Though mobile shopping habits are on the rise, there’s certainly a method to the madness, as global consumers are also using digital tools to monitor their spending and manage their finances.

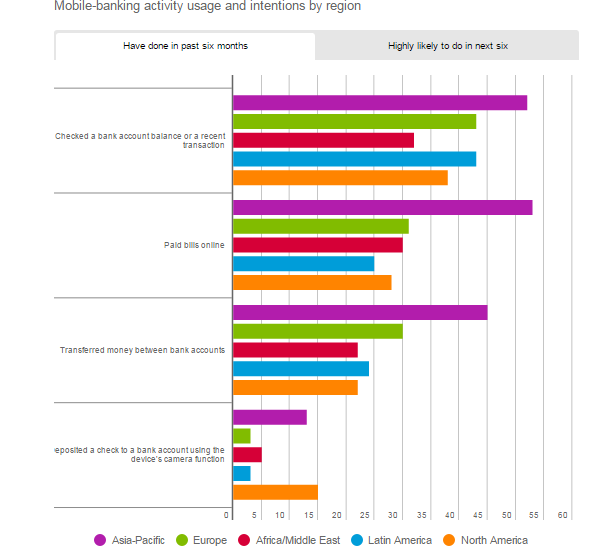

Certain mobile-banking activities, such as accessing account information and paying bills, are quite common. Nearly half of global respondents (47%) say they checked an account balance or a recent transaction on their mobile device in the past six months, and 42% say they paid a bill using their mobile device. Participation in these activities will likely be even higher in the near future: 53% of global respondents say they’re highly likely to check a bank account balance or recent transaction, and 46% say they’re likely to pay bills on their mobile device in the next six months.

Moving and depositing money are less common mobile-banking activities, but still just over one-third of global respondents (36%) say they transferred money between their own bank accounts on a mobile device in the past six months. More respondents (42%) expect they’ll transfer money between bank accounts in the next six months. Only 10% of global respondents, however, say they’ve deposited a check using their device’s camera function; 18% expect to do so in the next six months.

Asia-Pacific exceeds the global average when it comes to self-reported participation in mobile-banking activities, while response rates are lower in Europe, Africa/Middle East and Latin America. North America is also below the global average when it comes to current and future participation in mobile banking, with one exception: The region has the highest percentage of respondents who say they’ve deposited a check using their device’s camera function (15%) and the second-highest percentage who expect to do so in the next six months (23%, just behind Asia-Pacific at 24%). This may be due in part to the relatively high usage and acceptance of checks in the region compared with other countries. In the U.K., for example, most banks don’t provide checkbooks and most retailers don’t accept checks. And in the Middle East, cash remains king, while checks are less common.

The countries with the highest self-reported rates of participation in mobile banking are diverse. They include several developing markets, such as China, South Africa, Venezuela and India, and also more mature markets, such as Sweden.

“In some developing markets, usage is primarily driven by rural consumers that have the ability to access financial services without traveling to physical locations. They can also send money instantly to those who may be financially dependent on them,” said Stuart Tagg, Financial Services Leader, Nielsen Europe. “In China, widespread adoption of credit cards has not caught on, and many people don’t use banks at all. Consequently, Chinese financial institutions are leaders in offering many mobile money options. Sweden is a unique developed market that is ahead of the rest of the world when it comes to adopting mobile banking and mobile transactions. The strength of online and mobile banking in this market has been driven by high smartphone adoption and collaboration between the banks and government to establish BankID, a single digital security system used across financial and government services.”

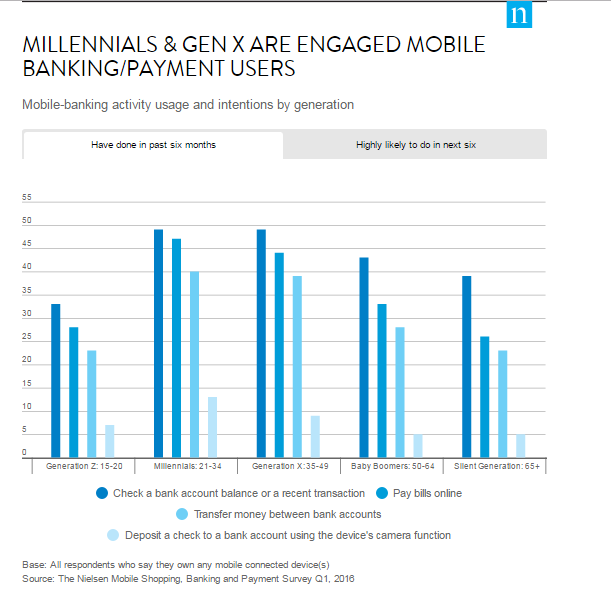

Not surprisingly, Millennials lead the way when it comes to mobile banking. Of all age groups, Millennials have the highest percentages who say they’ve participated in banking activities and say they plan to in the next six months. Generation Z follows closely behind.

Other findings include:

Among global respondents, 74% say they appreciate the freedom of being connected anywhere, anytime, and 70% strongly or somewhat agree that their mobile device has made their life better.

Millennials are more than twice as likely as Baby Boomers and Silent Generation respondents to say they’re likely to use a mobile-only bank.

Mobile-only banking is most popular in developing countries with large unbanked populations; usage rates are highest in India (46%), Indonesia (37%), Mexico (34%) and Turkey (34%).

Security concerns top the list of mobile-banking barriers (53% of global respondents), followed by a preference for physical locations (31%) and not needing the service (28%).

Facial recognition software (41%) and check scanning/deposit technology (39%) are the most commonly cited features that mobile device owners want to see in future banking apps.

More than one-third of global respondents say they’re highly likely to transfer money to (36%) and/or receive money from (34%) another person using their mobile device in the next six months.