Consumers Downloaded a Record 204 Billion Apps

Consumers Downloaded a Record 204 Billion Apps

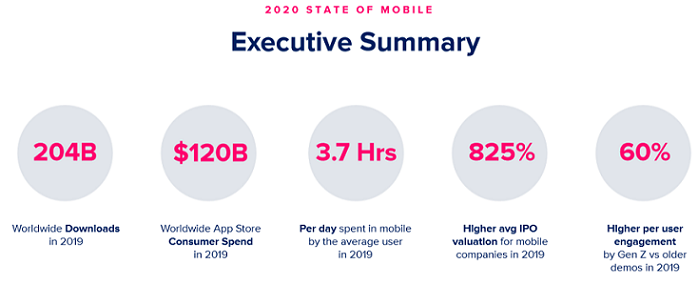

● Annual worldwide downloads have grown 45% in the 3 years since 2016 and 6% year over year, which is particularly impressive given this excludes re-installs and app updates.

● Downloads are largely fueled by emerging markets, including India, Brazil and Indonesia.

● Consumers in mature markets like the US, Japan and Korea have seen download growth level off, but are still seeking out new apps. Downloads in 2019 alone topped 12.3B, 2.5B and 2B in the US, Japan and South Korea, respectively.

Mobile Is Our Go-To Device, Capturing 3 Hrs 40 Min Per Day

● Across the markets analyzed, consumers are spending 35% more time in mobile in 2019 than 2 years prior.

● Mobile-first emerging markets like Indonesia, Brazil and India continue to spend the most time in mobile each day.

● France, India and Canada saw strong growth with the average user spending 25% more time in mobile each day in 2019 than in 2017.

Mobile-First Companies Saw 825% Higher Avg IPO Valuation

● The 3 largest initial public offerings (IPOs) in 2019 were companies with mobile as a core focus of their business: #1 Alibaba Group ($167.6B USD), #2 Prosus & Naspers ($100B USD), #3 Uber ($82.4B USD).

● Mobile-focused companies had a combined $544B valuation, 6.5x higher versus companies without a mobile focus.

● These are further indications that mobile is essential to succeeding with customers in 2020 and beyond

60% More Sessions Per User in Top Apps Than Older Demographics

● 98% of Gen Z (born 1997 – 2012) report owning a smartphone.

● Gen Z is expected to surpass Millennials as the largest generation by the end of 2019, comprising roughly 32% of the population.

● It is imperative to win Gen Z on mobile, or risk missing out on a mobile-native generation of consumers.

“Millennials and Gen Z have over $1 trillion in direct spending power, and will continue gaining influence in 2020 and beyond. In order to reach them, marketers need to take advantage of immersive mobile platforms like Snapchat, where we build engaging mobile experiences and drive powerful incremental reach among younger audiences.” Kathleen Gambarelli, Group Product Marketing Manager, Snapchat

2020 Is Set to Be Mobile’s Biggest Year, With Advertising Fueling Revenue

Mobile ad spend to reach $240B as brands harness mobile’s potential.

● The streaming wars will heat up in 2020 and consumers will decide where they spend their 674B hours on mobile.

● Apple Arcade and Google Play Pass will result in innovative new games for consumers and new revenue streams for publishers.

● 5G Is the next battleground, and gamers will be first to reap the rewards.

● Consumer and mobile ad spend to top $380 billion globally in 2020.

“As most growth marketers know all too well, driving performance through programmatic channels, be it CPA, ROAS or LTV, comes down to two things: (1) having a broad set of high quality unbiased, fraud-free user data, and (2) a rigorous practice for building and testing ad creatives. To successfully scale UA on mobile, marketers must invest equally in each.” Dennis Mink, VP Marketing, Liftoff

Mobile Gaming — All Other Gaming (Home Console, PC/Mac Gaming, Handheld Console)

● Mobile games in 2019 saw 25% more spend than in all other gaming combined.

● Call of Duty: Mobile and Mario Kart Tour launched on mobile in 2019 — evidence of console migrating to mobile to capitalize on the larger market.

● Mobile gaming extended its global lead in consumer spend to 2.4x PC/Mac gaming and 2.9x home game consoles in 2019.

● Mobile has democratized gaming, allowing for a portable gaming console to be in the pocket of nearly every consumer.

● Mobile gaming is on track to surpass $100B across all mobile app stores in 2020.

Globally, Consumers Are Migrating More of Their Financial Activities to Mobile

● Globally, consumers accessed Finance apps over 1 trillion times in 2019, up 100% from 2017. From stock management to mobile banking to payment apps, this showcases mobile’s central role in managing our daily finances.

● Loyalty and referral programs can help cultivate deeper engagement in finance apps. Citi reported 83% of consumers — and 94% of millennials — are more likely to participate in a loyalty program if it’s on mobile.

● Both Apple and Google have both recognized the power of mobile as our financial hub, with Google offering checking accounts and Apple offering a credit card.

User Base Growth of Top Fintech Apps Topped Traditional Banking Apps

● Globally, the average MAU of top 10 Fintech apps grew 20% year over year in 2019, while Banking MAU grew 15%. While Banking apps tend to have higher existing user bases, this illustrates Fintech’s disruption — enabled and accelerated by mobile — of traditional banking services.

● The key to mobile is ease, accessibility and simplicity. Features like face or finger recognition streamline the user journey. This underscores why companies can’t port over an existing experience to mobile. Mobile requires deliberate planning to meet consumers’ expectations.

● After all, a good mobile experience can make trading stock or transferring money as fun as leveling up in a game or as engaging as social media.

Shoppers Turn to Mobile for Research, Consideration, Purchase and Loyalty

● Increased time spent in Shopping apps is driven by both growing user bases and increased engagement.

● Global Shopping app downloads grew 20% from 2018 to 2019 to over 5.4 billion, an indication of strong demand.

● Time spent in Shopping apps in Indonesia grew 70% from 2018 to 2019 — highest among markets analyzed.

● With more companies adopting mobile platforms and experiences for their users, businesses are enhancing mobile experiences to streamline usability, personalization and services offered.

Brick-and-Mortar Retailers Made Strong Gains in Mobile Engagement

● Bricks-and-Clicks apps saw strong gains in total sessions year over year, often out-pacing Digital-First apps in their respective markets, a notable change from past years.

● However, among markets analyzed, Digital-First apps still had up to 3.2x more average monthly sessions per user than Bricks-and-Clicks apps in 2019.

● Mobile is central to growing retail businesses in 2020 — for both Brick-and-Mortar and E-Commerce brands. In Q3 2019, Nike’s digital business grew 42% — driven by mobile and app experiences.

● Nike has also focused on innovative app features that enhance the in-store experience, including product reservations and foot scanning technology to give shoppers an accurate shoe size.

Consumers Choose the Small Screen: Mobile Is Our Go-To Device for Entertainment

● Globally, consumers spent 50% more sessions in Entertainment apps in 2019 than in 2017.

● The ever-growing adoption of video streaming apps on mobile devices to watch movies, TV shows, and live events on-demand helped bolster demand for Entertainment apps.

● High quality streaming, growth in user-generated content, and offline mode becoming standardized were industry advancements that helped tip the scales from screen size to on-the-go viewing.

● Competition in the video streaming space will bolster better user experiences to drive growth in downloads, usage and revenue, and ultimately lead to partnerships and consolidation to win the wallets of consumers long term.

TikTok Tidal Wave: Time Spent Exceeded 68B Hours in 2019

● TikTok has grown to become both a social networking app and a source of entertainment, showcasing short, user-generated videos, often featuring lip-syncing or comedy. Musician Lil Nas X’s “Old Town Road” started as a meme on TikTok and went viral on the platform, landing at #1 and breaking Billboard Hot 100 records.

● Global time spent in TikTok grew 210% year over year in 2019, both from expanding user bases and increasing time spent per user. TikTok’s advertising platform positions this engaged and growing audience for brands to reach through videos designed to show value and entertain.

● 8 of every 10 minutes spent in TikTok in 2019 were by users in China, but the app’s usage has also skyrocketed in other markets.

Consumers Spent Over $2.2B in Dating Apps, 2x As Much As in 2017

● Tinder dominates for global consumer spend in dating apps. Tinder was the 2nd highest non-gaming app for consumer spend over the last decade, seeing strong success from in-app subscriptions.

● While the most popular dating apps are still growing, companies are also growing by creating a portfolio of apps that cater to a variety of dating interests, as opposed to trying to fit all needs in one app, such as JSwipe, Single Parent Meet, Chispa, and OurTime.

Ride-Sharing Apps See Strong Growth in Total Rides in 2019

● Ride-sharing apps saw strong growth in sessions in most markets analyzed, with South Korea being the main outlier.

● UK is the most concentrated market among those analyzed. It will be interesting to see if the November 2019 licensing changes in London will impact this in 2020.

● As sessions continue to grow, more mobility options proliferate. Some come from larger players looking to diversity (e.g. JUMP by Uber), while others are focusing solely on a sub category such as scooter-sharing (e.g Bird).

Consumers Turned to Mobile to Stream Their Favorite Sports Matches

● Globally, time spent in sports apps has grown 30% from 2017 to 2019.

● However, during the same time period, total megabytes used has grown 80%. This indicates that sports fans are increasingly turning to mobile to stream matches — whether from a connected device casting to a TV or on-the-go from their always-on device: their smartphone.

● In the US, ESPN and MLB.com at Bat were the top two sports streaming apps, respectively, by time spent on Android phones in 2019. In the UK, the top two were BBC Sport and Sky Sports, and in Japan the top two were Sports Navi and DAZN.

● 5G stands to lead to advancements in augmented sports viewing in 2020 and the years to come.

Consumers Spent 130% More Money in Health and Fitness Apps in 2019 vs 2017

Globally, consumers spent $1.5B in Health and Fitness apps in 2019.Mobile offers new pathways to meal planning, training regimes, exercise tracking and wellness and meditation — carving into the time and money spent at the gym.

● Growth in engagement and spend were strongest in APAC among markets analyzed. Consumers in China spent 330% more in Health and Fitness apps and in South Korea, 570% more time in them from 2017 to 2019.

● Cashwalk, a pedometer app, saw incredible growth in time spent in Korea at 175% year over year.