A new age of media is upon us. As a number of powerful media companies enter the streaming video marketplace in a very big way, choice in this promising arena has never been greater. The clamor to get involved in the streaming boom is certainly growing louder, but when it comes to determining successes and failures, the consumer is the ultimate decider.

A new age of media is upon us. As a number of powerful media companies enter the streaming video marketplace in a very big way, choice in this promising arena has never been greater. The clamor to get involved in the streaming boom is certainly growing louder, but when it comes to determining successes and failures, the consumer is the ultimate decider.

Content creators and platforms battling for audiences will be happy to know that consumers are willing to crown multiple champions. According to a special Streaming Wars edition of the Nielsen Total Audience Report, which serves as the industry’s premiere source of media truth across platforms, people and devices, consumers in OTT-capable homes are spending nearly one-fifth (19%) of their TV time streaming content, be it through ad-supported or paid subscription models. That’s a hefty amount of the already large media diet of audiences today, especially considering that the medium has only existed for a relatively short period of time. Not to mention, it’s a prime opportunity to easily reach consumers in the digital age, using interfaces that feel familiar and comfortable to them.

The report also notes that 60% of Americans subscribe to more than one paid video streaming service. Better still—especially for platforms entering the streaming market—is that 93% of U.S. consumers say they will either increase or keep their existing streaming services.

With the streaming arms race heating up and consumer attention still up for grabs, what factors are compelling people to not only retain their streaming subscriptions, but perhaps acquire new ones as well?

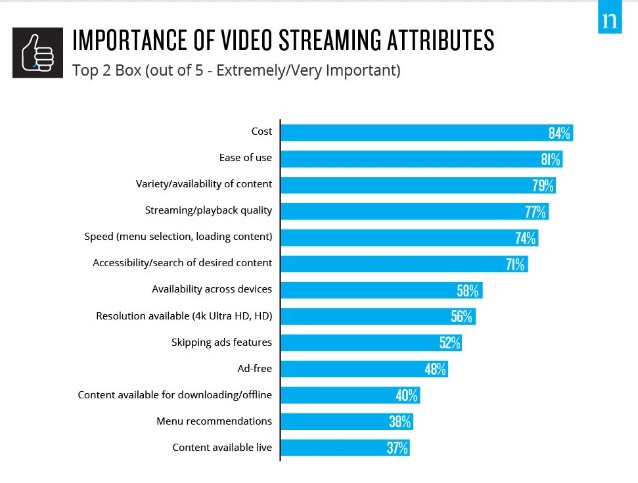

A consumer that doesn’t place cost as an important virtue is rare, and that’s no different in the streaming world. According to survey respondents, price is the most vital attribute for a quality streaming service. This puts the impetus on platforms to satisfy customers’ return on investment while being affordable enough for the rest of their media habits. In fact, when asked about what made them cancel a paid video subscription service, 42% said they didn’t use it enough to justify the cost.

42% OF RESPONDENTS SAID THEY WEREN’T USING A SERVICE ENOUGH TO MAKE THE COST WORTH IT

User-friendly interactivity plays a key role for streaming services and ranked second in consumer importance. Frustrating user experiences or hard to navigate interfaces may not bode well when it comes to subscriber retention, especially when the internet has cultivated a culture of convenience and consumers have a bevy of other media choices available to them. Of course, content is also of major importance for consumers, as the variety and availability of it placed in the top three of video streaming attributes.

While there’s myriad attributes that make a streaming service attractive to users, the content is what ultimately gets them to type out their credit card number and hit “Enter.” The top four reasons as to why survey participants decided to subscribe to additional streaming services were all content-based, with the top reason being to expand the content that they had available.

Content has always been king, but with the growth of streaming, content creators and rights owners are effectively given more power. Platforms must be able to maintain the programs that audiences want while offering compelling new ones to keep them interested. Wherever good content goes, subscribers will follow. When that content runs out, don’t be surprised when some of the subscribers do too: 20% of consumers said they canceled a service after watching all the content that they were interested in.

We’ve only just entered the first chapter of the Streaming Wars, but rest assured that the fight will continue. The platforms that can adapt to the marketplace may rise to the top; should they not continue to evolve nor expand their content libraries, then consumers just might replace them.