Pharma loses momentum: Q2 Top Stocks

NVIDIA, AMD, and Intel are some of the most-held stocks among UAE eToro users

● Big Tech names such as Snapchat, Adobe, Netflix, and Apple see decline in investor interest

● Pharma stocks also experience downturn as the pandemic recedes into the past

UAE retail investors continue to rally behind AI while Big Tech and pharma stocks lose momentum, finds the latest quarterly stocks data from trading and investing platform eToro.

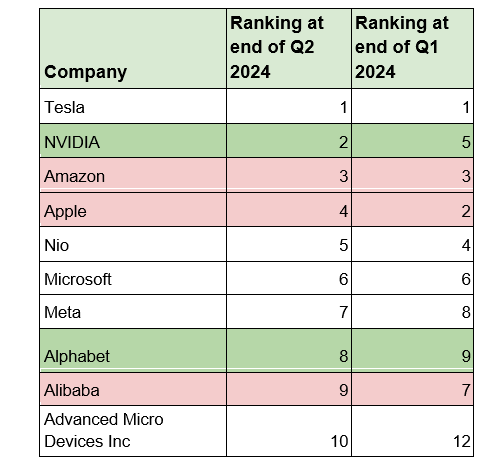

eToro looked at which companies saw the biggest proportionate change in holders, quarter-on-quarter on its platform (table 1), while also looking at the 10 most held stocks (table 2) in the UAE.

Amongst the most held stocks, Q2 saw a significant shift in the rankings, with NVIDIA rising to become the second-most popular stock on the eToro platform, behind only Tesla. The AI market leader ranked fifth at the end of Q1 and ninth three months earlier, and has continued to attract new users fuelled by another 37% surge in its share price over the latest quarterly period. Semiconductor company Advanced Micro Devices – AMD (+29%) also saw significant growth in users, as did Intel (+21%), which recently unveiled new AI chips in a bid to reclaim market share from NVIDIA and AMD . In addition, Palantir Technologies and Taiwan Semiconductor Manufacturing Company rose by 16% to feature among the top 10.

On the other hand, global technology companies such as Snapchat (-11%), Adobe (-16%), Netflix (-5%), and Apple (-5%) witnessed a decline in investor interest with workforce reductions reported across the sector .

Shows stocks most widely held by eToro users in the UAE and their position last quarter

Pharmaceutical stocks such as Moderna (-9%), Jaguar Health (-6%), and Pfizer (-5%) also experienced a downturn, as the Covid-19 pandemic and its after-effects receded into the past.

“The enthusiasm for AI giants underscores a collective investor belief in the transformative potential of artificial intelligence technologies. Investors are now favouring the promising advancements and higher growth potential within the AI sector over the established yet increasingly volatile traditional tech landscape,” explained George Naddaf, Regional Manager, GCC and MENA at eToro. “With the pandemic’s immediate impact fading and global travel resuming robustly, as evidenced by Dubai Airport’s resurgence as one of the busiest airports worldwide investor’s attention is also shifting away from pandemic-driven pharma gains towards sectors poised for substantial post-pandemic growth. This evolving investor sentiment underscores a broader trend of prioritising future-oriented, high-growth sectors over established, but currently less dynamic, industries.”