Mobile-banking is a popular way to bank on the go, with 47% of global respondents saying they’ve checked an account balance or recent transaction on their mobile device in the past six months. While paying bills, checking account balances and transferring funds from a mobile device may be convenient and easy, security is an ever-increasing consideration—and a critical barrier to success.

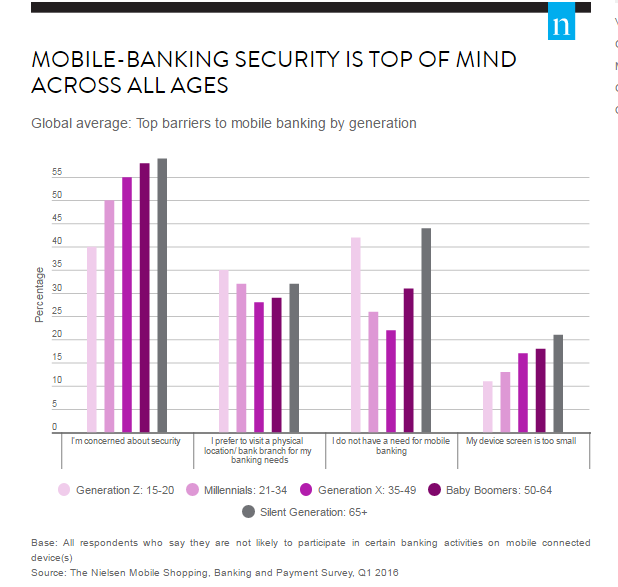

For most, cybersecurity concerns could be a deal breaker. In fact, among global respondents who say they’re not likely to participate in mobile-banking activities, security concerns top the list of mobile-banking barriers, cited by 53%. In addition, roughly three in 10 say they don’t use mobile banking tools because they prefer physical locations (31%) or don’t see a need for mobile-banking tools (28%). Interestingly, while self-reported mobile-banking usage varies widely by age and region, the primary barriers are remarkably similar across geographies and generations.

“Security concerns are highly emotional,” said Stuart Tagg, Financial Services Leader, Nielsen Europe. “Mobile-banking services have incorporated many features to protect customers’ financial information, but the threat of hacks and data breaches is real, and many consumers have a general uneasiness about sharing personal information digitally. While banks continuously monitor security threats and incorporate new measures to protect customers’ assets, they also need to better educate customers about the steps they’re taking, so customers believe their information is as secure on their mobile device as it is in a physical branch location. In the long-term, we believe concerns about fraud and security are initial hitches that will be overcome. The value mobile banking presents for consumers far outweighs the reason not to participate.”

Convincing customers to use mobile banking tools instead of visiting a branch or simply going online on a computer, however, is more difficult. Robust features and functionality that ensure customers can complete the same activities—and more—on their mobile devices as they can in person or online is essential in driving adoption.

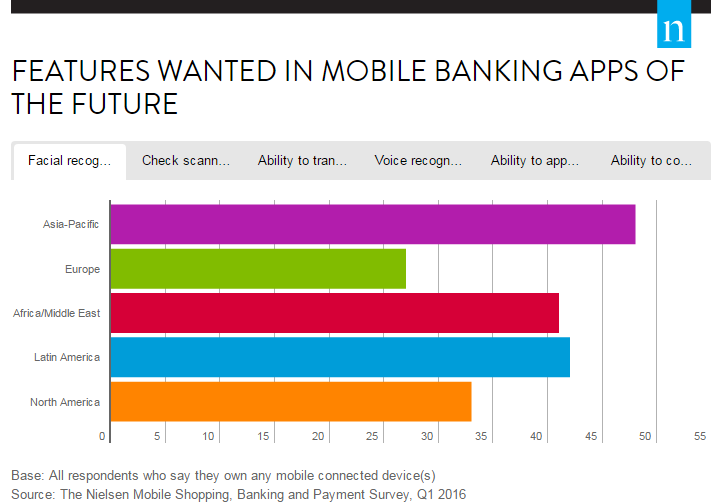

Which features do mobile device owners want in future banking apps? Facial recognition and check scanning and deposit technology are the most popular features, cited by 41% and 39% of global respondents, respectively. Respondents in Asia-Pacific are particularly enthusiastic about these features, while those in Europe and North America are below the global average. Slightly fewer global respondents (37%) want the ability to transfer money to other accounts or other people, with the highest percentage in Africa/Middle East (44%). This region also exceeds the global average—along with Asia-Pacific (40%) and Latin America (38%)—when it comes to wanting the ability to interact with their bank on social media via a mobile app.

Other findings include:

Millennials are more than twice as likely as Baby Boomers and Silent Generation respondents to say they’re likely to use a mobile-only bank.

Among global respondents, 74% say they appreciate the freedom of being connected anywhere, anytime, and 70% strongly or somewhat agree that their mobile device has made their life better.

Mobile-only banking is most popular in developing countries with large unbanked populations; usage rates are highest in India (46%), Indonesia (37%), Mexico (34%) and Turkey (34%).

More than one-third of global respondents say they’re highly likely to transfer money to (36%) and/or receive money from (34%) another person using their mobile device in the next six months.