L’Oréal retains title as most valuable cosmetics brand valued at US$11.2 billion

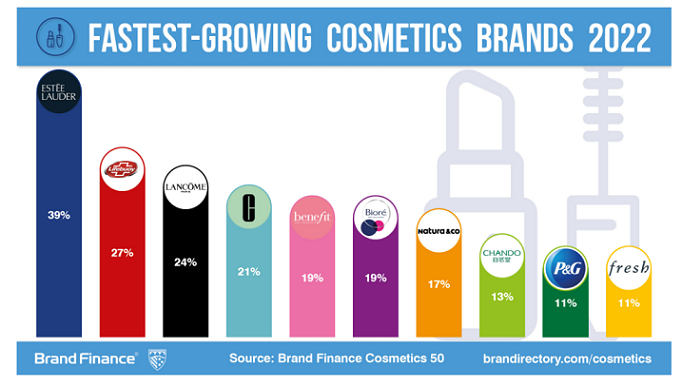

Estée Lauder brand value surges 39% this year to be fastest growing brand

Natura is world’s strongest cosmetics brand with AAA+ rating

Lifebuoy from Unilever enters Top 50 rankings with hand sanitiser and soap

Asian hair care brands struggle with Sunsilk, Clear and Rejoice falling in value

L’Oréal (brand value up 10% to US$11.2 billion) remains the world’s most valuable cosmetics brand, according to a new report from the world’s leading brand valuation consultancy, Brand Finance. After a tough two years due to the COVID-19 pandemic which substantially reduced cosmetics sales across the world, the brand value of L’Oréal has almost returned to its pre-pandemic value.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The cosmetics industry’s top 50 most valuable and strongest brands in the world are included in the annual Brand Finance Cosmetics 50 ranking.

L’Oréal continues to lead the global cosmetics industry on the back of its valuable brand portfolio, led by the L’Oréal Paris brand. The French brand has built significant value over 100 years of operation by continuing to innovate and acquire complementary brands that build upon its significant history, value and tradition. This year has seen a transition of leadership from outgoing CEO Jean-Paul Agon, who led L’Oréal for 15 years, to incoming CEO Nicolas Hieronimus. Industry analysts believe that the promotion of key lieutenant Hieronimus from within represents an effort to build on the existing strategy to lead the brand out of the pandemic.

Annie Brown, Associate Director at Brand Finance, commented: “L’Oréal is – again – the world’s most valuable cosmetics brand, but with consumers forecast to increase spending as they re-emerge from the pandemic, the brand has significant growth opportunities. The key challenge for new CEO Hieronimus will be to serve as an effective brand guardian for L’Oréal as it seeks to return to growth, especially throughout Asia.”

Estée Lauder brand value surges 39% this year to be fastest growing brand

Estée Lauder (brand value up 39% to US$7.9 billion) jumped three places from 5th in the cosmetics ranking this year to become the 2nd most valuable cosmetics brand in the world, and the fastest growing. In doing so, it passed Gillette (brand value down 8% to US$6.9 billion), Nivea (brand value up 10% to US$6.8 billion), and Guerlain (brand value up 8% to US$6.1 billion) in brand valuation.

Fresh from celebrating its 75th anniversary, Estée Lauder is investing significant effort in innovative technological developments focused on improved sustainability, with a particular attempt to reduce the use of plastic and refined petroleum products.

Natura is world’s strongest cosmetics brand with AAA+ rating

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. Natura (brand value up 17% to US$2.4 billion) is the strongest brand in the cosmetics ranking with a Brand Strength Index (BSI) score of 91.5 out of 100 and a corresponding brand rating of AAA+.

The brand strength of Natura is boosted by South American stakeholders feeling a strong affinity to the brand – significant proportions of customers familiar with the brand feel a strongly positive connection with the brand. Natura benefits from both local patriotism and a belief amongst many consumers that the brand is caring sustainably for local natural heritage such as the Amazon rainforest.

Lifebuoy from Unilever enters Top 50 rankings with hand sanitiser and soap

Lifebuoy (brand value up 27% to US$0.7 billion) entered the Brand Finance Cosmetics 50 for the first time on the back of rapid growth for the Unilever-owned hand sanitiser and hand soap brand. Lifebuoy, which was the second-fastest growing brand behind only Estée Lauder, answered strong global consumer demand for hygiene products in response to the pandemic.

Lifebuoy benefits from being in the Unilever portfolio of brands. This allowed Lifebuoy to obtain widespread distribution to supermarkets across the world and is a powerful reminder that availability and accessibility is a significant driver of brand value.

While the pandemic obviously created many weaknesses and threats for cosmetics brands, the disruption also created new opportunities, with responsive brands pivoting to the production and distribution of sanitiser and assorted cleaning products. While subsequent scientific advances questioned the widespread use of hand sanitiser to combat a virus which primarily spread in the air, many consumers have changed habits to use hand sanitiser daily.

Asian hair care brands struggle with Sunsilk, Clear and Rejoice falling in value

Several hair care brands in the Asian market faced a tough year, with Sunsilk (brand value down 20% to US$1.0 billion), Clear (brand value down 19% to US$0.9 billion) and Rejoice (brand value down 17% to US$0.9 billion) each losing brand value. This trio of brands are facing changing consumer demands, with each brand losing brand strength amongst their key consumer markets. Research conducted by Brand Finance suggests that these brands are failing to evolve with ongoing trends, while smaller start up brands in the haircare industry are leveraging social media promotion to target a younger customer base and employ e-commerce to sell directly to consumers shopping at home.