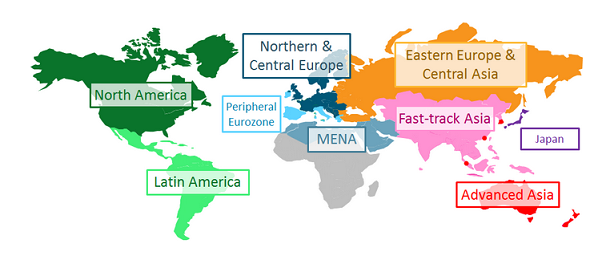

Since 2012 we’ve focused on nine regions of our own definition that we think capture similarities of behaviour and advertising growth more effectively than simply looking at regions defined by geography, such as Western Europe, Central & Eastern Europe and Asia Pacific.

Since 2012 we’ve focused on nine regions of our own definition that we think capture similarities of behaviour and advertising growth more effectively than simply looking at regions defined by geography, such as Western Europe, Central & Eastern Europe and Asia Pacific.

Peripheral Eurozone

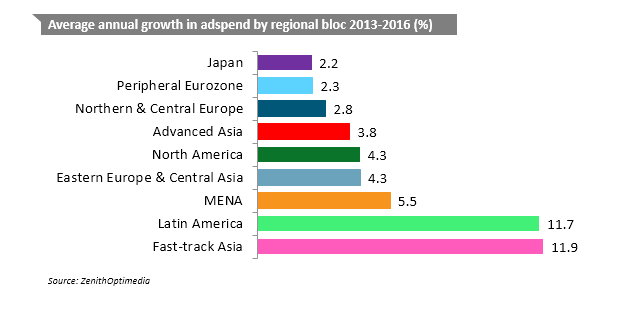

In Europe we have separated out the ‘PIIGS’ markets (Portugal, Ireland, Italy, Greece and Spain), which faced the full brunt of the Eurozone crisis, into the Peripheral Eurozone. During the great recession their ad markets fell even more sharply than their economies, as local advertisers cut back to reduce losses and preserve cash, and multinationals withdrew budgets to redeploy in more economically healthy regions. We estimate that ad expenditure in Peripheral Eurozone fell by 8.2% in 2013, but there has been a sharp improvement in their performance in 2014, when we expect growth of 0.4%, followed by 3.0% growth in 2015 and 3.5% in 2016. Only Italy is still shrinking (we forecast by 2.0% this year), while the other markets range from mild recovery (we forecast Portugal to grow by 1.9% this year and Spain by 2.1%) to robust growth (we think Ireland will be up 4.6% this year and Greece by 5.6%). We expect Italy to join the other markets by returning to growth in 2015. All this assumes that the Eurozone avoids disaster over our forecast period, and in particular assumes that no country crashes out of the euro, or falls into disorderly default on its debts.

Northern & Central Europe

Our next bloc – Northern & Central Europe – includes the rest of Western Europe, as well as Central European countries like the Czech Republic, Hungary and Poland, which are currently performing more like countries such as France or Germany than the much-faster growing markets of Eastern Europe. This is partly because many of these Central European markets are in the Eurozone, and because they have strong trading links with Western Europe. Signs of recovery in the eurozone encouraged advertisers to lift budgets in early 2014, after keeping them on hold for the previous two years. More recent disappointing news – such as zero economic growth in Q2 and weak manufacturing over the summer – has not yet affected budgets for 2014; we now predict 2.7% growth for this block, up fractionally from our 2.6% forecast in June. However, this news has made us more cautious for the future, and we have reduced our growth forecasts from 3.2% to 3.0% for 2015 and from 3.0% to 2.7% for 2016.

Eastern Europe & Central Asia

Eastern European advertising markets, such as Russia and Turkey, generally recovered quickly after the 2009 downturn and continued their healthy pace of growth, largely (though not entirely) unaffected by the problems in the Eurozone for the next four years. Their near neighbours in Central Asia, such as Azerbaijan and Kazakhstan, have behaved very similarly, so we have gathered them together under the Eastern Europe & Central Asia bloc. This bloc grew 11.4% in 2013.

The conflict in Ukraine severely disrupted the domestic ad market, while Russia has suffered from sanctions imposed by the US and the EU, the sanctions it imposed in response, and a withdrawal of international investment. We forecast adspend in Ukraine to shrink 32.5% this year, while Russian adspend grows just 1.7%. This will be the first year in which Russia will not grow at a double-digit rate since 2009. Overall we expect adspend growth in Eastern Europe & Central Asia to fall to just 1.3% this year, recovering gradually to 4.8% in 2015 and 6.9% in 2016. There are clearly downside risks to this forecast if tensions between Russia and the West escalate further.

Japan

Japan behaves differently enough from other markets in Asia to be treated separately. Despite recent measures of economic stimulus Japan remains stuck in its rut of persistent low growth. Japan grew 2.0% in 2013, and we expect the growth rate to remain at 2% a year through to 2016.

Advanced Asia

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that we have placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. Growth here was a disappointing 2.6% in 2013, after the threat of conflict with North Korea restrained confidence in South Korea, and we forecast another 2.6% growth in 2014 after weakness in the property market damaged consumer confidence in Singapore. In the absence of these problems we forecast steady improvement to 4.3% growth in 2015 and 4.6% growth in 2016.

Fast-track Asia

We characterise the rest of Asia as Fast-track Asia (China, India, Indonesia, Malaysia, Pakistan, Philippines, Taiwan, Thailand and Vietnam). These economies are growing extremely rapidly as they adopt Western technology and practices, while benefiting from the rapid inflow of funds from investors hoping to tap into this growth. Fast-track Asia barely noticed the 2009 downturn (ad expenditure grew by 7.3% that year) and since then has grown very strongly. Ad expenditure in Fast-track Asia grew 10.7% in 2013, and we forecast growth of between 11% and 13% a year for 2014 to 2016.

North America

North America was the first region to suffer the effects of the financial crisis, but it was also quick to recover, and adspend in North America has been more robust than in Europe since 2010. Adspend grew 3.5% in 2013, and we forecast a strong 4.6% in 2014, boosted by the Winter Olympics and mid-term elections, followed by 4.0% growth in 2015 and 4.1% growth in 2016. We have dialled back our forecasts for North America slightly since June – by 0.1 percentage points in 2014, 0.4 points in 2015 and 0.2 points in 2016 – after witnessing disappointing drops in network TV viewing and consumer magazine circulation.

Latin America

Similar to Fast-track Asia, Latin America is a region with rapidly growing economic output, and its ad market is growing at a similar rate. Adspend grew an estimated 9.3% in 2013, and – thanks partly to the popularity of the FIFA World Cup in Brazil – we expect it to grow 14.3% this year. We forecast adspend to grow a relatively restrained 8.6% against this tough comparison in 2015, but the summer Olympics, also hosted in Brazil, should help boost growth to 12.4% in 2016.

MENA

After the Arab Spring began in December 2010, advertising markets in Middle East & North Africa were constrained by the region’s social and political turmoil, which left many advertisers cautious about attracting negative attention. Adspend shrank 14.9% in 2011, and grew a meagre 1.4% in 2012. Confidence and activity began to recover in 2013, when adspend grew 4.7%. We expect growth to remain at 5% to 6% a year to 2016.

Authored by Jonathan Barnard, Head of Forecasting