Coca-Cola holds onto the top spot as Most Respected; Microsoft enters the Most Respected list, while Papa John’s, Foot Locker and CVS Health join the rank of Least Respected companies

Coca-Cola holds onto the top spot as Most Respected; Microsoft enters the Most Respected list, while Papa John’s, Foot Locker and CVS Health join the rank of Least Respected companies

Tenet Partners, a leading brand innovation and marketing firm, today released its third annual report on the most and least respected corporate brands – Brand Respect: The Most and Least Respected Corporate Brands of 2015. For the third consecutive year, The Coca-Cola Company tops the list of Most Respected Brands. Microsoft enters the ranking of Most Respected brands at #9, while Papa John’s, Foot Locker, and CVS Health join the ranking of the Least Respected companies.

The Brand Respect report correlates data determined by a survey of approximately 10,000 business decision-makers and opinion elites on two key metrics that contribute to a brand’s ability to drive long-term growth: Familiarity and Favorability. Brands with the highest Familiarity and Favorability are defined as most respected, while brands that are the most well known but have the lowest Favorability are considered the least respected.

“The respect a brand has earned, and can keep, speaks directly to its ability to remain competitive in today’s marketplace, said Hampton Bridwell, CEO and Managing Partner of Tenet Partners. “The Top 10 Most Respected Brands demonstrate the impact of a strong corporate reputation in building trust, loyalty and increased profitability. Meanwhile, the Top 10 Least Respected Brands – or simply the brands with the largest discrepancies between Familiarity and Favorability – need to think critically about the brand experiences they are creating in the marketplace and how they can regain the favor of consumers and investors.”

2015 Most Respected Brands

The Coca-Cola Company

PepsiCo

The Hershey Company

Bayer

Johnson & Johnson

Apple

Harley-Davidson

IBM

Microsoft

GE

Key Findings for the Most Respected Brands

Coca-Cola retains its top status for the third consecutive year. While the company’s Familiarity is up slightly year-over-year, its Favorability declined this year, reaching its lowest point since 2011. The company’s Investment Potential – the measure on which key stakeholders surveyed indicated whether or not they would invest in the company, has fallen sharply in recent years: decreasing 7.1 points since 2009. Its Overall Reputation and Perception Management has also taken a hit, each declining 3.9 points and 3.1 points respectively, since 2009. The iconic 125 year-old company and Tenet Partners’ #1 Most Powerful Brand for seven years running, is clearly at an inflection point. However, in a move to inspire increased consumer and investor confidence and grow revenue, CEO Muhtar Kent has pledged to boost media spending and brand-building initiatives by up to $1 billion by 2016.

Microsoft is new to the Most Respected list this year, having gained on both Familiarity and Favorability consistently over the past five years. The company saw notable gains across all three dimensions of Favorability: Overall Reputation, Perception of Management, and Investment Potential. While Investment Potential lags behind Overall Reputation and Perception of Management, analysts expect an improvement in earnings this year, due in large part to the latest version of its operating system, Windows 10 as well as from continued growth in the cloud-computing arena, which is continuing to find vigorous demand from enterprise customers.

Apple improved by 2 spots and places on the Most Respected list at #6 this year. Across the dimensions of Favorability, Overall Reputation and Perception of Management experienced the greatest gains, increasing 1.9 points and 1.2 points respectively. The company’s Investment Potential also increased this year, gaining 1 point year-over-year. Among the Top 10 Most Respected Brands, Apple is the fastest growing brand in terms of Favorability. Year-over-year, the average Favorability of the Top 10 Most Respected Brands fell by a tenth of a point, while Apple’s Favorability jumped significantly, 1.4 points this year. For the full fiscal 2014, Apple reported $182.8 billion in sales, setting a new company record. As further evidence of the company’s strong financial performance – Apple’s Investment Potential has climbed the most over the past five years, increasing 8.8 points since 2010. The company reported iPhone sales of 61.2 million in its most recent quarter, well above the 58 million that analysts had been expecting. Aside from its earnings, Apple is also returning more money to shareholders, expanding the capital return program from $140 billion to $200 billion. This includes a $140 billion share-buyback authorization and a new quarterly dividend rate of $0.52 a share.

Kellogg’s falls out a favor and drops off the Top 10 Most Respected Brands. The company has been struggling in recent quarters to drive earnings and innovation across its brand portfolio. Last year, the company saw sales drop 2% amid continued changing consumer sentiment towards a low-carb and protein heavy diet. Additionally, the continued growth of the Greek yogurt market, coupled with the rise of fast-food chains wooing consumers with cheaper breakfast alternatives, have also made it difficult for the company to maintain its strong standing.

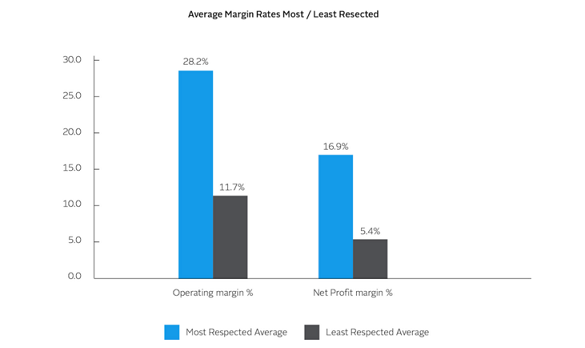

A notable trend among the Top 10 Most Respected Brands is that they have demonstrated slow, stable, but consistent growth in their share prices. These standout brands, such as Johnson & Johnson (#5), Apple (#6), and Microsoft (#9), continue to deliver above average, double-digit operating margins and net profit – reflecting the ability of a strong brand to command premium pricing and revenue performance.

2015 Least Respected Brands

Delta Air Lines

H&R Block

Big Lots

Papa John’s

Denny’s

Rite Aid

JCPenney

Best Buy

Foot Locker

CVS Health

Key Findings for the Least Respected Brands

Delta Air Lines (#1), H&R Block (#2), and Big Lots (#3) maintain their Least Respected status from 2014, each retaining their previous rank from last year. Although Delta is the least respected among the group, its Favorability has been steadily improving – gaining 5 points since 2010. The company’s Perception of Management score has experienced the most notable gain, jumping 11 points since 2010. The company’s CEO, Richard Anderson, is largely credited with helping to rebuild the once bankrupt brand. From buying an oil refinery in 2012 to help control fuel costs, expanding the airline’s base across Asia, Europe, Latin America and the U.S., to reducing the company’s overall debt, signs seemingly point to Delta strengthening its corporate image and in turn, distancing itself from the Least Respected ranks in the years to come.

Papa John’s (#4), Foot Locker (#9), and CVS Health (#10) are all new to the new to the Least Respected Brands this year. Papa John’s saw its Overall Reputation fall 8.1 points over the past five years – a key impediment to their performance. The company’s reputation, which also declined year-over-year, may have been damaged more recently by CEO John Schnatter’s public statements that in response to Obamacare and the Affordable Care Act, he would consider raising the cost of its pizza, cutting jobs, as well as closing a number of Papa John’s restaurants around the country.

Foot Locker returns to the Least Respected list after earning its way off last year. In 2013, the brand held the #10 spot. Year-over-year the company’s Favorability fell by .6 of a point with Overall Reputation declining a significant 3.2 points. Against the backdrop of heightened competition from Dick’s Sporting Goods and The Sports Authority, the athletic footwear and apparel retailer closed 136 stores during fiscal 2014. In its most recent earnings report management announced that it expects to have 40 fewer locations by the end of the calendar year. Also, the company announced that it would gradually phase out its Lady Foot Locker business over the next few years due to lagging performance, going from 567 locations in 2004 to 213 by the end of 2014.

CVS Health enters the Least Respected list at #10 despite the goodwill it received when it announced that it would stop selling cigarettes in its 7,700 stores. Since 2010, the company has experienced sharp declines across each of the three attributes of Favorability, with Overall Reputation and Investment Potential failing 11.7 and 8.5 points respectively. While the company’s decision to drop tobacco products garnered praise from consumers, Wall Street analysts were quick to raise concerns about how the move could impact the company’s bottom line. In the fourth quarter of 2014, the company reported that lost tobacco sales caused retail-operating profit to slip by 1.3%.

Best Buy moves from #5 in 2014 and registers at #8 this year. In recent years, the company has struggled to shake off its reputation as a “showroom” and stave off competition from Amazon.com. According to data from the American Customer Satisfaction Index (ACSI), the company has consistently been ranked as having one of worst customer satisfaction ratings. The company’s improved performance on Tenet’s Least Respected Brands can be attributed largely to its Perception of Management score, which jumped an impressive 11.8 points since 2010 and 2 points year-over-year. Since former CEO Brian Dunn resigned in 2012 and Hubert Joly took the reigns, the company has been reenergizing its efforts on customer service, e-commerce operations and overhauling its supply chain, which have helped to cut costs and improve efficiencies.

Linking Respect to Financial Performance

The 10 Least Respected Brands are largely characterized by having much lower profitability than the 10 Most Respected Brands list. While the Most Respected Brands appear to more nimbly adjust their business strategies to adapt to changing business conditions, the Least Respected Brands, conversely, tend to react more slowly in meeting consumers ever-changing needs and desires.

While Tenet expected to see the operating and net margin rates of the Most Respected companies outperform those of their counterparts on the Least Respected list, the average disparity stood out dramatically. Well respected corporations earn a number of benefits that impact financials including the ability to hire and retain talent, secure favorable terms from business partners/vendors, earn license to operate in a variety of markets and garner increased attention from Wall Street and the investment community at large.

About the data in this report

Tenet Partners’ Brand Respect scores are derived from the CoreBrand® Index, which provides the longest continuous quantitative benchmarking data, insights and corporate brand valuations for more than 1,000 companies across 50 industries. CBI research, conducted for 25 years since 1990, examines the corporate reputations of major public companies in the United States by polling more than 10,000 business decision-makers and opinion elites on the following:

Familiarity – Respondents are considered to be familiar with a brand if they state that they know more than just the company name. Familiarity scores can range from 0 to 100.

Favorability – Respondents familiar with a corporation are then asked about three dimensions that together, form a Favorability score, also on a scale of 0 to 100.

Overall Reputation – Do you have a favorable impression of the corporate brand?

Perception of Management – What is your perception of the company’s management? How would you assess the way senior leadership leads the enterprise and engages stakeholders? Does leadership have a future-forward outlook on the market in which it operates, as well as on the competition?

Investment Potential – Would you invest in this company?

Brands with the highest Familiarity and Favorability are defined as Most Respected, while brands that are well-known among audiences (identified as the 100 brands in the CBI with the highest Familiarity) but have the lowest Favorability are considered the Least Respected.