Study conducted on 191 innovations spanning price points in 20 developing and developed countries to draw up a blueprint for success in oral hygiene.

Study conducted on 191 innovations spanning price points in 20 developing and developed countries to draw up a blueprint for success in oral hygiene.

Results show that the overall base success rate for toothpaste concepts globally is 50%.

Propositions addressing mothers, highlighting essential benefits, demonstrating strong reason to believe and showing family and product visuals yield the highest potential success rates.

Facts To Chew On

Oral hygiene, which primarily comprises toothpastes, toothbrushes, and mouthwashes, is one of the categories with the highest reach in the personal care sector. And within oral hygiene, the toothpaste category is the largest and fastest growing, with a share of more than 55% of consumers around the world. Compared to the global oral hygiene market, which is expected to grow at 3% compounded annual growth rate (CAGR) in the next three to four years, India’s market is expected to grow at 14% CAGR. This represents a huge opportunity for players in India’s toothpaste segment, which accounts for over 70% of the oral hygiene category.

Trying to capitalise on this lucrative market, brands launch and test a large number of new and innovative concepts every year. However, the global overall base success rate* for toothpastes is just 50%.

To help companies better understand the oral hygiene market globally, Nielsen’s Innovation Practice compiled a list of 191 new toothpaste concepts tested globally between July 2010 and June 2013 across 20 markets and spanning a wide price range. The study was carried out to identify and highlight communication elements that occur more often among successful innovations.

Success rates for new concepts differ by markets and pricing. Developing markets display a higher success rate than their developed counterparts, which is not surprising since it is more difficult to achieve break through success in a more mature market. Meanwhile, economically priced products show a greater chance of succeeding than premium.

What Makes For A Winning Proposition?

We’ve found that the success or failure of new concepts can largely be attributed to four critical factors that make or break the perception of a new concept in the eyes of consumers. These include:

CONTEXT SETTING – Based on our research, most successful concepts use either an emotional proposition like confidence or popularity or a functional one like protection or oral health and hygiene. Contrary to popular belief that functional promises work better with consumers, the numbers tell a different story. Our study shows that emotional and functional propositions have equal rates of success when it comes to oral hygiene.

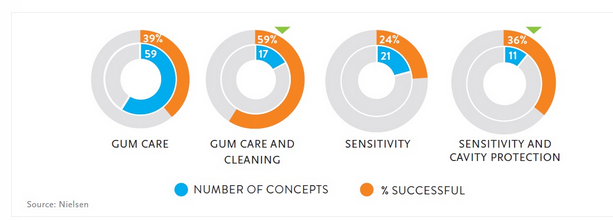

BENEFITS – Consumers have come to expect some essential benefits from oral hygiene products, like cleaning, germ killing, cavity protection, strengthening, etc. Then, there are advanced benefits like gum care, sensitivity, whitening, etc. Concepts with essential care benefits seem to have a higher rate of success than those with advanced care. However, there are some caveats:

Essential care benefits that are priced at a premium do not seem to work well in the market.

We also see that advanced care benefits work better if combined with essential care benefits, especially when designed for developing markets and premium initiatives.

Premium propositions have to work harder to succeed, irrespective of market characteristics

REASONS TO BELIEVE (RTB) – Any ingredients, technology or methods that lend credence to a concept’s benefit claims give consumers a reason to believe (RTB). Success rates in the study show that it’s important for any concept to have RTB, but the combination of multiple RTBs improves chances for success. Moreover, while the average success rate of concepts with RTBs is 54%, natural or herbal RTBs have a much higher success rate (86%) than chemical or technology-based ones (52%).

VISUALS – A picture is worth a thousand words and it’s no different for the toothpaste category. Visuals and imagery are integral to campaigns, and concepts that have family visuals tend to be more successful than those with visuals of individuals or friends. Meanwhile, visuals of dentists and professionals seem to be losing out on popularity with consumers, who would much rather see visuals of the actual paste.

BENEFITS THAT TICK

Concepts that focus on a single benefit fare better than those with multiple benefits which may distract the consumer. And, the single benefit that has seen the most success is cavity protection, perhaps because it is a visible manifestation of poor oral hygiene and can be quite painful.

According to a report by Global Industry Analysts Inc., the global toothpaste market is expected to grow to $12.6 billion by 2015. The opportunity is even bigger in India. With the domestic market expected to grow at a far greater pace than that of global, India’s oral hygiene market, especially the toothpastes segment, is an exceptional opportunity for retailers and manufacturers.