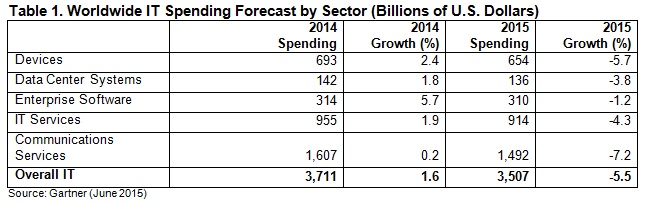

Worldwide IT spending is on pace to total $3.5 trillion in 2015, a 5.5 percent decline from 2014, according to the latest forecast by Gartner, Inc. Analysts attribute the decline to the rising U.S. dollar. In constant-currency terms, the market is projected to grow 2.5 percent. In Gartner’s previous forecast in April, it had forecast IT spending to decline 1.3 percent in U.S. dollars and grow 3.1 percent in constant currency.

Worldwide IT spending is on pace to total $3.5 trillion in 2015, a 5.5 percent decline from 2014, according to the latest forecast by Gartner, Inc. Analysts attribute the decline to the rising U.S. dollar. In constant-currency terms, the market is projected to grow 2.5 percent. In Gartner’s previous forecast in April, it had forecast IT spending to decline 1.3 percent in U.S. dollars and grow 3.1 percent in constant currency.

“We want to stress that this is not a market crash. Such are the illusions that large swings in the value of the U.S. dollar versus other currencies can create,” said John-David Lovelock, research vice president at Gartner. “However, there are secondary effects to the rising U.S. dollar. Vendors have to raise prices to protect costs and margins of their products, and enterprises and consumers will have to make new purchase decisions in light of the new prices.”

The Gartner Worldwide IT Spending Forecast is the leading indicator of major technology trends across the hardware, software, IT services and telecom markets. For more than a decade, global IT and business executives have been using these highly anticipated quarterly reports to recognize market opportunities and challenges, and base their critical business decisions on proven methodologies rather than guesswork.

Communications services will continue to be the largest IT spending segment in 2015 with spending at nearly $1.5 trillion (see Table 1). However, this segment is also experiencing the strongest decline among the five IT sectors. Price erosion and competitive threats are preventing revenue growth in proportion to increasing use within most national markets.

In the device market, mobile phones continue to be the leading segment, with growth in Apple phones, especially in China, keeping overall phone spending consistent. However, overall smartphone unit growth will start to flatten. The PC and tablet markets continue to weaken. The expected 10 percent increase in average PC pricing in currency-impacted countries is going ahead, delaying purchases even more than expected. Excessive PC inventory levels, especially in Western Europe, need to be cleared, which will delay Windows 10 inventory in the second half of the year.

Within the data center systems segment, storage and network markets are both expected to see weaker growth in U.S. dollar terms as a result of the appreciation of the U.S. dollar. Enterprise budgets for data center systems in local spending are expected to remain stable for the year, with users expected to extend life cycles and defer replacements as a means of offsetting the price increases. The overall near-term data center weakness is slightly offset by a more positive outlook for the server market. The server market is benefiting from a stronger-than-expected mainframe refresh cycle, as well as increased expectations for hyperscale spending.

Enterprise software spending is forecast to decline 1.2 percent in 2015, with revenue totaling $654 billion. Gartner analysts said many software vendors will try not to raise prices because software as a service (SaaS) is about market share, not profitability. Raising prices could take software vendors out of a sales cycle, and these vendors don’t believe they can afford to lose a client.

IT services spending in 2015 is projected to decline 4.3 percent. Gartner expects modest increased spending on consulting in 2015 and 2016, as vendors have demonstrated their ability to stimulate new demand from buyers looking for help with navigating business and technology complexities, particularly related to building a digital business. However, the forecast for implementation services has been slightly reduced. Increasingly, buyers prefer solutions that minimize time and cost of implementation, driving demand for more-efficient delivery methods, out-of-the-box implementation, and lower-cost solutions.

“IT activity is stronger than the growth in spending indicates. Price declines in major markets like communications and IT services, and switching to ‘as a service’ delivery, mask the increase in activity,” Mr. Lovelock said.

More-detailed analysis on the outlook for the IT industry will be presented in the webinar “IT Spending Forecast, 2Q15 Update: Why Is Global IT Spending Shrinking?” The complimentary webinar will be hosted by Gartner on July 14 at 11 a.m. EST. During the webinar, Gartner analysts will discuss where global IT spending is headed from 2015 through 2019. Analysts will also look at how foreign countries’ spending is being changed by the rising U.S. dollar. They will also look at where product prices have increased, and who will spend more and who will spend less. For more information, please visit http://www.gartner.com/webinar/2939722.

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of sales by thousands of vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data upon which to base its forecast. The Gartner quarterly IT spending forecast delivers a unique perspective on IT spending across hardware, software, IT services and communications services segments. These reports help Gartner clients understand market opportunities and challenges. The most recent IT spending forecast research is available at http://www.gartner.com/technology/research/it-spending-forecast/.