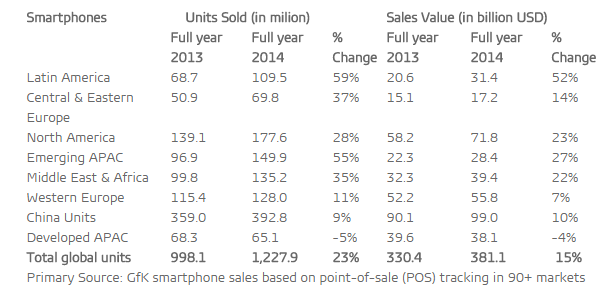

GfK’s 2014 sales tracking data shows Latin America is the fastest growing region for smartphones, up 59 percent year-on-year

GfK’s 2014 sales tracking data shows Latin America is the fastest growing region for smartphones, up 59 percent year-on-year

Globally, unit sales of smartphones with larger screens (5”+) grew 180 percent in 2014. GfK forecasts this to be the largest segment in 2015

Emerging markets will drive growth of smartphone sales this year, with those priced below $100 gaining the biggest market share globally.

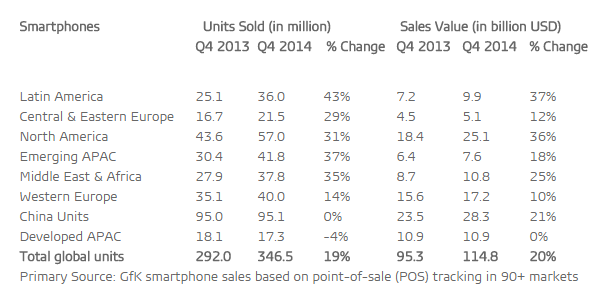

Global smartphone sales set a new milestone in Q4 2014, reaching $115bn for the quarter, an increase of 20 percent year-on-year, according to GfK data. The number of units sold globally increased to almost 346m, up 19 percent on Q4 2013.

In Q4 2014, all regions saw year-on-year growth in smartphones, both in terms of units and value. The one exception was Developed APAC, where subsidy changes in Korea negatively affected these already very mature markets. The Latin America smartphone market enjoyed the highest growth with 36m units sold in Q4 2014, a 43 percent year-on-year increase. This region also saw the value of units sold increase by 37 percent year-on-year to around $10bn.

China will remain the biggest market in terms of both unit and value sales for the foreseeable future. However, growth slowed dramatically in the second half of 2014. During the fourth quarter smartphone unit sales were flat year-on-year, although the value of units sold increased by 21 percent year-on-year to $28bn, the highest ever quarterly figure.

Kevin Walsh, Director of Trends and Forecasting at GfK says: “The increase in the value of units sold in China, despite the recent plateauing of unit sales, is due to consumers’ rapid adoption of higher priced smartphones with larger screen sizes. This is a trend seen in most markets and GfK global data shows that the 5 to 5.6 inch segment grew by more than 130 percent year-on-year in the last quarter of 2014 and by nearly 150 percent in the full year. In 2015, we forecast this segment to become the dominant screen size band, surpassing 4 to 4.5 inch for the first time.”

All other regions – except for North America and developed APAC – saw a decrease in the ASP in Q4 2014. Looking ahead, all regions will grow in unit terms in 2015, but growth rates will slow significantly from 2014.

Walsh continues: “The slowdown forecast for 2015 is due to developed markets reaching saturation point. As a result, global smartphone unit growth will be only 14 percent this year, down from 23 percent in 2014. We forecast emerging regions to drive growth in 2015 as smartphones further penetrate lower price points. GfK forecasts that smartphone price bands above $150 will see a decline in their market share. At the next level down, $100-150, sales will remain stable, but it is the cheaper smartphones priced below this point that will gain share.”

The most resilient two regions in 2015 – both forecast to grow by 33 percent in unit terms – are Emerging APAC and Middle East & Africa. Both regions still have significant room for growth as consumers migrate from feature phones and existing smartphones to trade up to a bigger screen.