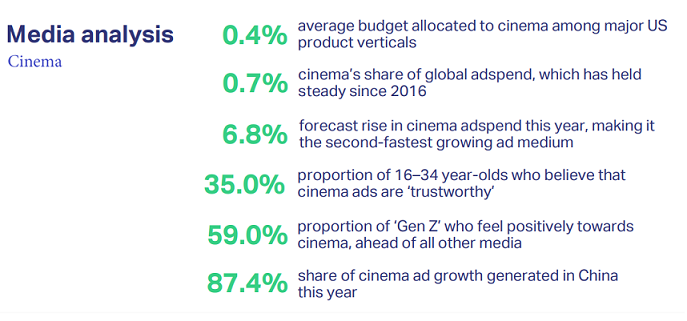

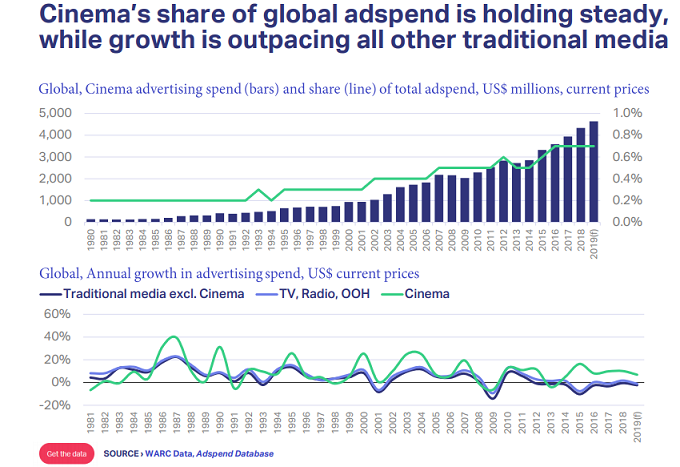

The global cinema advertising market is expected to be worth $4.6bn this year, representing a 6.8% rise from 2018.

The global cinema advertising market is expected to be worth $4.6bn this year, representing a 6.8% rise from 2018.

This is ahead of WARC’s all media growth forecast of 4.6% for 2019 (to $624.9bn), and places cinema as the second-fastest growing ad medium this year, behind internet as a whole.

Further, cinema’s 0.7% share of global adspend is expected to hold steady in 2019, making it the only medium other than internet not to lose share. Indeed, figures from WARC’s Adspend Database show that cinema’s share of global adspend has dipped only twice since 1980: once in 1994 and again in 2013.

Data show that growth in cinema ad investment has generally tracked ahead of other traditional media since 1995, and consistently so since 2014. Severe losses in print advertising business skew this comparison to a degree, but the trend is still apparent with print removed.

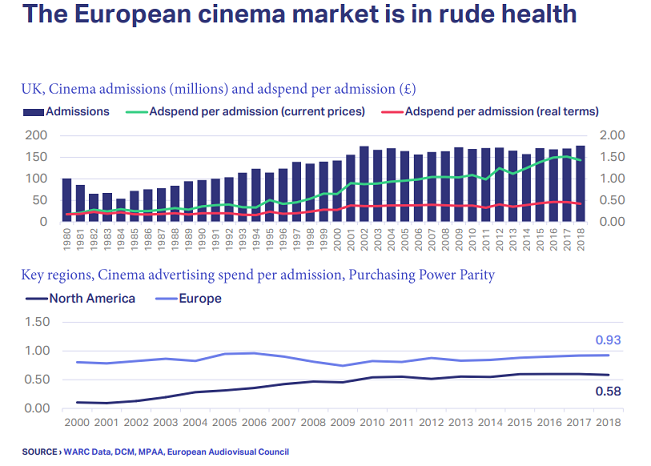

Adspend per admission has grown steadily over the long term in the UK, rising from £0.18 in 1980 to £1.43 last year, when 177m admissions were recorded – the highest on record. Beyond the UK, European advertisers spent 1.5 times more on cinema per admission than in the US last year when measured in Purchasing Power Parity (PPP) terms (so as to remove the distorting effects of exchange rate fluctuations).

Research by UNIC has found that the number of films screened in European cinemas (including the UK) has almost doubled over the last 15 years, with the highest growth recorded in Estonia (+175%), the UK (+112%), Poland (+102%) and Germany (+60%).

Ancillary research by the European Audiovisual Council, published this month, shows that China became the largest export market for European films in terms of admissions in 2017. China accounted for 37% of cumulative admissions to European films outside of Europe, compared to 28% for North America and 24% for Latin America. However, the US and Canada remained the most significant export market for European films in terms of gross box office earnings.

Cinema attracts a younger, more affluent audience who tend to be lighter TV viewers and who‘ve paid to give their undivided attention to the big screen. In the UK, DCM research shows that ABC1 adults visit the cinema 6.6 times in an average year, ahead of the all adult rate of 6.0. Further, those aged 16–34 visit 7.5 times in an average year, while main shoppers with children visit 5.6 times per year on average.

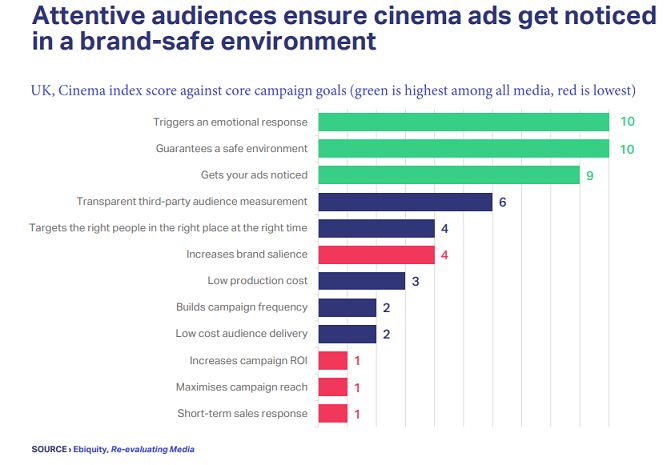

Captive audiences viewing high-quality ads in an emotional atmosphere is a draw for advertisers. Research from Ebiquity shows that cinema scores higher than all other media in regard to triggering an emotional response in audiences, getting ads noticed, and offering a brand-safe environment. As well as long-term brand building, cinema can also work for short-term activation: media can be bought by audience, specific film, location, genre and showing time for targeting. Cinemas are also close to retail outlets and, by extension, a point of purchase: 42% of consumers surveyed by DCM stated that they went for food or drink after seeing a movie.