High-profile events such as the FIFA Women’s World Cup and WNBA games have significantly increased viewership, alongside expanded media coverage and social media visibility. The heightened interest in women’s sports has fuelled sales of women’s sportswear and these products outperformed men’s over the last five years (5% vs 3% CAGR, respectively, over 2018-2023). Despite the better performance, gender gaps persist in the sports world, offering opportunities for those who want to invest in this expanding segment.

Brands, big and small, eager to leverage the women’s sports boom

In response to the growing interest in women’s sports, brands attempt to capitalise on growth opportunities through team/athlete sponsoring, new product lines, marketing campaigns, or partnering with women’s or girls’ organisations.

Either inspired by global/regional events such as Wimbledon, European Championships, Copa America or the Paris Olympics, or due to increasing popularity of certain sports such as tennis or golf, fashion brands and retailers have found a new stream of growth through sports-inspired products.

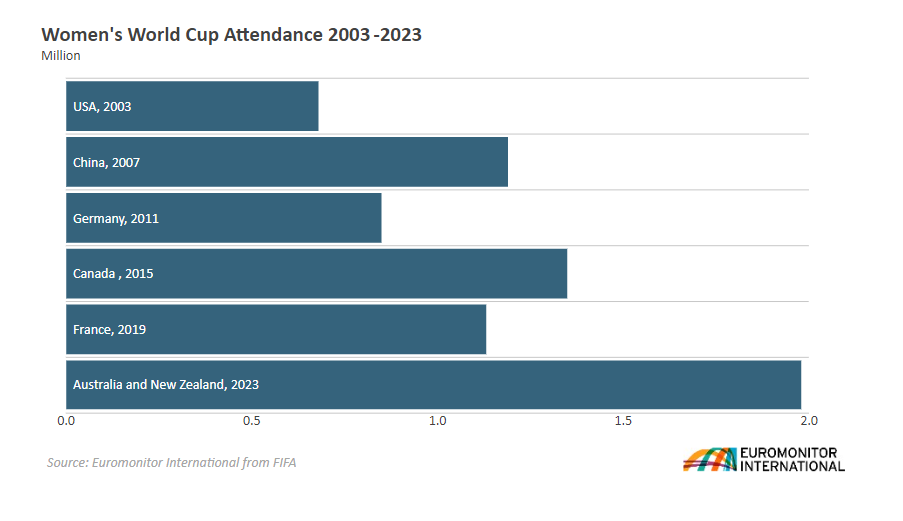

The FIFA Women’s World Cup 2023 captured the attention of football fans across the globe and broke records in ticket sales, broadcast figures, digital media data and merchandise sales, according to FIFA’s reports.

Almost 54 million viewers in China produced the highest audience for a single match when their team played against England

Source: Euromonitor International from FIFA

The growing popularity did not go unnoticed by brands across industries, as having access to such a captive audience brings enormous opportunities to increase visibility. Equipment sponsorships play a large part in this strategy, and sportswear brands Nike and adidas dominate the field with 26 and 11 sponsorship deals, respectively, across the top four women’s football leagues in the world.

Tapping into underserved segments opens new pockets of growth

Sportswear brands are driving growth by targeting underserved segments. Among those are women whose needs are influenced by their environments, beliefs, and cultures. For example, reaching approximately 800 million globally, many Muslim women seek sportswear that respects their cultural practices, prompting brands like REYD, Puma, Sweaty Betty, and Gymshark to launch sports hijabs.

The rise of sports like pickleball is leading to more offerings and collaborations. In the US, pickleball saw a 200% increase in participation since 2020, and grew even faster among women to reach 40% of players in 2023. Brands like lululemon are partnering with fitness centres like Life Time to cater to this growing demand by providing apparel for pickleball and collaborating on events.

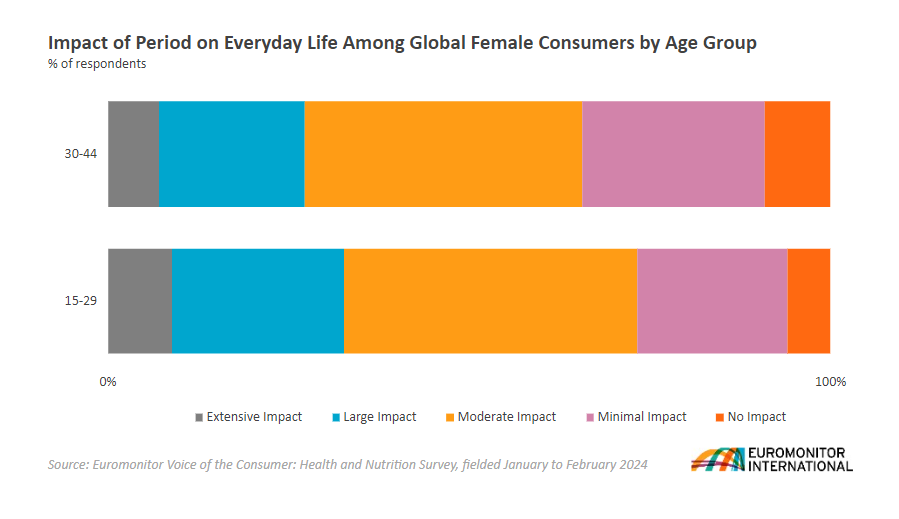

Period and menopause fashion items are becoming more mainstream, especially in Europe and the US, with sportswear brands beginning to address women’s specific health-related needs across different life stages.

Around one third of women aged 15-44 feel a large or extensive impact on their everyday lives due to their period

Source: Euromonitor Voice of the Consumer: Health and Nutrition Survey, fielded January to February 2024

Leakproof sportswear, once overlooked, has gained traction as major brands like adidas, Nike, and Puma have introduced period-proof leggings, shorts, and activewear.

The menopause market represents a significant opportunity and, so far, innovation in this segment is focused on moisture-wicking and temperature-regulating fabrics to help combat hot flushes and provide support for joint pain and muscle stiffness. For instance, US brand Fifty One Apparel, with its Thermocules technology that helps regulate body temperature, has made inroads into this segment.

Sports/physical activity as a path to women’s health

Gender equality remains a pending task in health and in sports science/sports medicine research – which still falls short when it comes to female-specific studies. Investments in women’s health within sports are crucial for ensuring they receive adequate support. This includes funding for research on female-specific health issues (menstruation, hormonal disorders, pelvic health, nutrition and injury risk, to name a few), improved access to sports medicine professionals who specialise in female physiology, and better facilities and equipment designed for women.

From partnering with women’s health organisations, creating safer exercise environments, providing education on the benefits of physical activity, offering women-only spaces or programmes, and challenging societal norms that discourage women from being active, brands and retailers play a key role promoting physical activity among women and further support their overall health.

28% of women globally do not engage in physical exercise or have low levels of activity

Source: Euromonitor’s Voice of the Consumer: Health and Nutrition Survey, fielded January to February 2024

Some brands are already investing in this area. ASICS’s running programme for women, “Road to Tokyo Legacy Half Marathon 2023”, examined the challenges women in Japan face in finding time to exercise, such as work, housework, or raising children. Similarly, lululemon’s “FURTHER” initiative, in collaboration with Canadian Sport Institute Pacific, is conducting research on underexplored areas of women’s sports performance and helping to develop new women’s sportswear products.

Advocacy for gender equality is set to get louder and stronger, further impacting the sports world. Female consumers will choose brands that advocate their cause, personalise products to their size, age or life stage, and change their messaging and marketing approach.