Global advertising confidence rising rapidly, 4.6% growth forecast for 2018

Global advertising confidence rising rapidly, 4.6% growth forecast for 2018

Amid growing industry speculation about cuts to digital advertising budgets, Zenith has found no evidence that advertisers as a whole are shifting budgets away from online advertising – in fact, its share of global advertising expenditure continues to rise rapidly. Zenith forecasts that advertisers will spend 40.2% of their budgets on online advertising this year, up from 37.6% in 2017.

This growth in spend is part of the wider process of digital transformation, as advertisers invest in technology, data and innovation to revolutionise their relationships with consumers.

“We are observing sustained ROI from digital transformation,” said Vittorio Bonori, Zenith’s Global Brand President. “And we are now at the forefront of a transformation as brands shift budgets along the consumer journey, benefit from powerful algorithms and advanced machine learning techniques, and invest in new e-commerce solutions. This transformation is at the heart of driving brand growth.”

The concerns of global advertisers about the effectiveness of some digital media investments and the safety of the digital environment have been widely reported. However, a number of Zenith’s global research projects link brand experience impact and brand growth to progressive use of digital throughout the consumer journey.

New research from Zenith* demonstrates the value of investing in transformational digital marketing. We created a standard index of brand growth, comparing results from prominent studies and matching brand performance with a series of communications and media benchmarks. Initial findings indicate that the fastest growing brands within categories such as communications, financial services and automotive tend to perform strongly on measures such as share of category search and website traffic; along with effective content marketing and strong performance in earned digital media. For automotive brands, for example, there’s an 89% correlation between their ability to rise up the index and the traffic to their websites. For financial services brands, rising up the index has a 71% correlation with the popularity of their owned content, and for communications brands it has an 81% correlation with how much of their revenue they spend on advertising.

We have seen also clear correlations between brands with high capabilities in marketing and media, and categories in which digital channels have high influence on the consumer journey. This suggests a positive reinforcement between the recognition of the digitisation of consumer behaviour and the positive transformation of marketing organisations.

Globally, advertisers continue to increase the share of their budgets allocated to paid digital channels. According to the March 2018 edition of Zenith’s Advertising Expenditure Forecasts, published today, online advertising grew by 13.7% in 2017 to US$204bn. It accounted for 37.6% of global advertising expenditure in 2017, up from 34.3% in 2016. This year we expect online advertising’s market share to exceed 40% globally for the first time, reaching 40.2%. In 2017 online advertising already accounted for more than 55% of adspend in three markets (China, Sweden and the UK), so there is plenty of potential for further growth. By 2020 we expect online advertising to account for 44.6% of global adspend.

Of course the rise in online advertising tells only part of the story of digital transformation. Rapid as the rise of online adspend has been, the rise of advertising tech has been much faster. Zenith tracked the revenues of 14 listed ad tech companies between 2010 and 2016, and found that their revenues grew five times faster than online revenues over this time. Companies have also invested heavily in innovation – since 2010, companies in the OECD have increased their investment in research and development three times faster than they have increased their adspend.

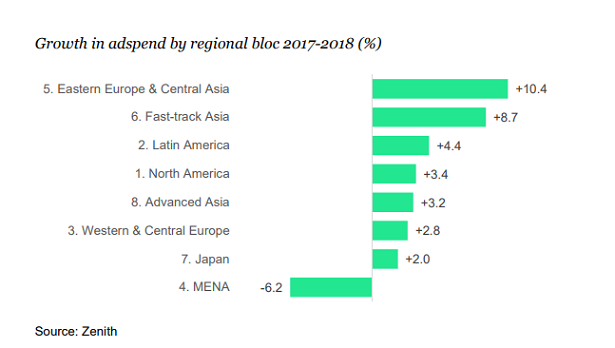

Biggest upgrade in global adspend forecasts for seven years

Confidence in the global ad market is currently improving rapidly. In December we forecast that global adspend would rise by 4.1% in 2018, towards the bottom of the 4%-5% annual growth range that the market has maintained since 2011. We now expect the market to rise by 4.6% this year, thanks in particular to improved economic growth in China and Argentina. A 0.5 percentage point revision to our forecasts is unusual; the last time we revised them upwards by so much was back in March 2011.

China’s economy has surprised analysts with particularly strong growth in early 2018, with industrial production and infrastructure spending beating expectations. Investment in manufacturing has picked up, and business confidence has increased. We now expect adspend to grow 8% this year, up from our 6% forecast in December. China is the world’s second biggest ad market, accounting for 15% of global adspend, so an upgrade here has a big effect on the global total. A notable development here is that television has fought back against strong competition from online video and is no longer losing adspend, which it did in 2014, 2015 and 2017. We expect 1% growth in television adspend in China this year, alongside 13% growth in online advertising.

Argentina has recovered from its 2016 recession more rapidly than expected. GDP grew 2.8% in 2017, beating the IMF’s forecast of 2.5% growth, fuelled by construction, agriculture and foreign investment. We now forecast that adspend will grow 1% in Argentina this year, up from our previous forecast of 2% decline, as consumer spending starts to rise again.

Our global forecasts for 2019 and 2020 are also above the forecasts we made three months ago, though not by so much. We forecast 4.4% growth in 2019 and 4.3% growth in 2020, both forecasts being up by 0.2 percentage points.

“The global ad market grew by 4.0% last year,” said Jonathan Barnard, Zenith’s Head of Forecasting and Director of Global Intelligence. “After a jump in confidence, we now expect it to grow substantially faster this year, boosted by the Winter Olympics, football World Cup and US mid-term elections.”

*Zenith’s study took six independent studies on brand growth – Millward Brown Brandz, Seigel & Gale Brand Simplicity Index, Interbrand Top 100, NetBase Brand Love study, Brand Finance Top 500 and the European Brand Institute’s Top 100 – and combined them into a single index of growth. It then analysed how this new ranking correlated with financial performance, media activity, digital activity, and the performance of owned and earned content.