Key Findings

Key Findings

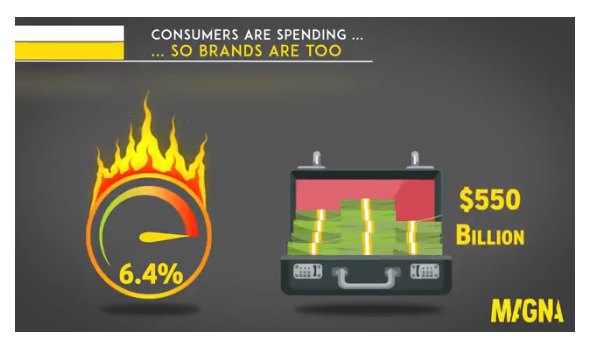

In its latest report on global advertising market trends, released June 18, 2018, MAGNA forecasts media owners’ net advertising revenues (NAR) to grow by +6.4% to $551 billion in 2018 in the 70 countries analyzed by MAGNA. That’s the strongest growth rate since 2010.

MAGNA increases its forecast for 2018 following strong market performance in the first few monthsg. +8% in the US in the first quarter, and +31% for Google and Facebook globally.

The 2018 growth (+6.4%) is an acceleration from 2017 (+4.5%), mostly due to the five billion dollars of incremental ad spend generated around cyclical events in 2018 (US Mid-Term elections, FIFA Football World Cup, Winter Olympics). Neutralizing cyclical revenues, the 2018 growth would be +5.5%, in line with 2017.

Global ad spend remains strong thanks to robust economies (US +6.4%, China +10%, Russia +12%, India +12.5%) and convalescent/recovering economies (Latin America +10%, Middle East +9%). Western Europe lags behind due to low economic growth and political uncertainty (+4.1%).

Digital advertising sales will grow by +15.6% in 2018 to reach $250 billion or 45% of global advertising revenues. Mobile ad sales reached half of total digital spend last year, and will increase to 62% of total digital spend this year. Digital will to represent half of the world’s total advertising sales by 2020.

In the US, advertising sales will grow by +6.4% in 2018 to reach an all-time high of $207 billion, including $4 billion dollars of incremental revenues from cyclical events. Excluding cyclical revenues, underlying growth this year will be 4.7% (similar to 2017).

US digital ad sales will grow by +15% this year to pass the $100 billion milestone (52% of total ad sales). Non-digital ad sales will shrink by -4.6%. National TV ad revenues will be flat while local TV will grow by +10%, OOH by +2%; print ad sales will decrease by -17% and linear radio by nearly -4%.

Next year (2019) will see a slower growth in the US: +2% in the absence of cyclical drivers, although core growth will also slow (+3.6%).

According to Vincent Létang, EVP, Global Market Intelligence at MAGNA and author of the report:

“Global Advertising Spending is going to expand by the strongest growth rate since 2010 this year, as several of the largest markets – including the US, Russia and China – experience robust economic growth. Many consumer packaged goods and automotive brands are freezing or cutting ad expenditure, which hurts the revenues of traditional media types, while digital media, used by millions of small and local advertisers, seems to be immune from slow-down so far. Linear television will enjoy modest growth in most markets however, as cyclical events bring incremental budgets and strong pricing (CPM inflation), offsetting shrinking volume (ratings decline).”

Global Findings

Globally, net media owners advertising revenues (NAR) are projected to grow by +6.4% in 2018, to $551 billion. This is above MAGNA’s previous forecast (+5.2% published December 2017) due to stronger-than-expected market performance year-to-date for digital media sales in particular. For instance, advertising spend grew by an impressive +8% in the US in the first quarter, while for Google and Facebook advertising revenues grew by +31% globally over the period, showing no sign of slow-down.

The major cyclical events taking place in 2018 (The FIFA World Cup in Russia, Mid-Term elections in the US, Winter Olympics in South Korea) will generate five billion dollars of incremental ad spend this year (two thirds of it in the US alone), thus contributing one percentage point to global ad growth. Excluding cyclical revenues, global underlying advertising growth would be +5.5% in 2018, i.e. level with 2017.

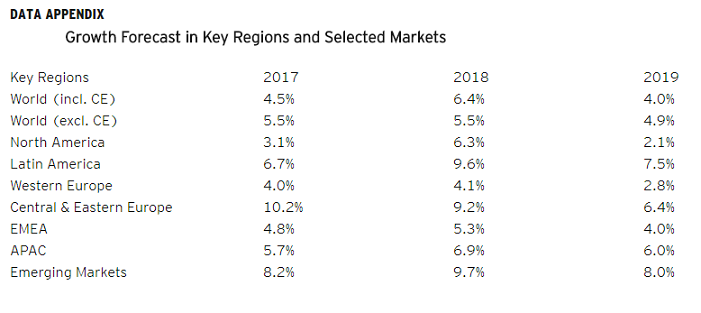

Global advertising demand remains strong in countries enjoying a robust economic environment (USA +6.4%, China +10%, Russia +12%, India +12.5%), and is recovering in convalescent/recovering economies (Latin America +10%, Middle East +9%). Western Europe is lagging behind due to low economic growth and political uncertainty, but double-digit digital growth and a minor boost from FIFA World Cup on European soil, will ensure moderate growth (+4.1%).

69 of the 70 ad market analyzed by MAGNA are expected to show some level of growth this year, with Singapore the only market forecast to shrink this year. The fastest-growing regions in 2018 will be Central & Eastern Europe (+9.2%) and Latin America (+9.6%), followed by Asia-Pacific (+6.9%) and North America (+6.3%).

Linear television ad revenues will grow again in 2018 (+3% to $185 billion), thanks to the return of even-year cyclical events, despite the continued, worldwide erosion of reach and ratings. Without the incremental even-year ad sales, TV would be just flat this year (+0.4% globally, -1.4% in the US).

The resilience of television is also caused by sustained demand from big consumer brands in CPG/FMCG sectors (food, drinks, personal care and household goods), media/entertainment, restaurant chains and pharmacy (where allowed). Because some marketers are concerned about brand safety and ROI accountability in digital environments, many brands have paused the long-term diversification of their media mix towards digital formats and have instead remained loyal to traditional linear television in the last 18 months.

That sustained demand for TV inventory, combined with declining supply (ratings) is driving high CPM cost inflation (ranging +5% to +15% in key markets while economic inflation remains below 2%). Strong TV pricing, however, is barely offsetting declining volumes resulting in flat revenues for broadcasters in the France, UK, Italy, Japan and the US (excluding cyclical ad spend).

Television is evolving too. “Advanced television” advertising techniques are gaining momentum in markets like the US and the UK. That includes live linear targeted ad substitution (household-addressable campaigns), on-demand TV content on television sets, and more generally the ability to buy qualified audiences (auto intenders, families with babies or pets…) with less wastage and better engagement, compared to traditional age/gender targeting. Most “advanced” TV campaigns these days are based on cable or satellite subscription and managed through set-top boxes, but the ubiquity of “smart” connectable TVs and over-the-top (OTT) devices creates the opportunity to target all TV viewers, including “cord cutters”, on the big screen around “safe” television content, through on-demand or linear consumption. Companies like Samsung, Roku, and others compete to provide the operating systems of television sets and offer “advanced” targeted advertising solutions to marketers.

Global Digital advertising sales (display, video, search, social) will grow by +15% this year, to $250 billion, slowing only slightly from 2017 (+18%), while offline ad sales (linear television, print, broadcast radio, out-of-home) will decrease by -0.2% to $300 billion. Digital media sales will represent 45% of total ad sales by the end of 2018 and MAGNA anticipates that it will reach 50% of global ad dollars by 2020. It will reach that milestone this year in the US, while the market share of digital media sales is already beyond 60% in markets like the UK or Sweden.

Digital ad spend will continue to be driven by Social (+31%) and Video (+27%) formats this year. Search will grow by +14% to $47 billion and remains the largest ad format.

Despite the scale reached by digital media spend and the controversies that hit some of the media owners in the first half of 2018, digital ad spend has showed no signs of slow-down yet. The combined advertising revenues of Facebook and Google grew by +31% year-over-year in the first quarter of 2018. Nevertheless MAGNA does anticipate a mild slow-down in the second half of the year but so far, spending from small, local, direct advertisers – often re-allocated from below-the-line marketing channels (direct mail, yellow pages) – continues to grow quickly, offsetting any slow-down in the spending from brand advertisers.

The majority of digital ad sales (62%) is now generated by impressions and clicks on mobile devices (mostly smartphones). Mobile ad sales will grow by +30% in 2018 while desktop-based ad revenues will shrink (-2%), due to ad blocking and the rapid shift of digital media consumption towards smartphones and away from computers.

Other media categories will struggle to various degrees this year as they don’t benefit from the pricing power and cyclical drivers of national television. Global Print NAR will decrease by -11% to $54 billion. Radio ad sales will decrease by -2% to 28 billion. This reflects legacy ad sales only(paper, linear broadcast spots). When and where we add an estimate of the digital advertising sales of publishers and radio broadcasters or audio pure-players, it mitigates but doesn’t offset the revenue decline. This is because online display pricing is poor and music streaming is moving towards a premium ad-free model, limiting ad inventory. Podcasting is mostly ad-supported and becoming increasingly popular; it has the potential to rejuvenate the audio media industry, in combination with the rise of voice-activated smart speakers. Just like the television industry did, the audio media industry needs to develop an on-demand leg to balance the linear leg.

The only “traditional” media category to show moderate growth in 2018 will be Out-Of-Home. Global NAR is forecast to grow by +3.4% to $33.5 billion. OOH does benefit from cyclical events but the main driver remains the roll out of digital OOH inventory. DOOH NAR will grow by +16% this year to reach $5.7 billion as new airports, malls and transport system become available for media buying this year. For instance the “old” DOOH system in the London underground is about to be upgraded and expanded, and thousands of screens are to be rolled out in the New York Subway.

US Findings

US Findings

In the US, media owners net advertising sales (NAR) will grow by +6.4% in 2018 to reach $206 billion, a new all-time high. Neutralizing the ad spend generated around the cyclical even-year events, 2018 underlying growth would be just +4.7% compared to +4.9% in 2017.

MAGNA increased its 2018 growth forecast from +5.5% (December 2017) to +6.4% (June 2018) following increased economic expectations, and a strong-than-expected market in the first few months.

Cyclical events will drive $3.7bn of incremental advertising dollars this year, up +12% from 2014 (the last Mid-Terms year). Political advertising will bring in $2.9bn, an increase of +18% vs 2014, as far more House races are expected to be competitive than initially thought (101 races this year vs 79 in 2014). The Winter Olympics brought in an estimated $630 million in incremental television ad revenues, on par with Sochi 2014, as stronger pricing compensated for ratings being down -24%. The FIFA World Cup is expected to generate $180 million of incremental ad sales, down 18% vs 2014 due to the absence of team USA and the time difference with Russia.

In the first quarter of the year, total ad revenues grew by an impressive +8% over 1Q 2017 – the strongest quarterly growth since 3Q16. Excluding cyclical (Olympic) spending, normalized growth was still +6.4%, thus accelerating from 4Q17 which had been the strongest quarter of last year (+6.0%). Digital media, in particular, grew faster than expected (Total +18%, Search +17%, Video +27%, Social +47%). National television also performed slightly above expectations (+5% year-over-year).

Most of the national TV revenue growth in 1Q18 was due to the incremental revenues brought in by the Winter Olympics, but excluding cyclical spend national TV was stable (+0.5%). That was still an improvement compared to the prior six consecutive quarters of decline (by an average of -2%). Other media categories grew in line with expectations: local TV +0.4% (-3.9% excl. cyclical), Print -14%, Radio -4%, Out-of-Home +1.5%.

MAGNA anticipates that US digital ad sales will grow by +15% this year to reach $106 billion, i.e. 52% of total non-cyclical ad dollars. Meanwhile, non-digital ad sales will shrink by -4.6% to $97 billion. National TV ad revenues will be flat (+0.2% or -1.4% excluding cyclical revenues), local TV will grow by nearly 10% (-3.4% excluding cyclical revenues), print ad revenues will decrease by almost -17% and radio ad sales by almost -4%. Out-of-Home ad spend will grow moderately (+2%).

Digital advertising sales will grow by +15% this year to reach $106bn, slightly slower than last year’s +18% performance, and still comfortably the fastest growing media format. Digital ad spend will continue to be driven by a few key formats, namely Paid Social (+31%), Video (+24%) and Search (+14%). Traditional banner display (-8%) and other forms of digital advertising such as email and online classifieds (-15%) continue to shrink in favor of other more attractive formats. In addition, as more and more display inventory switches to video, not only is the inventory less attractive, but the total pool of units for sale is shrinking.

By device, mobile advertising is the growth engine within digi Mobile spend will grow by +29% this year to reach $70bn, nearly two thirds of total digital spending. Desktop spend will shrink by nearly -5%. Formats have transitioned to mobile at much different rates; social media advertising is almost entirely mobile, with 90% of total social spending this year coming from mobile devices. This is followed by search (58%), video (56%), and display (56%).

Programmatic ad spend has seen rapid growth in the US, with $12 billion worth of display-related (banners and video) ad spend last year. That is already 62% of total display ad spend in the US and will increase to represent 78% by 2021. Programmatic campaigns are particularly popular in Finance, Technology and Automotive brands. The top programmatic advertisers last year were Apple, Samsung, P&G, Geico, and Amazon.

Smartphones are the big winner when it comes to media consumption, while computers and tablets are losing grounds, but television screens are making a come-back. The growing availability of “over-the-top” (OTT) IP-delivered premium content on TV sets, supported by 70 million connected “smart TVs” and over 50 million standalone OTT boxes, is leading to ever-growing consumption and advertising opportunities. OTT advertising spend, defined as ad impressions generated on television screens by YouTube, Hulu and other OTT content providers and operators like Roku, will reach $2.2 billion this year, up by +40%. Meanwhile addressable TV campaigns are also attracting increasing budgets: $800 million in 2018 (+27%).

OOH is the only traditional media channel likely to post net revenue growth this year (+21.9 to $8 billion), thanks to further organic growth in digital/ambient OOH inventory. One example is the launch of a multi-year development plan by Outfront Media and the New York Metropolitan Transit Authorities (MTA), aimed at installing 50,000 digital screens in the subway and bus systems, starting in 2018.

Radio advertising sales will continue to suffer in 2018 because of a negative pricing trend (CPM -3%) and the continued decline in listening. MAGNA expects linear broadcast radio NAR to decline by -3.8% to $13.2 billion. The digital advertising sales of radio broadcasters and streaming players will grow by approx. +6%, but “audio advertising” market(broadcast + digital revenues, traditional broadcasters + streaming “pure players”) is still expected to shrink by -2%. The “Chapter 11” filings of iHeartMedia and Cumulus (which together represent 25% of the entire radio ad market), reflect the struggles of this media category.

Print advertising sales will decrease by -17% to $14.7 billion. Adding publishers’ digital ad sales (+7% to $7.3 billion), total advertising revenues will still decline by -10% this year for publishers (newspapers -12%, magazines -8%). Finally direct mail advertising revenues (not included in MAGNA’s grand total) will decrease by -3% to $18 billion, as the expected boost from political mailing campaigns will not quite offset the long term erosion of mailing caused by the competition of digital formats.

In terms of spending verticals, MAGNA expects reduced ad budgets from Automotive (-4%), and Movies (-10%). Those two sectors are cutting marketing expenditure as car sales and box office revenues are decreasing. Growth sectors this year will include Technology (+13%, but little or no growth in TV spend) and Finance (+7%, also concentrated in digital).