In China, luxury brands are embracing WeChat as it opens up multiple easily accessible entry points for connecting with shoppers.

In China, luxury brands are embracing WeChat as it opens up multiple easily accessible entry points for connecting with shoppers.

Shopping online has never been more easy or intuitive in China than it is now. The country’s digital retail industry used to revolve around its major e-commerce giants, Alibaba’s Tmall and JD.com, but a leading social media platform in China is increasingly shaping consumer’s purchasing habits and global brands are jumping on board.

On June 19, European beauty retailer FeelUnique set up an e-commerce service within the WeChat app. More than one-third of Chinese consumers spend over four hours a day using the app, according to the World Economic Forum and Bloomberg Businessweek, using it for everything from paying their bills to messaging friends. FeelUnique’s new online store is entirely operated through a WeChat Mini Program, a lightweight sub-app that allows users to seamlessly browse and buy all of their cosmetics without ever having to leave WeChat.

“Our Mini Program represents an additional channel to drive consumer acquisition in China,” says Feelunique CEO Joël Palix. “It will leverage our existing WeChat presence—which includes an official account with over 100,000 followers and a WeChat store—by enabling customers to complete a purchase within the WeChat ecosystem.”

Since WeChat’s parent company Tencent first launched Mini Programs at the beginning of 2017, more than half a million have been developed, and more than one-third of users spend between $80 and $150 a month on them, according to Jisu App, completing transactions using Tencent’s own mobile payment system WeChat Pay. While companies create Mini Programs for all kinds of services, of those dedicated to e-commerce, Jisu App analysis finds that about one-third feature fashion and footwear brands. FeelUnique is one of the first pure-play cross-border retailers in China to develop a Mini Program.

WeChat’s social commerce model is not entirely unique to China; over the past two years, Instagram has been gradually rolling out a similar social commerce concept through shoppable posts that take users from a photo to a purchasing page with just one click. However, only five products can be listed at once. Facebook is also experimenting with commerce, but when it comes to the big brands, the social media platform is more about driving users to retailers than about becoming a retailer itself.

What makes WeChat’s efforts especially significant is that the app is more driven by key opinion leaders or influencers than its Western counterparts, says Thomas Graziani, cofounder of WeChat marketing consultancy Walk the Chat. “Influencers have a much higher price tag and generate tremendous sales,” he tells JWT Intelligence. “We all have in mind the Becky Li campaign, which sold 100 Mini Coopers in five minutes.”

In another sales “miracle,” when China’s leading WeChat fashion blogger Mr. Bags launched his own BaoShop Mini Program to sell his capsule collections with luxury brands on June 26, he sold out of his 300 limited-edition Tod’s mini backpacks in just six minutes. Each bag was priced at the equivalent of around $1,600.

Tencent first jumped into the online shopping arena by buying a stake in e-commerce platform JD.com in 2014, which allowed brands with official WeChat accounts to embed their online shops and later to create entire stores within their profile. Luxury brands were at first reluctant to step on board—globally, the digital arena has been a tough area for high-end brands to navigate because it means negotiating on luxury’s crucial aspects of exclusivity and tradition. However, the fact that nearly 95% of millennials, an important luxury market, are on WeChat, eventually made social commerce a no-brainer.

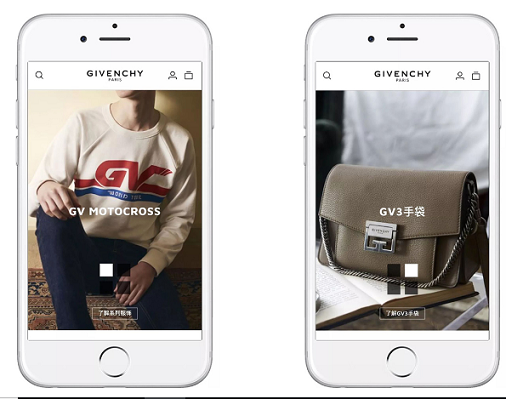

Cartier was among the first luxury brands to fully take advantage of being able to build an HTML5 store within its official profile page on WeChat in 2016, following a slew of brands doing pop-up sales or linking to their official online store. Since then, brands like Gucci and Louis Vuitton have followed suit, and Givenchy is the latest to launch a new WeChat boutique after first working closely with influencers and bloggers to sell exclusive products on the platform.

WeChat consistently develops new ways for brands and shoppers to engage with each other within its ecosystem. In March 2018, Tencent ramped up its efforts to catch up with e-commerce companies’ livestreaming pursuits, investing more than $1 billion in two Chinese livestreaming platforms. Soon after, L’Oréal harnessed a WeChat Mini Program to create a shoppable livestream event at the Cannes Film Festival. And in the household goods arena, Pinduoduo, a similar platform to Groupon, shot up to the number two e-commerce app in China in December 2017, gaining popularity by allowing users to gather WeChat friends to buy the same product, to get major discounts. And the social commerce craze shows no signs of slowing down.

“WeChat will keep rising as a main source for brands who want to trigger impulse buys,” Graziani says. “It is also a key component for new brands who want to tell their story via influencers. For more commoditized goods and brands, Tmall and JD will remain the main platforms. They are driven by search keywords, while WeChat sales are driven by social connections, impulse, and excitement.”

“WeChat will keep rising as a main source for brands who want to trigger impulse buys,” Graziani says. “It is also a key component for new brands who want to tell their story via influencers. For more commoditized goods and brands, Tmall and JD will remain the main platforms. They are driven by search keywords, while WeChat sales are driven by social connections, impulse, and excitement.”

Source;JWT Intelligence