The consumer decision journey has evolved from the early days of brand building. To successfully build brands today, marketers should have a solid understanding of the new path to purchase. The digital brand ecosystem and the sheer volume of behavioural insight data available have changed things dramatically.

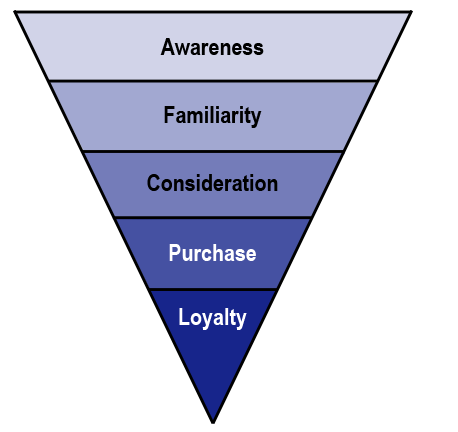

Many businesses traditionally thought consumers followed a linear journey to brand purchase. The naïve consumer first became aware of a brand, learned of a desirable quality it had (perhaps through advertising), and consciously decided to purchase it. After personally experiencing the benefits for themselves they became loyal buyers. Market research measured the proportion of consumers who had achieved each of these progressive steps and presented the facts to marketers in the shape of a funnel.

A classical marketing consumer purchase funnel

The width of the funnel indicates the number of brands “active” at each point of the consumer decision journey

It’s likely that consumers were always more complex than this, but the arrival of digital brand ecosystems and the insights gained from behavioural economics and neuroscience have proven that brand builders need to move on to a more accurate model of consumer decision journeys. The concept of shifting from a ‘funnel’ to a ‘cycle’ (first discussed by McKinsey1) makes sense.

Some of the key factors marketers now have to consider include:

The fact that ‘fast’ decision-making (or System 1 thinking as Daniel Kahneman calls it) is preferred by the brain whenever possible. It uses heuristics to make choices in the simplest possible way – and ‘brand’ may not be a critical factor.

Online information – both brand driven and consumer generated – about brands, products, and the companies that make them is readily available and leads to two-way conversations.

The disruption created by the fragmentation and multiplication of consumer touch points, especially online and mobile.

Brands are stored in memory as a loose network of known facts, experiences and emotional associations. Context determines the extent to which these associations are brought together and reflected upon, and when they are used explicitly to make decisions in a more active or slow (System 2) thought process.

The importance of situation for the consumer – what am I doing, who am I with, what is the occasion? – in any evaluation of a brand and consequent purchase. The lack of consumers’ self-identifying with most brands: loyalty is an instinct or habit rather than a conscious action, making penetration critical to driving brand growth2.

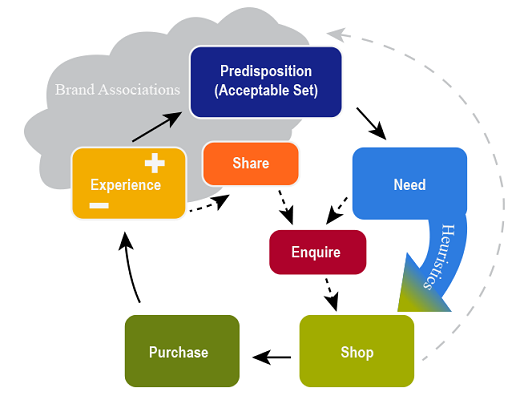

The new cyclical consumer decision journey may seem fuzzy. It clearly presents challenges that marketers should consider when making decisions about where and how to invest in their brand. For most brands and categories, consumers go through purchase occasions with a combination of prior experience and future expectations. Most people don’t classify themselves as a ‘buyer’ of a particular brand. They have likes and dislikes and their associations create predisposition towards brands. This applies both to fast-moving consumer goods and to services. Past experiences are a combination of their own first hand product or service usage and the second hand experiences shared on social media or directly communicated by the brand. The overall positive feeling created by these experiences will nudge consumers to choose one brand over another. Their attitudes are formed more often after usage, and from a need to justify decisions.

The consumer decision cycle looks something like this.

But for any given consumer and occasion, it won’t be so neat. They will take shortcuts. Steps that look sequential might be collapsed together, or jumped over.

Measurement of the brand’s health therefore needs a new approach too.

Brand Associations: aren’t often reflected upon so implicit measures are the best way to assess the emotional responses that frame decisions and the effortless associations that will drive choices and post-rationalization. Predisposition measures need to tell us if a brand is acceptable and whether the combination of rational and emotional associations are ‘nudging’ for a greater share of decisions when brand is important. The salience or a brand being top of mind in a decision situation is the first critical factor. The other factors Millward Brown identified through extensive R&D are ‘meaningfulness’ and ‘difference’. All three factors interact: if a brand has a tangible point of difference, consumers still need to know about it. If the brand comes easily to mind, it still has to be liked and credible.

Heuristics: come in a number of forms, and vary in importance across categories. If ‘first/fast to mind’ is important, use a measure of needs-based salience. If ‘bought last time’ dominates, keep the old funnel metric of recent purchase. Other heuristics may include price, quality, identity, self-worth, and gratification. Aligning brand metrics to the important heuristics for the brand’s category will identify the true KPIs that will drive brand success.

Experience: understanding how well a brand delivered against expectations can also be vital. Social media tracking will indicate how often brand experiences are shared and whether their messages are positive or negative. Brand marketers should be utilising freely available metrics of Sharing and Searching to understand how effectively they are managing the consumer journey.

Shopper: metrics such as pricing, distribution, ease of finding (all viewed as physical availability) and of course promotion are influences on the decision. Typically these are considered sales metrics and viewed separately from brand marketing metrics. In fact, the two sets of data need to be considered together in the context of category shopping behaviours.

These measures all move away from a linear, funnel shaped model. Awareness might be low, but involved consumers will discover – or be usefully reminded about – brands during enquiry phases, or even at point of purchase. The number of brands that are active at any point in the cycle will vary both up and down. Consideration is a conscious measure but System 1 thinking may go behind and around deliberation: a consumer might have a need triggered but jump straight to a particular brand to avoid the effort of thinking. Perhaps most importantly, research has proven that strong brand associations which can influence predisposition derive more from experience of the product or service. Advertising impressions can contribute to brand associations, in particular when they frame brand experiences, and when they vividly sustain brand salience.

Key Takeaways

Marketing KPIs centred on classical, linear models and which rely on System 2-based survey data should be superseded by metrics, suited to the particular points in the consumer decision cycle where the brand can compete.

The fundamental job of marketing is to create and sustain brand associations from experiences which are meaningful and competitively different. This can be done through any lever in the consumer decision cycle, all of which should be considered.

Marketers today have access to more data than ever before, from online behaviour to System 1 measures of emotion and mental associations. Those who integrate all of this data to understand consumer decision-making will have a competitive advantage.

Source:Millward Brown