In this piece, we round-up the key trends and insights our data uncovered in the media, content and agencies world in 2021.

Media consumption has changed – what does it look like now?

The COVID-19 pandemic has upended the global media industry. Among other things it has shut down cinemas in many countries; caused entertainment giants to invest more heavily in streaming content; created mass layoffs in media and advertising agencies; and accelerated the year-on-year decline in traditional newspapers and magazines.

YouGov’s International Media Consumption Report for 2021 – the first of its kind – explores this industry at a unique point in its history. Using Cube data combined with specific, deep-dive custom research, it examines 17 different global markets: from content subscription services in India to advertising in the US and beyond.

A few takeaways from the international study include:

Streamed video grew in the US (up 5-percentage points) and UK (up 8-points) as people adapted to their new realities of working remotely and spending more time at home. Podcast listenership also surged in the US (from 39% to 43%) and UK (from 27% to 33%).

While fewer people listened to the radio in the US (down 8-points), but they tuned in more on their smartphones and computers. This marked a major shift in the occasions for listening and how frequently people are listening throughout the day.

Significant shares of US and UK consumers say they used social media platforms more often amid the pandemic and TikTok was one of the fastest growing social brands among young consumers over the past year.

Throughout the year, YouGov looked at consumer adoption of streaming services and the differences between key streaming audiences. In one example, we examined the intersection of streaming and advertising attitudes among British consumers to help advertisers segment and better connect with different types of heavy streamers. YouGov conducted a similar study in the US to help marketers engage with American audiences who vary by their opinions on advertising.

To keep pace with watching behaviors, we also analyzed the success of popular shows this year such as Squid Game and Ted Lasso. Squid Game was one of Netflix’s big winners on the year and was watched by 25.9 million US viewers in the 14 days following its release, according to YouGov Stream, a fully opt-in data tool that provides insights into SVOD and AVOD viewership across multiple platforms.

And in a brand new report, we measured the potential reach of streaming platforms in 2021 with the greater aim of understanding how consumers perceive product placement.

YouGov’s Product Placement White Paper 2021 looks at how popular product placement is with audiences in the US and Great Britain. It looks at consumer awareness and consideration for this type of advertising among people who use streaming services such as Netflix, Hulu, Amazon Prime Video and Disney+.

Which brands won 2021?

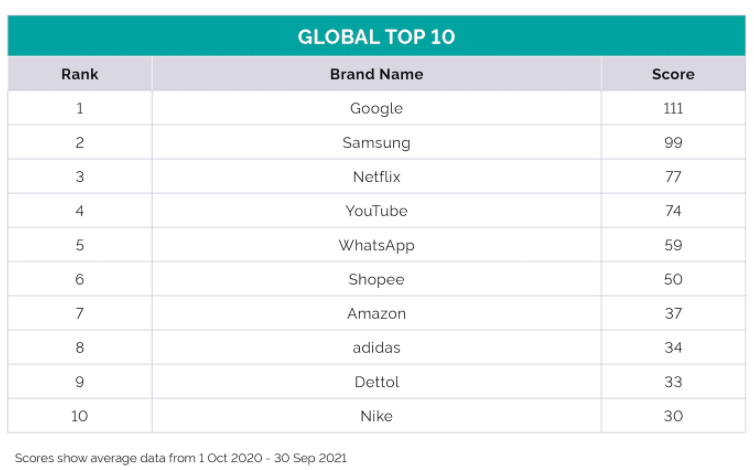

Every year, YouGov measures the top performing brands around the world in our Best Brand Rankings 2021.

From the brands that people relied on for communication and entertainment to those that improved people’s health and life at home, the most highly ranked brands this year all enriched people’s lives in some way and helped them adjust to the pandemic.

Here are highlights from our analysis of the top brands this year:

Globally, technology brands continue to dominate as Google, Samsung, Netflix, YouTube and WhatsApp were the most positively perceived brands. Get the full list of global winners here.

Band-Aid and Dawn topped the list of Best Brands in the US, while Pfizer and CeraVe showed the most improvement and have the most momentum going into 2022. See how the top performing US brands did it.

Netflix and Marks & Spencer led the Bet Brand Rankings in the UK, with Thomas Cook and Disney+ being top improved brands over the last year. Explore the full list of the UK’s Best Brands here.

On-demand webinar: Hear from M&S, Whirlpool & Octopus Energy as they discuss how they made it into the UK’s Best Brands of 2021

Looming changes to data privacy

Consumers have become increasingly concerned about who controls their personal data in recent years, however, and laws have been passed in places around the world forcing websites and companies to be transparent about how they collect and use people’s data.

The looming elimination of third-party cookies will have a major impact on the digital advertising landscape, forcing businesses to shift away from third-party data and, in turn, evaluate other sources to identify potential customers and inform their advertising strategy.

To help brands prepare for the rapid shifts in data collection and the privacy climate, YouGov looked at how loyalty programs can help provide insight into consumer attitudes and engagement, while also creating meaningful interactions with consumers as part of a value exchange.

Below are a few key takeaways from the analysis:

Consumers say it’s fair to share personal data if they get something valuable in return (88%).

People like when brands offer discounts and personalized benefits based on their purchase history (68%).

A separate study also looked at a real-world example of McDonald’s customer base, how this audience feels about loyalty programs and why the debut of McDonald’s Rewards program couldn’t have been timelier for the brand.

And on the topic of data privacy, one of the most visible impacts of data privacy regulations are pop-up cookies disclosures.

YouGov asked consumers in 17 markets about what they do upon seeing cookie disclosures. Our analysis revealed that consumers covered by the General Data Protection Regulation (GDPR) in countries such as Poland, Spain, the UK and Sweden are more likely to agree they always ‘accept all’ cookies after being asked for consent.