Our perception about personal finances is one factor that contributes to our confidence in the economy, which can impact our willingness to spend and save. Mirroring the rise in global consumer confidence in the third quarter, immediate spending intentions also increased, rising to 43%, up from a low of 30% in 2008 during the Great Recession. North Americans showed the biggest surge in plans to open their wallets with a 14-percentage point quarterly increase to 58%. Most regions followed, with spending sentiment up two percentage points in both the Middle East/Africa (38%) and Europe (34%) and up one percentage point in Latin America (33%). Spending intentions were flat in Asia-Pacific (47%).

Our perception about personal finances is one factor that contributes to our confidence in the economy, which can impact our willingness to spend and save. Mirroring the rise in global consumer confidence in the third quarter, immediate spending intentions also increased, rising to 43%, up from a low of 30% in 2008 during the Great Recession. North Americans showed the biggest surge in plans to open their wallets with a 14-percentage point quarterly increase to 58%. Most regions followed, with spending sentiment up two percentage points in both the Middle East/Africa (38%) and Europe (34%) and up one percentage point in Latin America (33%). Spending intentions were flat in Asia-Pacific (47%).

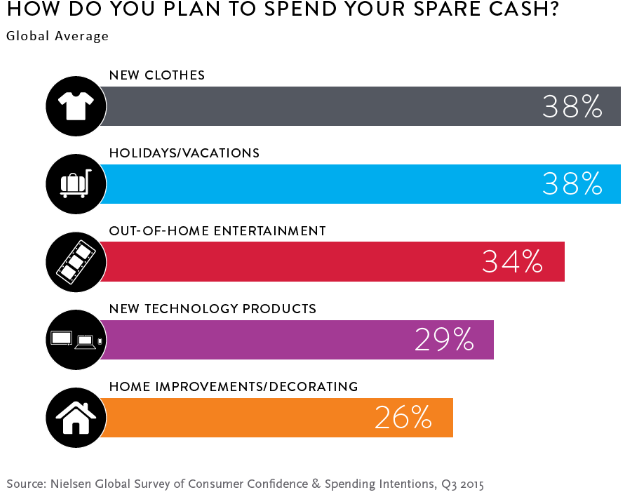

How do we intend to spend our hard-earned cash this quarter? Global discretionary purchase intentions high on the priority shopping list included spending on new clothes, holidays/vacations, out-of-home entertainment, new technology products and home improvement projects. More than half of global respondents (52%) planned to save their spare cash, an increase from 48% in the second quarter.

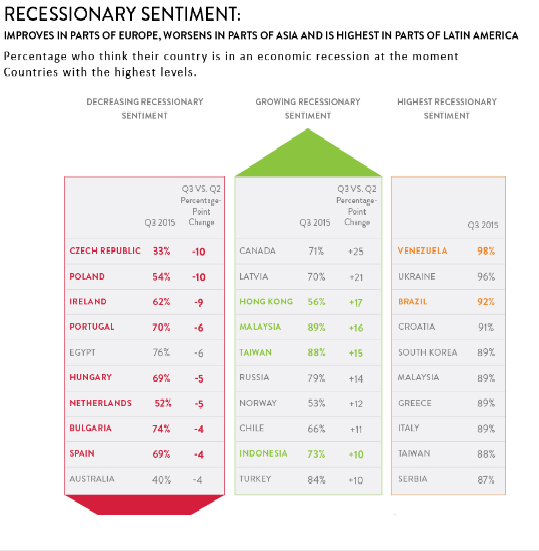

Despite a rise in spending confidence, however, more than half of global respondents (56%) still felt that their country was in recession in the third quarter, up from 54% in the second quarter. In fact, recessionary sentiment increased in 31 of 60 countries from the second quarter.

“Many consumers, across mature and emerging markets, have the mindset to spend across a range of consumer categories,” said Louise Keely, senior vice president, Nielsen, and president, The Demand Institute. “Still, a majority of consumers continue to believe their economies are in recession, even though most no longer are. Sharp adjustments in recessionary sentiment usually reflect actual changes in a country’s economic prospects, and indicate that consumers will be either pulling back on or more inclined toward spending.”

Other findings from the report include:

Morocco was added to the Global Survey this quarter, and the country’s index is reflected in the Middle East/Africa regional average.

Global consumer confidence rose three percentage points in the third quarter, to an index score of 99.

The U.S. showed the biggest quarterly improvement of 18 percentage points in the third quarter.

Confidence in the U.K. reached 103 – the highest score for the country since 2005.

Taiwan showed the biggest quarterly decline of 12 points from the second quarter, while South Korea reported the lowest score of 49 in the third quarter.