Netflix’s international subscriber base now makes up just over 60% of overall subscribers, with international markets consistently driving growth for the streaming platform.

Netflix’s international subscriber base now makes up just over 60% of overall subscribers, with international markets consistently driving growth for the streaming platform.

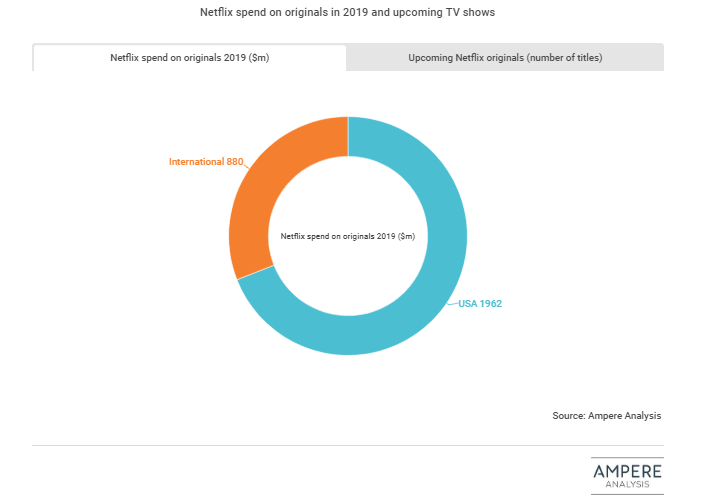

To support this growth Netflix has increased its investment in international content. Alongside the acquisition of localised content Netflix has also been developing a broad slate of international original content. Ampere estimates that in 2019 Netflix spent $2.8bn on original content, of which $880m—just over 30%—was spent on international originals.

Building a broad original content slate has been central to Netflix’s strategy for a number of years. A larger original library protects Netflix from the loss of licenced content from major studios who are rolling out their direct-to-consumer offers. Additionally, exclusive original content acts a key subscriber acquisition and subscriber retention tool for Netflix. As international markets have risen in importance, increased content investment has followed to create more localised content offer.

Netflix’s upcoming slate shows a strong commitment to this strategy. International content now accounts for 59% of Netflix’s new upcoming TV series and 40% of its upcoming movies. Outside of the US the largest international markets for Netflix TV series commissions include Canada and the UK, as Netflix is able to exploit English language content in multiple markets. Other key international markets include France, with 10 series in the works, and India with 10 upcoming series. Both Spain and South Korea have also been important markets for Netflix original content in recent years. This includes global hits Money Heist and Elite from Spain. Netflix is looking to continue development in these markets with 9 upcoming new TV series in both Spain and South Korea.

Source:Ampere Analysis