The European Super League (ESL) is set to be a €2.5bn own goal. Brand Finance has been tracking the financial value of football brands for 15 years and this proposition is potentially the biggest shakeup to the game seen in that time.

We calculate that the ESL Founding Clubs are likely to lose a combined brand value of €2.5bn, but that number could potentially be as high as €4.3bn.

Richard Haigh, Managing Director of Brand Finance, commented: “For the ESL ‘Founding Clubs’ the prize seems obvious – more money – but this ignores the huge risk that fans won’t follow and neither will the money. There is outrage in the home markets from both fans and leagues alike, but it is not clear yet what the repercussions will be. Will fans vote with their feet and leave the clubs many have supported their entire lives? Will the leagues impose fines, or point deductions leading to relegation and further financial loss?”

In the most likely scenario, we estimate that the annual loss for the Founding Clubs will be €1.1bn in revenue a year and the brands will all suffer significant reputational damage, leading to a drop in brand value of €2.5bn. This loss is a combination of lower broadcasting, commercial, and matchday revenue. It assumes that the UEFA will not allow the teams to compete in Champions League and the national leagues also remove the teams from their rosters.

Our analysis indicates that not only would the move inflict financial damage on the Founding Clubs themselves, but also on the other clubs in their leagues, which may lose up to 25% of their brand value.

Hugo Hensley, Head of Sports Services at Brand Finance, commented: “In our view the result will be damaging for the clubs involved. The sentiment of fans online is overwhelmingly negative, with negative posts outweighing positive ones 3 to 1. Negative sentiment like this will inevitably lead to lower matchday spend and commercial revenue in the clubs’ home nations, which is still the lion’s share of any European club’s income.”

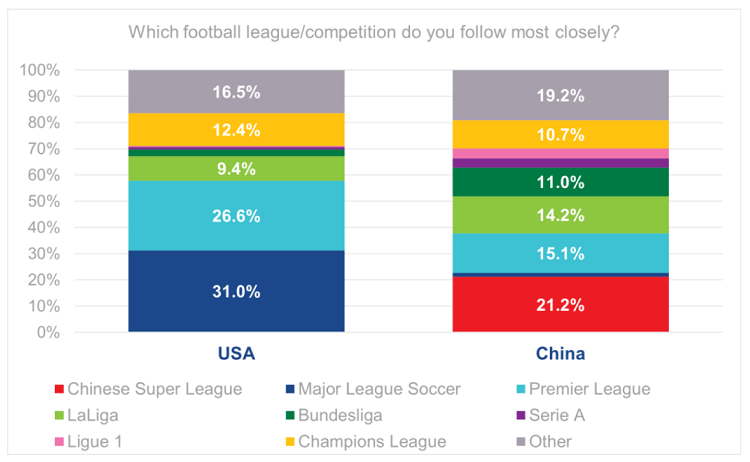

If not from the domestic markets, then the revenue will have to come from the US or China, but an uplift in either of these geographies seems unlikely. In both the US and China, the domestic leagues are by far the most popular as measured in Brand Finance’s Football Fan Survey. 31% of US fans prefer Major League Soccer and 21% of Chinese Fans prefer the Chinese Super League – and these numbers are already strengthening year by year. Both are countries that will more readily put their resources behind home grown team brands than foreign ones if the opportunity presents itself.

China is no longer an undeveloped market for European and North American football brands to grow. As we have seen in our studies of other industries, Chinese brands are growing fast. Many of these brands, like Evergrande, are starting to become household names in Europe and it is only a matter of time before we start hearing about Chinese Football clubs more regularly. The European Super League launch plays into their hands.

David Haigh, Chairman of Brand Finance, commented: “In 2011, President Xi Jinping announced his dream to see China win the World Cup, a dream many thought impossible, but as a result the game has received investment at all levels in the country. If the ESL Founding Clubs think that the Chinese market is a vacuum available for them to fill, they are in for a nasty shock when they discover there’s only one true ‘super league’ in China.”

Source:Brand Finance