KOLs and live-streaming now integral to social commerce in China: Ebiquity report

Ebiquity launches a new report to guide marketers on maximizing return on influencer marketing

The report covers 7 steps that can help advertisers successfully leverage the power of KOLs

Ebiquity plc, the world leader in media investment analysis, announced today the release of its latest report, “How to maximise your return on Influencer Marketing in China”. Advertisers who want their brands to succeed in China should consider key opinion leaders (KOLs) as a key plank of their country-wide marketing strategy.

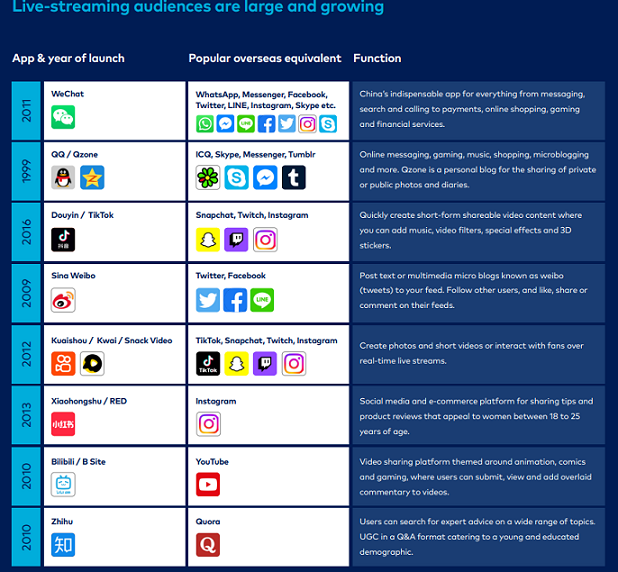

As the largest social media market in the world, China has a penetration rate of 66%, representing 28% of the global social media population. China’s social media market has evolved quickly over the past few years, propelled in part by the stratospheric rise of key opinion leaders (KOLs) and live streaming, which has permanently altered the social landscape.

Today, social commerce is heavily reliant on live-streaming sales, and that means advertisers who want their brands to succeed in China should consider KOL live-streaming as a key plank of their country-wide marketing strategy. This report looks into the evolution of KOLs and livestreaming in China’s social media market and its growing relevance in the country’s advertising market today. As with most campaigns, planning is crucial, but marketers need to follow best practices in navigating a fragmented market of over 10 million KOL accounts across more than a dozen different major social media platforms. Setting the right KPIs for these KOLs is also key since the market is relatively new and cost transparency is still uncommon.

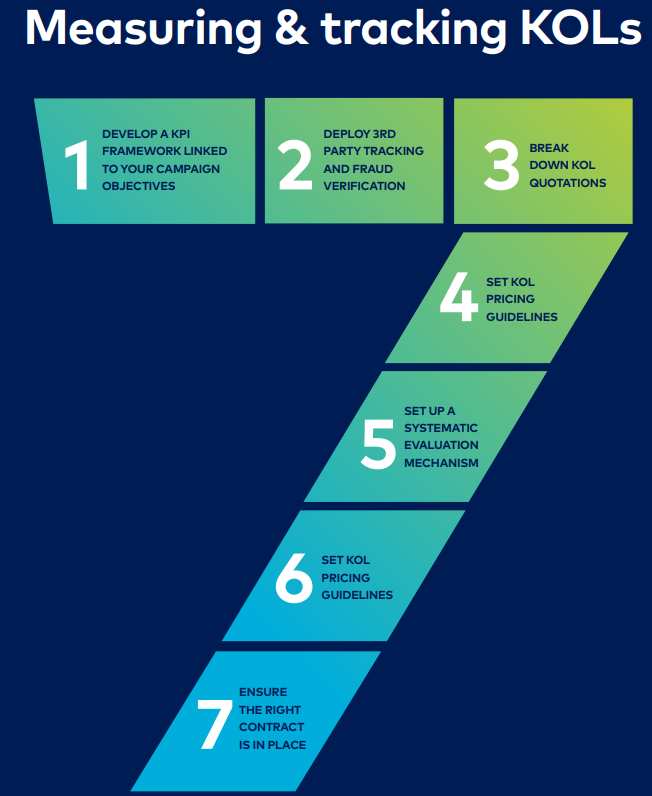

Advertisers will therefore need to understand the finer points of KOL monitoring and selection. This report covers 7 steps that can help advertisers successfully leverage the power of KOLs. These include developing a KPI framework; deploying 3rd party tracking and fraud verification; breaking down KOL quotations; setting guidelines; agreeing to a systematic evolution and agency remuneration model; and finally, ensuring that the right contract is in place.

And most importantly, work with the right local partners. While we look into some of the most effective third-party KOL agencies and analytics firms in the market today, marketers are also encouraged to do their own research. It’s clear that KOL marketing and live-streaming is set to become a dominant platform and ecosystem in China going forward, and marketers will need to hone their craft in this new integrated channel to boost sales and future-proof their brand’s relevance with the next generation of consumers.

“KOL marketing and live-streaming is set to become a dominant platform and ecosystem in China going forward,” said Stewart Li, Managing Director, Ebiquity China. “Marketers need to hone their craft in this new integrated channel to boost sales and future-proof their brand’s relevance with the next generation of consumers.”

Today, social commerce is heavily reliant on live-streaming sales, which means advertisers who want their brands to succeed in China should consider KOL live-streaming. Having conducted dozens of KOL performance audits and benchmarking projects over the years, Ebiquity’s China team has identified best practices, risks, and attention areas that advertisers should look out for when considering KOL live-streaming.

This report covers 7 steps that can help advertisers successfully leverage the power of KOLs. These include developing a KPI framework; deploying 3rd party tracking and fraud verification; breaking down KOL quotations; setting guidelines; agreeing to a systematic evolution and agency remuneration model; and finally, ensuring that the right contract is in place. And most importantly, work with the right local partners.

Influencer marketing in China is extra-ordinary. Our research finds top 15% of all KOLs in China generate return on investment six times more than the average ROI”, said James Gong, Vice-President of Datastory. “We suggest advertisers take a closer look at the effectiveness of their campaigns. And seek ROI maximization opportunities from KOL selection and content optimization.”

Navigating China’s KOL market is fraught with obstacles and pitfalls. From a KOL placement and measurement perspective, marketers face a number of significant challenges. The first is the nature of the market itself. With over 10 million KOL accounts across up to nine different major social media platforms, the market is incredibly fragmented and decentralised. Note as well that media buyers are not negotiating with media channels—they are dealing with individual persons, which can be a very different experience from traditional media and channel selection and comes with its own challenges.

The second challenge is tracking and measurement. With traditional online media, invalid traffic (IVT)—that is, activity that may represent either accidental or outright fraudulent clicks or impressions—can eat into marketing costs and siphon advertising budgets. However, KOL tracking layers on an additional risk of invalid engagements (IVE), which often involves fake followers spamming artificial bot engagements. And every second, there are over 3,000 posts on Sina Weibo alone, which makes tracking and measurement incredibly complex.

Finally, advertisers often run into the perennial problem of transparency. With over 100,000 multi-channel network (MCN) agencies in China, marketing professionals have to negotiate with complicated and opaque KOL buying chains, with little visibility or detailed breakdown over what exactly the client is purchasing. Rate cards and standardised cost quotations are not common practice, and the cost of a KOL placement can often be bundled in with other below-the-line activities without the knowledge of the buyer.

Having conducted dozens of KOL performance audits and benchmarking projects over the years, we’ve identified a series of best practices, risks and attention areas that advertisers should look out for. We’ve combined these insights into seven key aspects that will hopefully offer marketers a more comprehensive model to get started, covering the entire end-to-end process of KOL buying and management.

Conclusion

KOLs and Livestreaming are a relatively new marketing ecosystem and can be quite challenging to negotiate. The insights outlined in this report should offer a solid primer for advertising

professionals ranging from veteran marketers looking to emulate best practices to new entrants looking for some guidance on how to get started.

But this is only a start. Ultimately, there’s no substitute to proper due diligence in choosing the right local partners and platforms that fit your business strategy. A good partner can make or break a KOL campaign, helping you eliminate fraud, set the right KPIs, find suitable KOLs, minimise your fees and ensure you hit your targets.