Connected cars far from mainstream as auto brands struggle to sell benefits

Connected cars far from mainstream as auto brands struggle to sell benefits

25% of car owners aren’t actively using their connected car’s features – a figure which includes 11% who don’t even know if their vehicle has the technology according to a new study of the attitudes and purchase behaviour of more than 8,500 consumers across Europe, North America and China by one of the world’s largest research agencies, Kantar TNS.

The findings show that despite investing vast amounts in embedding new technologies and services to create a market that is predicted to be worth €113 billion in 20201, auto brands are struggling to convince owners of the benefits of their new features. In fact, more than half (56%) of drivers who accessed these services at the time of car purchase either don’t plan to, or are unsure whether they will renew them in the future.

“We are seeing car manufacturers competing for market share by differentiating their offer with ever-more sophisticated technologies and services,” said Vincent Groen, Global Connected Car Lead, Kantar TNS. “But we’re not yet seeing this translate into embedded and habitual usage among car owners. Worryingly, we found a clear disconnect between what manufacturers are producing and what the car owners are looking for.”

Unconnected connectivity

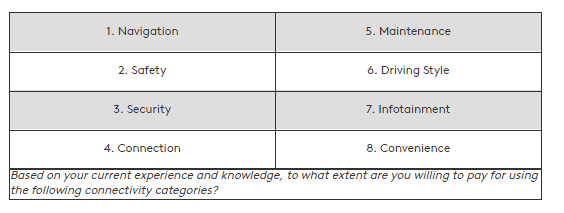

Kantar TNS finds that for many owners, the technology is still seen as an optional extra and not an intrinsic or embedded part of the vehicle. This highlights a stubborn perception gap given the role that technology and connectivity can play in the vehicle’s performance, safety and the driving experience. The study finds that six out of ten respondents globally would pay for driver related services such as navigation features – a figure which falls to 50% for entertainment features where buyers often prefer to use well-known apps on smartphones rather than in-built services in their cars. Across all regions, it’s clear that it is premium brand owners that are leading the way in terms of the adoption of connected features, with a higher proportion of premium owners willing to pay for connected features when compared with mainstream brand vehicle owners. For example, whilst 67% of all car owners cited navigation features as something they would be willing to pay for, this rises to 74% when looking at only premium car owners. This pattern is played out across the categories and shows that the investment in connected features by premium brands is now reaping rewards in terms of consumers’ willingness to purchase.

The study finds a large number (42%) of owners are ‘aware but are uninterested’ in autonomous driving systems on vehicles – although this falls to 14% in China, home to the world’s most ‘tech-savvy’ car owners.

China stands apart from other mature markets in terms of its attitudes towards technology. The study found that Chinese drivers are more receptive to connected features such as navigation assist, with 65% of respondents in China embracing these features, compared to only 40% of European and 32% of North American respondents. They’re also more receptive to infotainment features such as social networking and music/video streaming, with 40% choosing these options for their vehicle compared to 13% in Europe and North America.

Perhaps unsurprisingly, the Chinese market also represents the greatest opportunity for auto brands to introduce other innovations. The study found greater openness to the wider CASE innovations (connected, autonomous, shared and electric driving) than in other markets with interest in the technologies significantly higher than in other markets: self-driving cars (75% in China versus 24% in North America and 36% in Europe), cars that are either fully or partially powered by electricity (79% in China versus 29% in North America and 53% in Europe) and car sharing (68% in China versus 8% in North America and 21% in Europe).

Vincent Groen commented: “Car manufacturers have an opportunity to make connected features more accessible, personalised and relevant to the driving experience. To do this, automotive brands must demonstrate the relevance of connected features for car owners, increase usage and build trust, both of the safety of the vehicle itself and the security of data. They must alter how they sell connected vehicles and demonstrate the new technology in person, simplify the features and integrate them into the vehicle purchase, instead of presenting as an optional extra.”

The trust equation

Auto brands are in a strong position when it comes to perceptions of safety and security among drivers, as they enjoy significantly more trust than their tech rivals – 37% of consumers trust car brands with their data compared with 18% for companies such as Google and Facebook. The issue of trust is most pronounced among the Nordics (Sweden, Norway, Finland, Denmark) and Germany where the figures are 51% and 49% in favour of the car manufacturer. Aside from security and privacy, demonstrating how technology can improve driver and passenger safety will also appeal to consumers – with 44% of the users of connected features globally saying it is an attractive feature.

Show me the benefit

There is further good news for car manufacturers as the study shows there’s a strong appetite for connected vehicle purchases, with over half (North America: 52%, Europe: 53% and China: 79%) of consumers planning a connected vehicle as their next car purchase, with an overwhelming majority of people (64% in both the Europe and North America) looking to their car dealers for guidance on these emerging technologies. Interestingly the dealer channel preference drops to 25% in China, highlighting the dominance of online communication in this market. This can be attributed to the high adoption rate of technology in the country, which has resulted in multiple channels been embraced in this significant market.

Vincent Groen concluded: “In the minds of many car owners, connectivity is complex. Rather than following the ‘build it and they will buy’ model, auto brands have an opportunity to grow their market share by simplifying their features, aligning them with the core customer wish list and by communicating the benefits more effectively within their existing marketing channels. In mature markets such as in Europe and North America, it’s clear that for now, dealer networks still have a big role to play here as trusted players in the path to purchase. In China – a market that is leading the way in the adoption of these kinds of connected features – the reverse is true. Here a multichannel approach is key, automotive brands must prioritise online to ensure a presence at the dominant touchpoint for car owners in this market.”

Source:TNS Global