What just happened?

Warner Bros. Discovery (WBD) and Paramount are reported to have held preliminary talks on a possible merger. WBD CEO David Zaslav is said to have met with Paramount CEO Bob Bakish in New York, with press reports citing ‘sources familiar with the deal’ as stressing the very preliminary nature of the talks and the fact that they may relate to sale of certain assets rather than a full merger.

What would this mean for the industry?

Industry chatter that a wave of consolidation is about to kick off has become deafening in recent months. Paramount is usually cited as a potential target because of its smaller streaming scale compared to giants like Disney, Netflix and WBD with both studio-on-studio and big-tech on studio consolidation seen as likely routes. While Disney/Fox was perhaps the first of the new Hollywood mega-mergers, the pandemic got in the way of further activity. If WBD/Paramount now follows, it will surely ignite a round of further M&A of a scale seen only once in a generation with the end result being creation of the touted 3-5 global streamers with the scale to survive and thrive in the new global content and direct-distribution market. Such a round of consolidation would change the face of Hollywood forever.

Sony, which has remained resolutely independent from the streaming distribution side of the market would be the next logical target for M&A, leaving only NBCUniversal as an outlier. It’s global strategy to date has been a hybrid of old-school pay TV and streaming which may leave it on its own exploring the third way in its approach to the new global market. Following a round of content mega-mergers, the next step would surely be the combination of big tech with the newly engorged content giants. That would have parallels to the content-plus-distribution infrastructure mergers of the 90s and noughties.

What about content and scale?

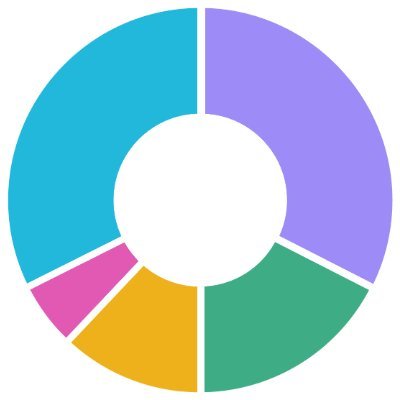

From a content perspective, Paramount has often been unfairly labelled as too ‘small’. In fact, Paramount’s content assets, which combine the power of Viacom, Showtime and CBS, are extensive and satisfy a broad range of demographics. The combination of Paramount+, Showtime, BET and Max/Discovery+ would result in a catalogue of more than 74,000 hours (based on current US catalogue size), placing it immediately in the top slot for scale in the US streaming market currently (for comparison, Hulu has 65,451 hours and Netflix has 31,798 hours), and slightly larger in size than a combined Disney+/Hulu catalogue following the removal of NBCUniversal content from Hulu.

For global subscriber scale, Paramount+ has less than half the scale of Disney+ with 63m customers (based on Q3 2023 and including Korean TVing operations) compared to Disney+’s 112m. Max reaches 41m with an additional 29m under HBO branded streaming services and 20m Discovery+. While there is undoubtedly some overlap, a combination would catapult the new entity to be at least equal in scale to Disney+. That would leave Netflix, Amazon, Disney and the new Paramount/WBD as the four major global players. The questions would then be two-fold: is there still room for a fifth? And does that force the hand of the remaining streamers and tech-led players of scale to seek their own combinations?

Is consolidation a foregone conclusion?

Ampere’s recent analysis of the finances of studio streaming businesses (see our recent report: The race to profitability: when will studio streaming pay?) suggests that all major studios will see a profit from streaming within 18 months, after which they begin to scale to significant cash-generating business units. Market demands for consolidation, driven by a desire for streaming to make, rather than just spend, money will doubtless quiet when this happens and the assumption that consolidation to achieve scale at all costs must occur will lessen.

Global streaming will always have a voracious appetite for fresh content, meaning scale plays will remain attractive, but it is far from a foregone conclusion that consolidation is a must for the studio direct streaming model to flourish. As advertising becomes an increasingly important part of the streaming equation and the free television business transitions to streaming (in the same way that the subscription business already has), additional growth opportunities will begin to emerge and a less frenetic approach to business, and to deal making, should follow.

Source: Ampere Analysis