According to a paper published by Kantar Worldpanel ComTech, mobile penetration in the US and Europe‘s Big Five Countries (EU5) has reached 91%, and in urban China, that number has risen to 97%.

Nearly everyone now has a mobile phone, and if those numbers are not staggering enough – 65% of Americans, 74% of Europeans, and 72% of urban Chinese consumers own a smartphone.

“With this kind of market penetration already in place, some in the industry are wondering where future sales will come from,” said Carolina Milanesi, chief of research at Kantar Worldpanel ComTech, one of the authors of the paper. “As is often the case, the answer depends on how you look at it.”

During 2016, Milanesi estimates, smartphone sales will be largely based on:

• Convincing die-hard feature phone users that they need a smartphone

• Persuading smartphone owners that they want and need the “next big thing”

Changes in smartphone OS market share, along with sales for the two top smartphone brands (Apple and Samsung), will come mainly from convincing users to switch from the competition.

“Many feature phone owners simply do not want a smartphone,” Milanesi added. “Price is the biggest hurdle in getting feature phone users to upgrade to a smartphone. In Germany, 79% of recent feature phone buyers spent less than €60 on their device, while just 19% of smartphone buyers spent that amount. Smartphone buyers spent a total average of €276, while feature phone buyers spent an average of only €57.”

Feature phone owners across markets are challenged in finding smartphones that offer what they consider a good value for money spent. They are unlikely to upgrade to a smartphone until they can no longer rely on their current device. While looking year over year might not be enough to see a clear trend, examining the past three years makes it clear that smartphone life cycles are getting longer.

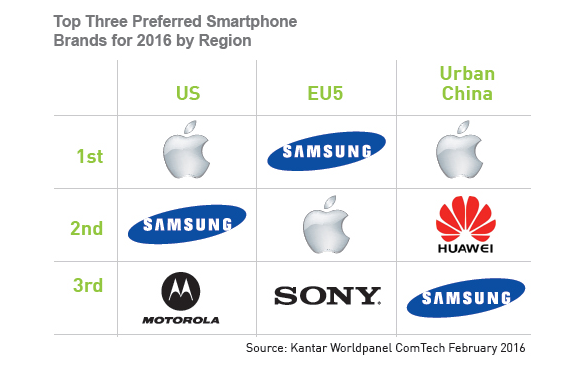

“In the US, 40% of consumers planning to change their device prefer Apple, and another 35% prefer Samsung. Then, there is a large gap before we get to Motorola (6% preference) and LG (5%). In the EU5, the leadership position among preferred brands is reversed, with Samsung at 37% and Apple at 29%,” she reported.

For the foreseeable future, Milanesi believes, the smartphone will remain the device around which millions of people organize their lives. With market saturation, there are no longer hundreds of millions shopping for a first smartphone, but there are hundreds of millions who will carry smartphones everywhere they go.

“The smartphone market will never again see the growth of the past ten years. But, the opportunities to monetize from what has already been built are there, for those with the vision to find and seize them,” Milanesi said.