The importance of Saudi Arabia to the Middle East cannot be understated. As the largest country in the region with the highest oil reserves in the world, Saudi Arabia is a key player in the Middle East’s geo-politics.

The importance of Saudi Arabia to the Middle East cannot be understated. As the largest country in the region with the highest oil reserves in the world, Saudi Arabia is a key player in the Middle East’s geo-politics.

Across the Middle East, companies work seamlessly thanks to trade agreements that exist within these countries. However, this also means that any business changes in a particular country can have a cascading effect on the business health in the entire region.

Therefore, when Saudi Arabia decided to change the terms of employment in late 2013 – the so-called Saudization and the replacement of foreign workers with Saudi nationals in the private sector – it sent tremors throughout the business world. In a country where expatriates make up a significant part of its work force, any change in employment laws affects multiple industries on both the supply and demand sides of the economy.

Any change of such magnitude takes time to manifest itself and requires some time to settle down. So far, qualitative reports from discussions with industry participants have indicated that manpower shortages in the short term resulted in uncertainty, loss of confidence and pressure on supply and consumption.

Therefore, when determining how this change in regulations is affecting the fast-moving consumer goods (FMCG) industry in Saudi Arabia, it is important to study market movements. At a very broad level, the impact of this regulation was expected to affect both the breadth (universe estimates) and depth (channel shifts) of the market. It is evident that stability is returning to the markets as we speak, but certain fundamental shifts can also be clearly observed.

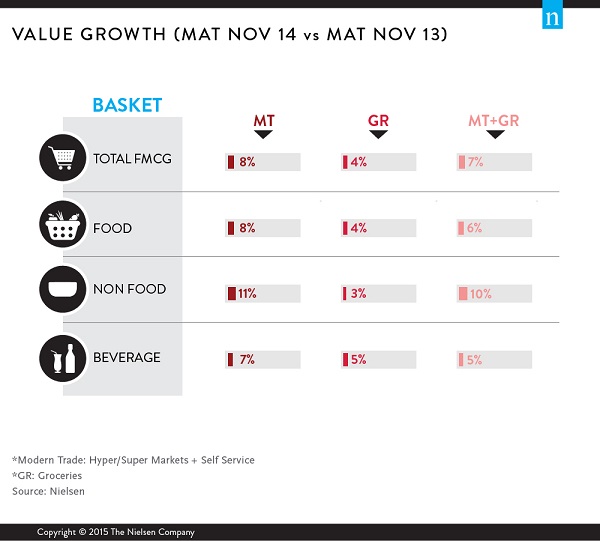

The most significant shift involves the accelerated importance of modern trade. It is clear that the labor regulation changes largely affected traditional trade, where smaller FMCG outlets struggled to comply with the new rules and regulations. Evidently, consumers would seek out alternative means of obtaining provisions, and in all likelihood, this has perpetuated into permanent changes in shopping behavior.

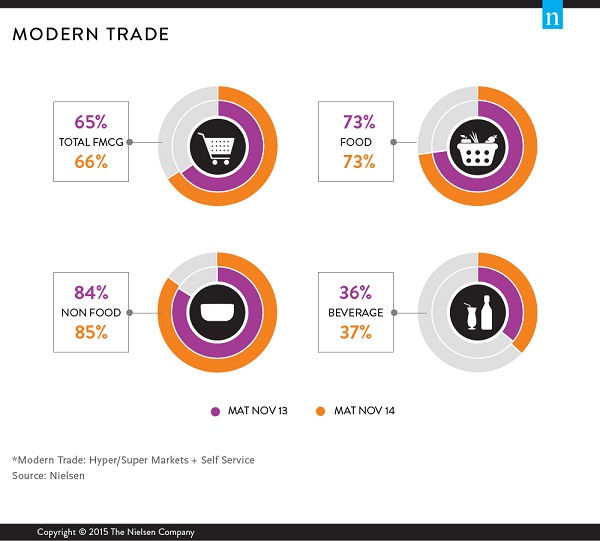

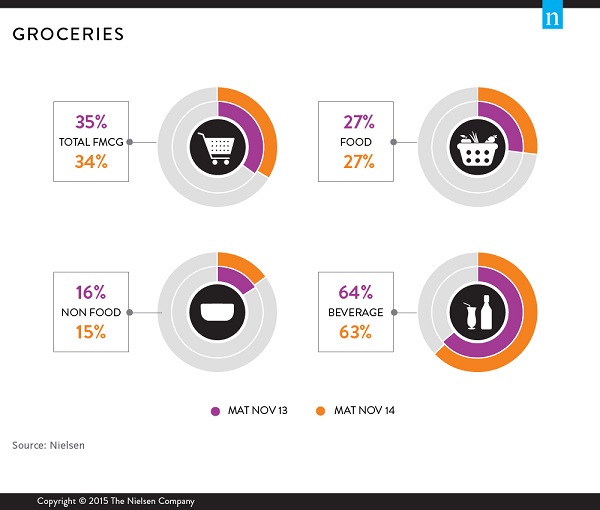

The trend is clear for all FMCGs—food, including beverages and non-food in the modern trade format (hyper / super markets and self-service stores) have gained in average up to 1% increase. This conforms to the universal trend of modern trade development in the Middle East region. While this is indeed the case, we believe that such a large movement towards modern trade has been abetted by the country’s change in employment environment between 2013 and 2014.

I was recently in Taif city trying to get a first-hand feel of the market conditions. Conversation with a small grocery owner (an Indian who I had to converse in Arabic through an interpreter) inadvertently turned to the recent labor regulations. “Business has become stable after the initial uncertainties but we don’t have the same number of people working for us. Our shop remains open for a shorter duration now,” the shopkeeper said. He was evasive when questioned whether sales from his grocery had reduced or not.

Interestingly, the modern trade growth is being led by new outlets rather than increasing sales in existing ones. Still, one can hypothesize that modern trade retailers (including pharmacies) could further drive growth with their increasing reach and access to consumers. Saudi Arabia is a country of immense consumption potential, with a growing population and high per capita income. It is therefore no surprise that organized retailers and retail chains continue to invest keeping the great opportunity in sight.

Written by Abhik Gupta, Managing Director, CPG, Nielsen MENAP

Source:Nielsen