Pokémon Go has turned into a bona fide phenomenon, as the game — launched just last week — rocketed to the No. 1 top-grossing app in the US App Store in just 14 hours, according to SensorTower data shared with BI Intelligence.

Pokémon Go has turned into a bona fide phenomenon, as the game — launched just last week — rocketed to the No. 1 top-grossing app in the US App Store in just 14 hours, according to SensorTower data shared with BI Intelligence.

For context, it took Clash Royale just less than three days; Mobile Strike six-and-a-half months; and Game of War: Fire Age a year and a half to achieve the same.

Moreover, Pokémon Go has accumulated a number of very impressive user statistics:

In the US, the game has been downloaded more than 2 million times on iOS devices, generating roughly $1.6 million in daily revenue from in-app purchases, according to SensorTower. Across both iOS and Android, the game has more than 7.5 million downloads in the US alone.

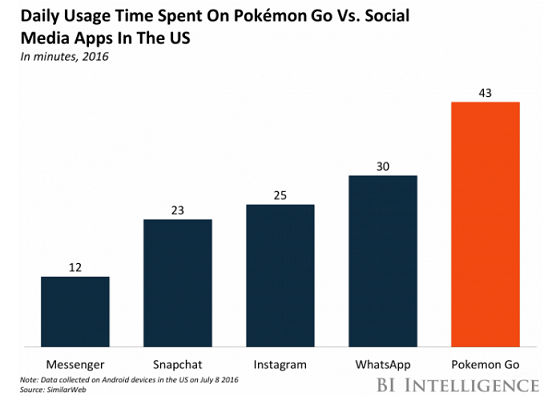

Pokémon Go is being used more than WhatsApp and Instagram, according to SimilarWeb. On average, users in the US are spending 43 minutes each day on Pokémon Go, compared with 30 minutes on WhatsApp, and 25 minutes on Instagram.

What separates Pokémon Go from the multitude of other apps already available?

Built upon the existing databases of Niantic’s AR game, Ingress, there is nothing particularly innovative about Pokémon Go. However, the game leverages a number of features already built into smartphones to help it continuously engage users, in turn providing increased opportunity to generate revenue through in-app purchases, notes Phunware.

Camera functions and AR: Pokémon Go works by superimposing images of Pokémon onto a user’s immediate environment using a mobile device’s camera. This technology is already available on most high-end devices. As the technology is used more widely and as smartphone processors advance, AR/VR capabilities will increase. It’s therefore important that developers begin thinking about the ways they can involve AR concepts into their apps.

GPS location data: Players are required to move around to different parts of their city to find different types of Pokémon. For example, water-based Pokémon require players to travel to rivers, lakes, water fountains, and other bodies of water to capture them. The game also requires users to travel to designated points of interest to virtually collect items needed to play the game. Pokémon Go can collect and use this data to derive more accurate insights into players’ user habits.

Sensor connectivity: Aside from GPS location, players can also add a tethered Pokémon Go Plus wearable that alerts them whenever a Pokémon is nearby. These value-adds, which give users a rest from holding their smartphones, provide an in-app experience while engaging users beyond their mobile devices.

What can app developers learn from Pokémon Go?

While it’s too early to tell whether Pokémon Go is a fad, its massive success is a proof of concept for developers and will likely open the floodgates to a plethora of apps leveraging similar technology and in-game activities. Publishers and marketers alike can learn from what Pokémon Go has done well in order to ensure the highest ROI:

Take advantage of what smartphones already offer. Smartphones are already replete with built-in technologies, such as location services, Bluetooth, and cameras that can be used to collect detailed user-behavior data. This can then be sold to advertising companies and used in targeted ads. Publishers should make use of these contextual technologies to generate a more personalized in-game experience for users based on their habits and location, for example.

Leverage users’ environments. The integration of AR and mobile technology is blurring the lines of gaming and reality. This adds a certain level of fun to the in-app experience as well as a point-of-difference. Brands can use the technology to interact with users in a contextual way, such as by applying sponsored ad filters to the camera screen advertising a deal on in-app experiences. However, it’s imperative that brands don’t annoy users with irrelevant advertisements or notifications.

There is great potential for integrating location-based tech into gameplay. Retailers are increasingly using beacons to drive interactions with users. For example, when a consumer enters a store that has a beacon activated, it could communicate with the consumer’s phone to send a push-notification about a deal that brand has. Beacon interactions can have a massive effect on store sales: BI Intelligence estimates that the addressable market for beacon-influenced consumer packaged goods is 13% of total US sales within the category, or $35 billion. Again, publishers should be careful in ensuring that the technology is used sparingly and in a contextual and relevant manner, or they risk inundating users with push notifications and driving them away.