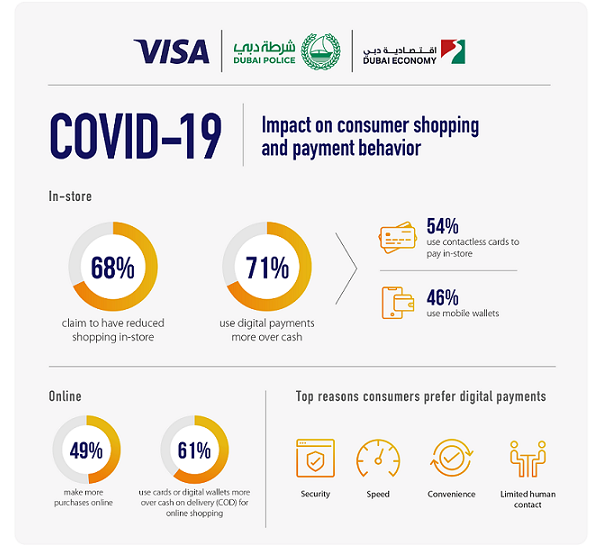

Current pandemic climate: 71% of consumers report increased use of digital payments when shopping in-store; 1 in 2 consumers (49%) in UAE shopping more online, with 61% of them using cards and digital wallets to pay instead of Cash on Delivery (COD)

Current pandemic climate: 71% of consumers report increased use of digital payments when shopping in-store; 1 in 2 consumers (49%) in UAE shopping more online, with 61% of them using cards and digital wallets to pay instead of Cash on Delivery (COD)

Post-COVID-19 outlook: 43% will continue using contactless payments; 48% will opt for digital payments online over COD for future eCommerce purchases

Survey release marks launch of fifth annual Visa “Stay Secure” social media campaign – this year in partnership with Dubai Police and DED

Dubai Police, Dubai Economy (DED), and the world’s leader in digital payments, Visa (NYSE: V), today released findings of a survey on the impact of COVID-19 pandemic on payment behavior of consumers in the UAE. The survey also looks at consumers’ general views, preferences and concerns related to digital payments and offers key insights for merchants.

The survey release corresponds with the launch of Visa’s fifth annual “Stay Secure” – this year in partnership with both Dubai Police and DED – social media campaign on Facebook (@VisaMiddleEast @DubaiPolice) and Instagram (@VisaMiddleEast, @DubaiPolice @DubaiDED) to promote safe digital payment practices. This year’s campaign comes at a time when more consumers in the UAE have increased their use of digital payments, and many opting to shop online for the first time to get what they need during this health crisis. The Stay Secure webpage has tips and educational videos, and information on security features of digital payments.

COVID-19: Impact on Consumer Shopping and Payment Behavior

Sixty-eight percent of respondents surveyed in the UAE have reduced shopping in-store since the outbreak of the pandemic and 49% are shopping online more. When they do shop at stores, 71% are using digital payments over cash with the majority using contactless cards (54%) and mobile wallets (46%) more. For respondents shopping more online, the majority (61%) use cards or digital wallets more to pay online over COD. Increased trust in the security of the payment technology, speed, convenience and limited human contact, were the top reasons cited for their increased preference for digital payments.

The New Normal?

These shifts in consumer behavior caused by the pandemic are expected to be the “new normal” as more consumers gain confidence in digital payments. Forty-three percent of consumers surveyed believe they will continue to use contactless payments more in-store post the pandemic and 48% said they will continue to opt more for paying online with card or digital wallet over COD.

Brigadier Jamal Salem Al Jalaf, Director of Criminal Investigation Department in Dubai Police, said: “Combatting cybercrime by raising awareness and vigilance among UAE residents is a unified goal across all our government entities. Fraudsters are seeking to take advantage of people spending more time online, preying on their fears and anxieties, and exploiting new systems of remote working. Government authorities, private sector, and the local community all have an important part to play to ensure we are all protected. Dubai Police is very pleased to partner with Visa and Dubai Economy on this Stay Secure initiative, which not only helps amplify our efforts towards reducing fraud and cybercrime in the UAE but also echoes our recent National Fraud Awareness campaign to address this threat.”

Ahmad Al Zaabi, Director of Consumer Protection in the Commercial Compliance & Consumer Protection (CCCP) sector, Dubai Economy, said: “The study shows that consumer behavior changes due to the pandemic – such as shifting online and increasing use of digital payments, are likely to continue even after the pandemic – an important take-away for businesses developing strategies for the post-COVID-19 consumer and market overall. Dubai Economy has been promoting online shopping and contactless payments not only to ensure safe shopping during the COVID-19 crisis but also as part of our larger goal of accelerating the digital transformation of economic activity, particularly retailing, in Dubai. With malls and commercial outlets already reopened in Dubai contactless payment promises to add to the safety, convenience and overall consumer experience of shopping in the city. We are pleased to partner with Visa and Dubai Police on the ’Stay Secure’ campaign – a much needed and timely initiative – to help consumers protect themselves and offer merchants important insights for navigating the new normal of cashless commerce, which is a significant step forward in accelerating the course of UAE’s digital future.”

Data Privacy, Biometrics and Mobile Wallets: General Attitudes and Concerns

Up to 53% of respondents were comfortable sharing personal data with banks, telecom operators, and government owned entities. Name, demographic data and contact information were cited as data that needs to be protected the most. Sixty-three percent find biometrics secure and for 55% biometrics is convenient to use. Sixty percent trust paying with mobile wallets such as Apple Pay and Samsung Pay. These wallets use Visa’s tokenization technology, which replaces sensitive card data, including the 16-digit card number, with a random number, also known as a “token”, to protect cardholders’ account information when paying in store or online.

Neil Fernandes, Visa’s Head of Risk for Middle East and North Africa, commented: “The pandemic has changed how consumers shop and pay with increased reliance on and preference for digital commerce. With increased usage both among experienced and first-time users, cybercriminals too are keen to capitalize on the increased activity and vulnerability, especially of first-time online shoppers. That is why educating consumers about safe payment behavior is critical not only for the moment but as we move forward and adapt to the new normal. We are delighted to partner with Dubai Police and Dubai Economy to continue our mission of empowering consumers to continue using digital payments and online channels with full confidence.”

Gen Z vs The Rest

Interestingly, the findings also revealed significant differences in the behaviors of Gen Z (18-22 years) compared to the general population. For example, less than half (49%) of Gen Z respondents find biometrics secure compared to 70% of the rest. With regards to tokenization technology, less than half of Gen Z consumers (48%) believe it improves mobile wallet security compared to 61% of non-Gen Z consumers. With Gen Z entering the job market and their purchasing power expected to increase in the future, insights into their views and behavior are useful for businesses looking to cultivate long-term relationships with them.

Enhancing Online UX and Reducing Cart Abandonment: Key Insights for Merchants

More than half (58%) of UAE consumers surveyed have abandoned their online shopping cart because of authentication delays or failure. Of those who abandoned their carts, 62% try again after some time, 35% purchased from other sites, 34% purchased from a nearby store, and 32% dropped the idea of purchasing the product altogether. For 66% of respondents, an authentication process that doesn’t require them to enter one-time-passcode (OTP) for standard and recurrent transactions would be more convenient; 65% would trust a more seamless process.

Merchants seeking to deliver an enhanced online experience for customers can now adopt Visa Secure (previously known as Verified by Visa), an updated program to help make online payments more secure and seamless. It uses the latest EMV 3-D Secure (3DS) specification, which leverages fraud-detection intelligence working behind the scenes to verify cardholder identity and block unauthorized transactions.

The survey provides further insights on how merchants can build trust in eCommerce sites. The following emerged as the top “confidence builders” by consumers surveyed: offering a wide range of payment options (51%); displaying verified customer reviews (50%); offering payment options in local currency (45%); trust badges/security icons (42%); ease of refunds (42%); and SSL certificate (40%).