). This comes despite the number of pay TV subscribers growing by 3 million over the same period to 18 million – so ARPUs will fall.

Thirteen of the 20 countries will lose revenues between 2023 and 2029. Turkey and Israel together will supply nearly half of the 2029 total.

Pay TV revenues for the 13 Arabic-speaking countries will be $802 million by 2029; half of the $1,570 million recorded in 2016. Turkish revenues will reach $707 million in 2029; $203 million lower than 2016. Pay TV revenues in Israel will drop from $1.14 billion to $376 million over the same period.

Pay TV penetration will fall slightly to 30% by 2029. Pay TV revenues will be flat at $26-27 million as competition cuts ARPUs. About three-quarters of the 301,000 TV households receive digital satellite signals. IPTV subs have overtaken satellite TV. Digital terrestrial switchover, using DVB-T2, was completed in 2013, although its impact is limited because of the ready acceptance of other platforms.

beIN renewed several key sports rights, which will help to push its pay TV subscriber numbers back up. Traditionally appealing to expatriates, OSN is attracting more local subscribers. It increased Arabic content to a quarter of the total. We estimate 14,000 satellite TV subscribers by end-2023.

Batelco started offering IPTV services via its FTTH network in September 2011. Batelco had 61,000 IPTV subs at end-2023. Batelco offers Netflix (BHD5.25/month) and Shahid VIP (BHD3.14/month).

Principally a mobile operator, STC (formerly called Viva) carries OSN+ (BHD4.20/month), STC TV (BHD3/month for 100 linear channels and 20,000 ondemand titles), Shahid VIP (BHD3.99/month) and Hindi-language Spuul (BHD2/month). STC is owned by Saudi Telecommunications Company.

Zain carries Zee5 (BHD1.90/month), Apple TV+ ($7.99/month), Viu (BHD2/month), OSN+ (BHD2.20-3.20/month) and Shahid VIP (BHD3.99/month). Zain is 55.4% owned by the Zain Group.

Simon Murray, Principal Analyst at Digital TV Research, said: “Legitimate pay TV penetration has always been low in most MENA countries, but the decline is accelerating as pay TV subscribers convert to OTT platforms.”