The 18% rise forecast this year means UK adspend will reach annual total of £27.7bn

The latest Advertising Association/WARC Expenditure Report, the only source to collect advertising revenue data across the entire media landscape, predicts that UK adspend will grow by 18.2% this year to reach a total of £27.7bn. This is an upward revision from the 15.2% rise forecast in April and includes an estimated 54.7% rise during the second quarter of the year – by far the highest on record albeit coming on the back of an exceptional downturn due to the pandemic.

This growth will recover the entirety of 2020’s £1.8bn decline and is expected to precede a 7.7% rise in 2022, by when the market will be worth a record £30bn. The projected figure of 18.2% growth this year would be the largest rise on record, surpassing the previous high of 15.9% growth set in 1988.

Ancillary forecasts from WARC also suggest that the UK is on course to achieve the fastest ad trade recovery of any major European market this year, and one of the strongest growth rates across 100 global markets.

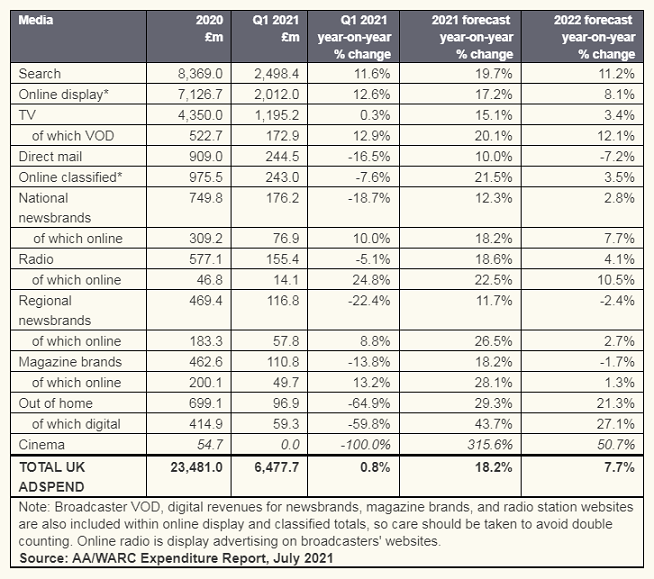

Adspend growth forecast for all media in 2021

Particularly strong results are expected for the media most adversely affected by the pandemic, namely cinema at +315.6%, out of home at +29.3%, of which digital out of home at +43.7%. Online classified investment is set to rise by a fifth (21.5%).

Online display – inclusive of social media and online video – is set to see growth accelerate this year (+17.2%), as is the case for search (+19.7%). TV adspend is expected to increase by 15.1% in 2021 (a significant upward projection from the 8.8% forecast in April), reflective of increased activity during the Euros.

The picture in Q1 2021

The latest dataset includes actual adspend figures for Q1 2021, which show UK advertising spend rose 0.8% to £6.5bn during the first three months of the year. This is behind the 1.8% rise estimated in April.

Online formats – most notably search, online display and BVOD – were seen to grow by double-digits during the quarter. Out of home spend was down by almost two thirds and cinemas remained closed as the UK adhered to lockdown and social distancing restrictions.

Among other industries that also saw year-on-year decline in Q1 were direct mail (-16.5%), national newsbrands (-18.7%) and regional newsbrands (-22.4%).

Caroline Dinenage, Culture Minister said: “It is brilliant to see that, following a record year, the future of UK advertising is set to deliver bright prospects for the entire media landscape. With the UK having the fastest growth in Europe, we should take pride in the excellence of this industry and its vital contribution as we build back better from the pandemic.”

Stephen Woodford, Chief Executive, Advertising Association commented: “These are hugely encouraging figures for the UK advertising industry and reflect the strong outlook in the wider economy. Advertising is a vital engine for growth, with each £1 invested in advertising delivering £6 back to GDP. The upward growth revision in spend growth this year – to reach a record of 18.2% – would mark an exceptional recovery, after the record declines in 2020.

“UK adspend growth also looks set to race ahead of European markets, reflecting the success of the vaccine rollout and fast-rising corporate and consumer confidence. The UK is the global hub for advertising and will also benefit from faster growth in major export markets for UK advertising services. If the AA/WARC expenditure estimates turn out as forecast, then the ad industry will contribute strongly to the nation’s economic resurgence this year and into next.”

James McDonald, Head of Data Content, WARC commented: “Seventy pence in every pound spent on UK advertising is invested in digital formats, a rate which accelerated greatly last year and is now surpassed only by China. It is these formats that will lead absolute growth over the coming terms and none more so than paid search, which is seen to be benefitting from burgeoning e-commerce trade.

“Our forecast update since April is demonstrative of the current strength of this sector in particular, though it is notable that online formats across the board are set to see growth after a tumultuous 2020. That the ad market will generate more value this year than before the crisis is testament most to its role within the lives of the connected consumer.”