Today’s children are different from the generations that have gone before. They’ve grown up with streaming, social media and screens on every available device. Information, entertainment and human connection has always been just a click away. This has had a massive impact on how they live — and how they shop.

Today’s children are different from the generations that have gone before. They’ve grown up with streaming, social media and screens on every available device. Information, entertainment and human connection has always been just a click away. This has had a massive impact on how they live — and how they shop.

But are retailers prepared for the needs of Generation Alpha, the 6-16-year olds entering the stores in five to ten years’ time? The answer, for the most part, is no. Many organizations are struggling to initiate strategies that will make them relevant for this future generation of customers. And all the while, retail innovators like Amazon are leading the way with one-day delivery, lightning fast payments, value-adding loyalty schemes and content creation — setting the benchmark for customer expectations.

To compete in this world, retailers must look beyond their quarterly, half and annual targets. Adopting a long-term view is the only way to meet the expectations of Generation Alpha when these shoppers come of age. With this in mind, Wunderman Thompson Commerce set out to discover more about Alphas, the next generation of consumers who are currently aged between 6 and 16. We spoke to over 4,000 individuals in this age bracket, half in the UK and half in the US, to learn more about their views on everything from influencers and Amazon, to deliveries and the shop floor.

There’s a tendency to view Alphas as ‘digitally native’ and therefore wedded to their screens. Notably though — as we’ll see later in the report — the digital world hasn’t won out yet, as children would prefer to split their time equally between the indoors and outdoors (47%). A further 27% would rather spend time outside, just

beating the 26% who want to stay indoors. And, interestingly, 46% of children would like to work outdoors when they grow up. This omnichannel approach to life, spanning digital and analog, is a recurring theme later in the report when it comes to shopping habits too.

Alphas think a lot about their future career, even though it’s a long way off. The majority would like their work to have a positive impact on the world. 59% would like to work somewhere saving lives, while 51% want a job where they can use technology to make a difference, a figure which is markedly higher for boys (61%) than girls (43%). In a trend we’re seeing more of among younger people, sustainability again looms large: 63% would like to work somewhere helping to save the planet.

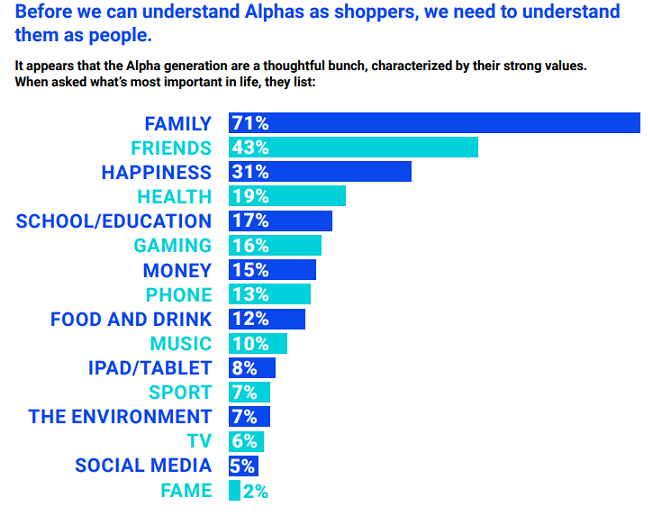

Mini-Alphas feel most strongly about an environmental career, with 67% of 6-9-year olds saying saving the planet will be their job focus. American children are also most interested in this type of work, with 66% of children in the US choosing this vs 60% in the UK. This focus on values is matched by a similar level of positivity when it comes to organizational ethics. Unsurprisingly, Alphas want to buy from places that match their values and that behave responsibly towards the environment and society at large.

Two thirds (66%) of kids like to buy from companies that are trying to do good in the world. The attitudes of this emerging generation raise some interesting questions for the future of eCommerce. Retailers need to appreciate what differentiates Alphas from their elders. As the first fully digitally-native peer group, Alphas will be preconditioned to expect great service through any online channel they choose. But it’s their focus on values and ethics that will really make a difference. To secure this generation of shoppers, retailers will need to embrace Alphas’ principles — even when this seems to run counter to the drive for profit.

Friends and family have always exerted influence over our buying habits. You see someone wearing or using something cool, whether that’s in the playground, on the bus or at a party, and you go and buy it yourself. That’s how trends work. But young people today are being influenced by a wider range of factors than ever before and more of these factors are external. We’ve moved far beyond the bus and the playground. Now, children are influenced by social media platforms, programmatic advertising and on-demand TV. This means that brands need to be across multiple channels — and more importantly, the right channels — to ensure they’re finding their target audience.

As it stands currently, Alphas are too young to take control of their own finances. So, it’s unsurprising that they are influenced by the people who do: their parents. 53% are likely to shop in the same way as their parents, which means if their mum and dad purchase online, so will they. And if our previous Future Shopper report is anything to go by, then Gen Alpha are likely to turn to Amazon for their purchases, to emulate their parents; our 2019 research found that 58% of online purchases in the US and 35% in the UK are made via Amazon.

But when it comes to deciding what they want to buy, children are influenced by a number of different factors — and influencers are chief among them. Only 3% more children cite friends as a bigger influence than influencers or bloggers. And, perhaps most significantly, Alphas regard influencers as more important than family by 4%. Astonishingly, influencers have relegated family members to third position when it comes to shaping the shopping preferences of children. Interestingly, influencers and bloggers on social media affect all age groups to the same extent, showing that the pulling power of influencers starts at an alarmingly early age.

What we’ve found is a curious gender split. Boys are much more likely to be influenced by online videos than girls (29% vs 20%), while girls feel the effect of social media more strongly (23% vs 13%). And, while online videos are slightly more influential in America for kids than in the UK (26% vs 22%), children are much more swayed by TV adverts in the UK than in the US (22% vs 15%). The difference in preferences, based on gender and geography, demonstrate that decisions about content, media and channel cannot be blindly applied to Generation Alpha, but must be selected based on more precise audience segments. While video, TV and online is the most influential, social media is not to be overlooked. The majority of Alphas (57%) say seeing adverts on social media makes them want to buy those products. And this is especially effective for Midi-Alphas, as 59% of 10- 12-year olds feel most strongly about this. And the influence of social media content only becomes stronger as children grow older; with 13- 16-year olds three times more likely (32%) to say that social media posts influence their purchasing decisions than 6-9-year olds (9%) and twice more likely than 10-12-year olds (15%).

Interestingly, 6-9-year olds are more futuristic and ambitious in their thinking, with 15% wanting to shop with our minds in the future, in comparison to 11% of 10-12-year olds and 5% of 13-16-year olds. In comparison, 13-16-year olds could be seen as having a more traditional approach to shopping, with a quarter (25%) saying they would most want to purchase in a physical store, rather than through their screens. This is compared to 16% of both 6-9-year olds and 10-12-year olds. While the numbers may reflect the fact that younger minds are more imaginative, mini-Alphas’ openness towards new and innovative methods of purchasing should be a welcome invitation for retailers, marketplaces and brands to think outside the box when it comes to how the next generations want commerce to work in the future.

When considering what they would most like to change about shopping today, three in ten children pointed to a model like Programmatic Commerce™ (whereby machines will automatically order items based on pre-set preferences): “companies will send me things they think I would like to try or use, even without asking”. A further one in ten said: “everything would be automatically ordered for me”. This suggests that Programmatic Commerce™ will be well-received among this age group when it’s rolled out.

Voice assistants and interacting with brands via voice is also gaining traction with the Alpha generation; however, there is still some way to go in perfecting this approach to commerce. More than half of Alphas (51%) like to talk to Alexa, but only one in ten say their preferred method of shopping will be through a voice assistant. Even though a majority enjoy communicating through voice, confidence in the technology still has some way to go. Only 39% of children trust Alexa and 43% were “not sure” if they did or not. Clearly there’s more work to be done to encourage Alphas to purchase via voice, but the seeds have already been sown for a future where screens are less important to online purchasing. Already, usage of Alexa is high. Nearly a quarter (22%) of children have used Alexa or a voice assistant to purchase online and 41% of children intend to shop through Alexa when they are older.

This trend is more pronounced amongst Mini-Alpha respondents: 6-9-year olds are most likely to do this (47%), followed by 10-12-year olds (43%) then 13-16-year olds (32%). Similarly, today’s children are happy to embrace the digital world when it comes to owning and consuming products. Looking at shopping online, 55% would rather buy or download something digitally e.g. via a Kindle/tablet/Netflix than buy a book or DVD.

The fact that the majority are comfortable with the idea of buying products in a digital format shows how far eCommerce has come in recent years; and should act as a lesson for organizations on how transitioning from physical to digital products can place them at the forefront of commerce in the future. But at the same time, the high street — and traditional bricks and mortar retail — holds a significant sway. Three quarters of Gen Alpha (75%) like the experience of going to an actual shop, while 47% enjoy shopping on the high street. Only 38% prefer buying/being bought something online rather than in shops. It seems that the experience of trying things out is important to children: when considering the one thing they would change about retail, over a quarter (27%) of children said, “every shop would have an area where I could use the gadgets or play with the toys”. This goes to show that, for physical retailing to remain relevant, it must either be an experience or innovative; or, ideally, both.

In the face of these numbers, it seems that a digital-only offering could alienate the many future shoppers who still value the physical store and overall high street experience. In fact, children are asking for an alignment of the physical store with the digital one, as 74% like seeing the same thing in a shop and online. Technology could even bring the physical shopping experience into the home, as 22% of children agreed that: “using virtual reality, I could visit any of my favorite shops without needing to go there myself”. In this way, combining the best of both worlds seems to be the winning formula for the Alpha generation.

Retailers must anticipate the desires of today’s young people, five to ten years into the future, or they will risk losing the next generation of consumers before they even begin shopping. It’s an intimidating prospect. Expectations have never been higher and they’re growing at the same rate as the children who hold them. Businesses who prepare now will ensure they’re ready to meet Alphas’ needs when they come of age. This means:

Building an omnichannel offering is essential, including: – Developing an Amazon strategy – A complimentary direct-to-consumer offering And remember, physical retailing is not dead!

• Having a social media and social influencer strategy is vital.

• Prepare for the future of social… social commerce… with an even more fragmented channel mix and the entry of a new breed of “influencer retailers”.

• Create and implement a voice (and zero-UI) plan.

• Think differently about how to purchase your products and about the products themselves — how can friction points be addressed by digitising all or part of the product and its experience?

• Invest in infrastructure to avoid reliance on third parties and hit the customer expectation benchmark around services like delivery.

Clearly, Alphas are looking for a rich and exciting shopping experience, accessible both online and instore. They invest in the emotional rollercoaster of delivery and expect not to have to wait. They follow the trends set by influencers and they already enjoy the convenience and choice offered by Amazon. And all of this is underpinned by a new emphasis on ethics and sustainability.

This emerging generation has given retailers a lot to consider. But this is where the opportunity lies. Hopefully, the advice and insight in this report has helped to both challenge and inspire your thinking, and will help you develop an action plan for the years ahead. At this moment in time, retail businesses have to make a choice. Will you remain as you are and miss out on the changes brought about by a whole new type of shopper? Or will you follow the lead of Generation Alpha and take your first steps into maturity — and an exciting future?