Vuclip Hits 5 Million Monthly Subscribers;

Vuclip Hits 5 Million Monthly Subscribers;

Insights indicate that the Mobile phone has become the preferred Platform of Choice for a growing consumer audience

Vuclip, the world’s largest independent mobile video and media company, today reported the most significant mobile video trends for 2014 including those related to consumer behavior, popular content and mobile operating systems and devices. Also notable is that Vuclip is experiencing rapid subscriber growth for its premium products and has hit 5 million monthly subscribers who are now enjoying long and short form premium unbuffered video content.

Top Three Mobile Video Trends of 2014

Here are the year’s top trends in consumer behavior related to viewing mobile video:

· Mobile is becoming the first and preferred screen

67 percent of 12,000 global survey respondents prefer mobile as their primary method for watching their favorite movies, music videos, and TV shows, while only 20 percent of men and 29 percent of women still prefer their televisions.

· People are increasing the time they spend watching mobile video

80 percent of respondents watch mobile videos at least once every 2-3 days, with more than half opting to watch daily. 85 percent of men and 75 percent of women said they will increase the amount of time they watch videos on mobile in the future.

· The overall experience, from unbuffered viewing to ease of payment, is critical

73 percent of men and 61 percent of women said it is important that the video not buffer while they are watching it; with 54 percent of men and 49 percent of women saying they would pay to download videos just to avoid buffering. 65% of men and 54% of women prefer the ease of paying through their mobile carrier to purchase mobile videos; followed by credit/store payment and net banking payment, respectively.

Popular Regional Content & Search Terms in Q4 of 2014

For this past quarter, consumers from South East Asia, the Middle East, and the Indian Subcontinent remained engaged with market-focused films, shows and songs. Here are some specifics:

· Users in India consumed a wide variety of content this past quarter, from a clip comparing Bollywood actresses Katrina Kaif and Deepika Padukone in their new films to a video about two Bangalore girls who beat up two bikers who were bothering them, as well as other Bollywood trailers and movie reviews.

· Middle East viewers watched many clips from the third season of Arab Idol, as well as new shows from MBC such as Desert Force, Driven, Al Hokm and Happens in Egypt. Also, this past quarter, Vuclip introduced Tagalog content, which pushes Tagalog music and TV entertainment into the top genres consumed in the region.

· Southeast Asia saw renewed interest in the local pop group Geisha surrounding its 10th anniversary live show, in addition to the hot celebrity wedding of Raffi and Gigi, as well as the usual sports and gossip content.

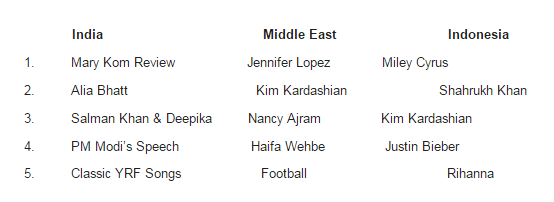

Additionally, the most common search terms provide a snapshot of what was on the minds of viewers this quarter. Celebrities are always a hit:

Mobile Operating System and Device Trends

2014 also saw some major shifts in terms of devices that people used to connect to Vuclip. Android is on a tear in emerging markets driven by the rapid proliferation of low cost smartphone devices in these markets. Additionally, consumers increasingly prefer higher resolution, large screen devices. Smaller Android phones such as the Galaxy Y – not to mention Blackberries and Symbian handsets – gave way to higher resolution offerings such as the Galaxy S IV, phablets such as the Galaxy Note I/II/III and finally full tablets, led by the iPad. Established Blackberry handsets declined in share on Vuclip. Despite limited market opportunity in emerging markets, the iPhone almost doubled in usage with the older 4/4S entering these regions, alongside the more accessible 5C, which Apple added in the last generation. Some country-specific trends related to Vuclip viewership are as follows:

· India — Micromax arrived in force, erupting from a few dozen models in January to over a hundred distinct handsets by the end of 2014. In addition to Micromax, other domestic manufacturers such as Karbonn, Intex and Spice made their mark, capturing market-share ceded by declining manufacturers such as Sony, LG and Nokia.

· United Arab Emirates — A traditionally mixed market, the Blackberry Bold and Nokia E/N Symbian lines ceded share on Vuclip to the iPhone, Galaxy S IV, and the various Blackberry 10 handsets.

· Indonesia — Android has held and further developed a dominant position in Indonesia. Samsung leads the market for Android in Indonesia, with strong performances from the main lines – S, Note and Tab – supported by the Ace and Core.

“2014 saw mobile video viewing exploding in growth and becoming the primary form of entertainment for many consumers in emerging markets,” said Arun Prakash, COO, Vuclip. “Our rapid subscriber growth is a testimonial to the fact that people in these markets highly value an excellent viewing experience and compelling content tailored to this medium. And they are willing to pay for the same.”

Prakash continued, “With the rapid adoption of low cost smartphones and increasing accessibility of the mobile Internet, no doubt 2015 will bring tremendous momentum to the mobile video economy. We are enabling transformation in the way people consume entertainment in these markets. We feel both pride and responsibility and that’s what drives us to continue to innovate to deliver a superior mobile video on demand experience to consumers.”

Methodology

The trend statistics in this report were gathered from Vuclip user surveys predominantly of users from India, Southeast Asia and the Middle East. Users were provided with multiple-choice questions and had the option to opt out. No incentives were provided for responding. The information gathered for the top searches and operating system and device trends comes as a result of our ability to collect anonymous information about what users are searching for, the handsets they are using and the country they’re in. When we aggregate that data, it makes for a compelling snapshot of trends in the mobile world.