The GCC chapter of the Interactive Advertising Bureau released a first of its kind industry study in MENA to measure investment for the region.

The IAB board that includes 14 of the leading companies in the ad industry (Choueiri Group | DMS, MBC Group, MMP World Wide, Anghami, Amazon, Google, Facebook, Snapchat, Twitter, Publicis, OMG | PHD, MCN Mediabrands, GroupM and Dentsu) commissioned the study earlier this year to MTM, a research organization that has previously produced similar market sizing studies across multiple markets in Europe including for IAB Europe. The board unanimously approved the release of the data and released it via an online event that took place on the 22 of September, 2021.

Here are some key highlights:

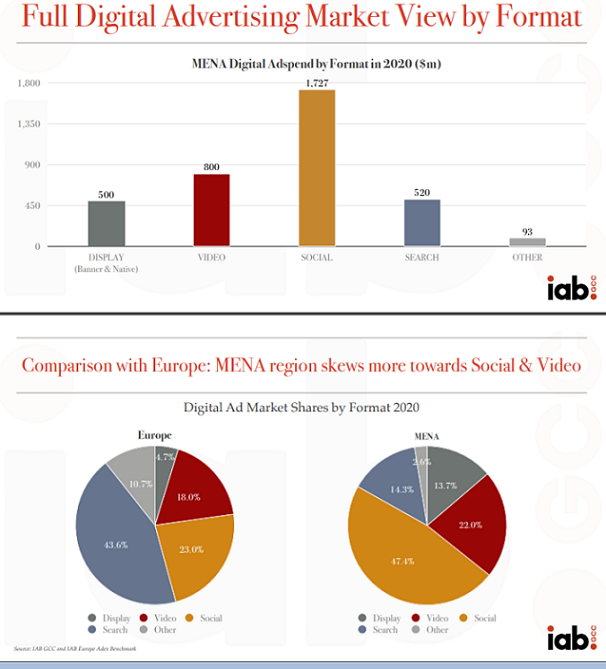

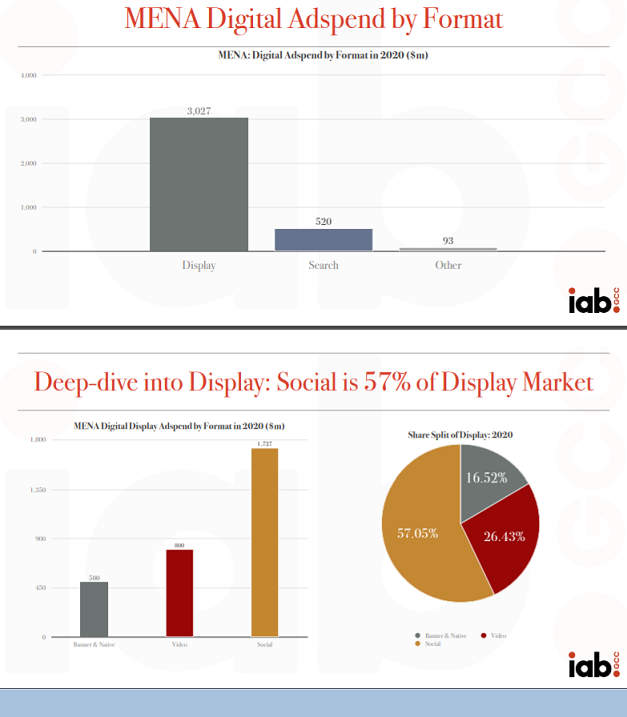

Social channels accounted for as much as 47% of total digital advertising in 2020, surpassing European benchmarks, yet in line with consumer trends for the region’s which has a traditionally strong social user base.

Digital Video ($800M excluding social video) continues to dominate over display ($500M), again supporting the region’s traditionally strong digital video viewership.

Search advertising accounted for 14% of total digital, well below the European average.

Commenting on the release, Rayan Karaky, Chairman of the IAB GCC, said: “The significance of this study is well beyond the numbers; it’s the first time we have truly come together as an industry in an effort to bring more transparency to the market. As you’ll see from the results the digital adspend per capita in MENA is still severely below global benchmarks even in similar markets to ours, these numbers show the opportunity is significant and we as the IAB GCC will continue being the enabler of growth to the digital Ad ecosystem.”

Ian Manning, IAB GCC Acting CEO added: “We’re excited to share this with the market as it shows that MENA’s digital sector is larger than many may have thought, it’s growing strongly and it’s clear there is still substantial room for growth. Interestingly, while lagging European markets in areas like programmatic adoption, we are in fact leaders in other areas, perhaps indicating the future direction for Europe.”

MCN Mediabrands CEO, Shadi Kandil commented: “As agencies, it’s important for us when looking at the market size to check our own bias on the type of industries we normally service; the study clearly shows that direct businesses, retail, commerce as well as long tail advertisers constitute a large share of the market which really is a meaningful opportunity for our business to build solutions that cater to this segment of the market.”

Michel Malkoun, Chief Growth Officer, Choueiri Group and IAB Vice Chair added: “This piece of research will act as a lighthouse to attract global investments to the region, guide start-ups on growth areas, and help to shine global interest onto MENA, to name a few advantages. This is all in the hope of bringing MENA up to par in terms of advertising spend per capita with similar markets. What’s remarkable is that for the very first time, we have a consensus from all the major players, on not only the research but also its desired outcome. We’re very excited about this development.”

Working with the region’s main digital buyers and sellers, a unique methodology was devised and implemented with the help of MTM. Dr Daniel Knapp, IAB Europe’s Chief Economist who led the MTM team commented: “This methodology was in fact addressing an issue that many markets across the world had been grappling with in getting accurate figures – the lack of total platform spends. By including a mix of reported actuals, collaborative estimates, mathematical modelling and comparative benchmarks to come to an agreed industry figure, we were able to estimate the total market more accurately.”

Townsend Feehan, CEO, IAB Europe added: “The strong growth we saw in our own market sizing in Europe shows that digital advertising is going to be ever more important in the media mix post 2020. It is great to see the MENA region launch its own market sizing to put the evolution of digital advertising on a robust and evidence-driven basis.”

Conclusion & Key Learnings

• Ad market sizing in MENA pioneered a new hybrid method that combines granular estimations from market participants with extensive econometric modelling

• Versions of this model will successively be applied by other markets, as the standard model of revenue reporting surveys only reflects part of the market

• MENA is an early market to adopt programmatic market sizing which is still undergoing a lot of development internationally

• Despite its classification as an ‘emerging’ digital ad market in terms of international Adspend per capita comparisons, the MENA Adspend emphasis on key growth areas of video and social suggest that MENA is already ahead of format adoption compared to other, more ‘mature’ markets