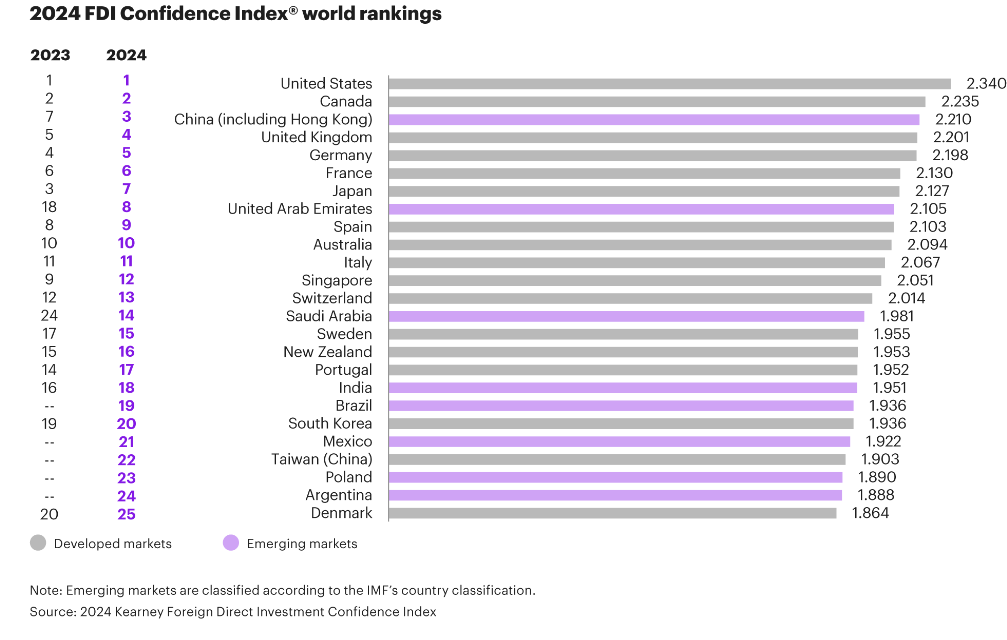

In an impressive testament to its economic strategy, the United Arab Emirates has made a significant leap to the 8th position on Kearney’s 2024 Foreign Direct Investment Confidence Index® (FDICI), up from 18th place in 2023, and now stands 2nd on the Emerging Market Index after China.

The FDICI, now in its 26th iteration, continues to be an authoritative forecast of global FDI trends, with the UAE’s advancements reflecting its successful drive to diversify its economy and solidify its position as a strategic regional hub on the global stage.

The UAE’s multifaceted economy has witnessed extraordinary growth across key sectors that have thrived as a direct result of the nation’s diversification policies. This is reflected in the increase in FDI inflows from $20.7 billion in 2021 to $22.7 billion in 2022, representing 60% of the total FDI attracted to Gulf Cooperation Council (GCC) countries.

Rudolph Lohmeyer, Partner at National Transformations Institute, Kearney Middle East, said: “The UAE’s remarkable ongoing rise in Kearney’s 2024 FDI Confidence Index is a clear reflection of its visionary leadership and decisive push towards economic diversification, which have firmly cemented the UAE’s position as a magnet for global investment. Its higher ranking reflects growing investor confidence driven by the UAE’s sustained track record of policy reform. The UAE’s demonstrated resilience, state-of-the-art infrastructure, robust capital markets, and a thriving tech ecosystem, enable it to offer a uniquely attractive value proposition for global investors, even in the context of intense global competition for investment.”

The UAE’s attractiveness to global investors reflects the country’s comprehensive efforts to create an optimal business environment, including by building an exceptional technology environment which is fueling investment in sectors including fintech, e-commerce, agritech, logistics, ICT, and renewable energy.

Further driving the UAE’s investment appeal is its world-class infrastructure, a feature that not only facilitates business operations but also enhances the quality of life. The nation’s commitment to infrastructure development is a cornerstone of its appeal to high-value industries and plays a pivotal role in its sustained economic momentum.

The second annual ranking for emerging markets welcomes newcomers to the top 25

China, the United Arab Emirates, Saudi Arabia, India, Brazil, Mexico, Poland, and Argentina make up the top eight positions, and they are the only emerging markets included in the world rankings. Regionally, the Americas has the most markets on the list with nine, followed by Asia Pacific at seven, the Middle East and Africa at five, and Europe at four. Southeast Asia continues to show its strength, with Thailand, Malaysia, Indonesia, and the Philippines all among the top 15. Seven of the 25 markets on the Index—Poland, Chile, Romania, Peru, Hungary, Uruguay, and Oman—joined the list for the first time.