Despite the fact that Millennials are coming of age in one of the most difficult economic climates in the past 100 years, a recent Nielsen global online study found that they continue to be most willing to pay extra for sustainable offerings—almost three-out-of-four respondents in the latest findings, up from approximately half in 2014.

The rise in the percentage of respondents aged 15 – 20, also known as Generation Z, who are willing to pay more for products and services that come from companies who are committed to positive social and environmental impact was also strong—up from 55% in 2014 to 72% in 2015.

“Brands that establish a reputation for environmental stewardship among today’s youngest consumers have an opportunity to not only grow market share but build loyalty among the power-spending Millennials of tomorrow, too,” says Grace Farraj, SVP, Public Development & Sustainability, Nielsen.

But younger generations aren’t the only ones who say they care, so don’t abandon Baby Boomers in the quest for Millennials. Fifty-one percent of Boomers (50-64) surveyed are willing to pay extra, an increase of seven percentage points since last year. This segment will remain a substantial and viable market in the coming decade for select products and services from sustainable brands.

CARE-FULL GLOBAL CONSUMERS

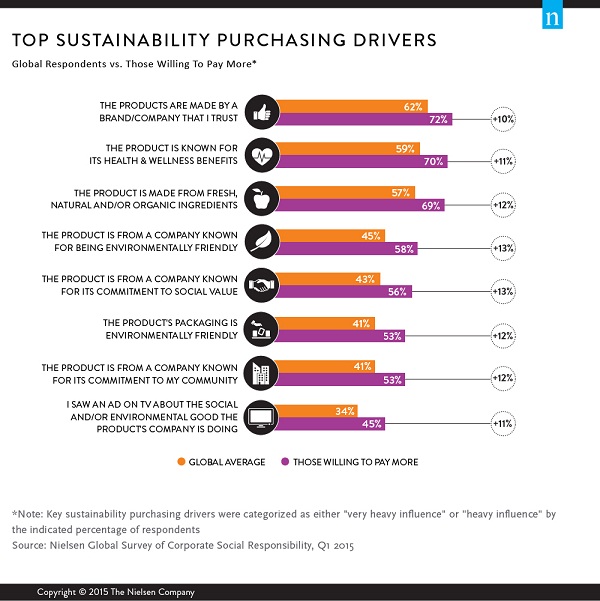

Among global respondents willing to pay more, statements about product sustainability purchase drivers were 10 to 13 percentage points higher than the global average percentages for these statements. Attributes such as a company being environmentally friendly (+13 pp), a company being known for its commitment to social value (+13 pp) and a product being made from fresh, natural and/or organic ingredients (+12 pp) ranked the highest in the comparison. Statements about price-driving product attributes like sales and coupons didn’t even make the top five among those willing to pay more. For those willing to spend more, the findings show that personal values are more important than personal benefits, such as cost or convenience.

“When it comes down to financial commitment, a sustainable sentiment shifts to one of increased social awareness and responsibility,” said Farraj. “Marketers need to connect messaging with the causes that matter most to consumers and that also align with their brand.”

Other findings from the report include:

66% of global respondents say they’re willing to pay more for products and services that come from companies that are committed to positive social and environmental impact, up from 55% in 2014, and 50% in 2013.

The percentage of measured sales that come from brands using both product claims and integrated sustainability marketing promotions is much higher in developed markets than in developing countries.

Brands that use a claim plus a marketing sustainability approach comprise a majority of sales measured in the following categories: Baby food (85%), coffee (78%), tea (61%) and snacks (60%).