KEY TAKEAWAYS

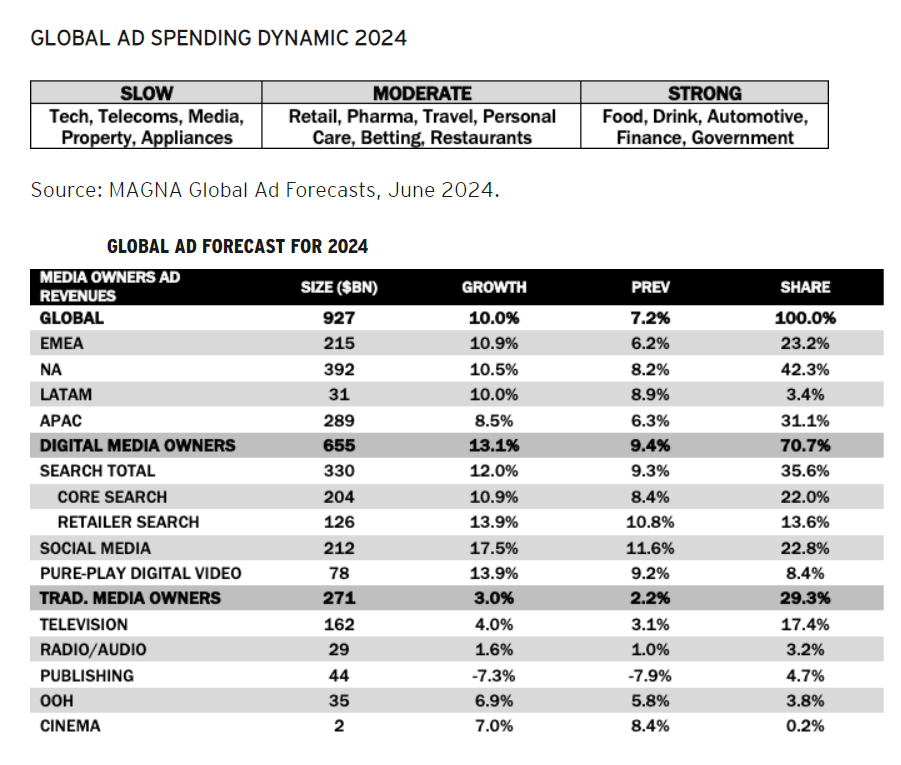

The summer update of MAGNA’s “Global Ad Forecast” published Monday June 17 predicts that global media owners’ advertising revenues will reach $927 billion this year, growing by +10%.

MAGNA is raising its 2024 growth forecast following a stronger-than-expected ad market in the first quarter (+12%) and an improvement in the economic outlook (real GDP growth +3.2%, US +2.5%).

The advertising revenues of traditional media owners (TMO) – from the television, radio, publishing, and out-of-home media industries – are expected to grow to $272 billion, a +3% increase that represents a noticeable improvement compared to 2023 (-4%).

TMO ad sales are driven by a record number of cyclical events and a +11% growth in TMO’s non-linear ad sales (e.g. ad-supported streaming +18%) that are now accounting for one quarter of total TMO ad revenues.

The advertising sales of Digital Pure Players (DPP) will increase by +13% to reach $655 billion.

DPP ad sales are boosted by increased competition in ecommerce (e.g., Temu and Shein targeting European and American consumers), the rise of retail media networks ($146 billion this year), and better monetization of short vertical videos in video apps and social media apps.

Keyword Search remains the largest digital ad format, growing by +12% to reach $330 billion this year. Social Media owners (e.g., Meta, TikTok) accelerate (+18% to $212bn), while short-form pure-play video platforms (e.g., YouTube, Twitch) grow by +14% to reach $78 billion.

Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experiencing economic difficulties and slower-than-average advertising spending (both +8%).

The US ad market will grow by +10.7% this year to $374 billion. Traditional Media Owners ad sales will grow by +4.4% to $111 billion while DPP ad revenues will expand by +13.5% to $263 billion.

Automotive and CPG/FMCG brands will be among the fastest-growing ad spending verticals this year, while Finance re-accelerates and Government expands due to the many elections taking place this year.

Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report, said: “Based on MAGNA’s analysis of media companies financial, advertising revenues were much stronger than expected in the first quarter of 2024. Coupled with some improvement in the macro-economic outlook, this leads us to increase our full-year global advertising growth forecast from +7.2% (December 2023 update) to +10%. All categories of media owners are faring better than expected so far this year, including traditional media owners and, specifically, television and premium long-form video. The introduction and rapid development of ad-supported streaming in more markets by nearly all streaming players (now including Prime Video) is driving non-linear TV ad sales by +16% this year, and total TV ad sales by +4%. Non-linear forms of television are finally reaching scale in terms of viewing and advertising monetization.”

The summer update of MAGNA’s “Global Ad Forecast” predicts media owners net advertising revenues (NAR) will reach $927 billion this year, growing +10.0% over 2023. This is a significant acceleration on the global growth recorded in 2023 (+6.4%). Neutralizing the impact of cyclical events in 2023 and 2024, the normalized acceleration is still real but more modest: non-cyclical ad revenues grew by +7.5% in 2023 and will grow by +8.7% in 2024.

A record number of cyclical events are taking place in 2024, including four major sports tournaments (Paris Olympics, UEFA Euro 2024, Copa América hosted by the US, and the ICC T20 Cricket World Cup hosted by the US and the West Indies), and general elections in five major markets (Mexico, India, US, France, and the UK). The first three elections take place in countries with little or no restrictions to political advertising, therefore moving the needle in terms of advertising sales. Overall, the 2024 cyclical events will provide 1.3% extra growth to global ad revenues this year, 5% extra growth for television, 0.5% extra growth for digital media, and almost 2% extra growth for the US market alone.

MEDIA: TMO DIGITAL SALES GROW DOUBLE-DIGITS

MAGNA was always expecting a strong ad market in the first quarter of 2024, due to a comp effect (1Q23 was extremely weak). Based on our analysis of media companies’ first-quarter financial reports, 1Q24 was an even stronger than expected. Year-over-Year growth average +12% in key markets, +17% in Spain, +15% in France, and Germany. Quarterly growth rates will gradually slow as comps become tougher in the second half, but this strong start of the year, coupled with a stronger economic outlook led us to raise the full year 2024 forecast for almost every individual market we monitor, bringing the expected global growth from +6.4% in December, to +10% now. The full-year ad revenues of traditional media owners are now forecast to grow by +3% instead of +2%, and the ad sales of digital pure players are now expected to grow by +13% (previously +9.4%).

Traditional media owners (TMO) historically focusing on Television, Audio, Publishing, OOH, and cinema media, will grow ad revenues by +3% globally in 2024, to reach $272 billion.

TMO’s non-linear ad sales (e.g., ad-supported streaming, digital audio, publishers’ digital ad sales) are now accounting for +25% of total TMO ad revenues and supporting advertising growth while traditional linear ad sales are stagnating. Ad-supported streaming is taking off in 2024, as traditional TV players (e.g. Disney+, Max, ITV Hub, Joyn, TF1+, etc.) and pure streaming players (Netflix, Amazon) will generate at least $18 billion this year (+16%). Amazon has already introduced an ad-supported tier on Prime Video in most large markets in the first half of 2024, including the US, Canada, Mexico, France, Germany, Italy, Spain, and the UK. Everywhere users are defaulted to the new ad-supported tier, and MAGNA believes most users will permanently remain on that tier, rather than upgrade to a more expensive ad-free tier. Other streaming platforms are introducing such ad tiers in more markets (e.g., Max in Latin America in Feb. 2024) while the rising cost of ad-free options makes the ad-supported tiers increasingly attractive.

Cross-platform television remains the largest traditional media with total ad sales reaching $162 billion this year (+4%) as media owners benefit from cyclical events and rapid growth of ad-supported streaming. Publishing ad sales will remain subdued (-3% to $44 billion) while Radio ad sales reach $29 billion (+2%).

After finally catching up with the pre-COVID levels in 2023, OOH media continues to show significant organic growth (+7% to $35 billion) driven by additional screen units generating digital OOH growth (+12%, reaching almost 40% of global OOH ad sales), and by omnichannel programmatic spending.

Digital Pure-Play (DPP) media owners, offering Search/Commerce, Social, Short-Form Video, Static Banners, and Digital Audio ad formats, will reach $655 billion this year, growing by +13% over 2023, and accounting for 71% of total ad sales. DPP ad sales are fueled by multiple organic growth factors including the rise of ecommerce, the rise of retail media networks providing much needed consumer data to the programmatic ecosystem, growing digital penetration in emerging markets, and better monetization of the rapidly growing short vertical video formats in social and video apps.

Keyword Search will remain the largest digital advertising format, reaching the $330 billion milestone driven by Retailer Search (e.g., Amazon and product listing ad retail media, +14% to $126 billion) and Core Search (e.g., Google, Bing, Baidu, +11% to $204 billion). Social Media ad sales (e.g., Meta, TikTok) will grow by 17.5% to $212 billion), while Short-Form Pure-Play Video platforms (e.g., YouTube, Twitch) will expand ad revenues by +14% to $78 billion.

MARKETS: INDIA AND SPAIN AMONG THE MOST DYNAMIC

The economic outlook is the primary factor behind advertising spending decisions, and economic activity is so far stronger than previously expected this year. In its April report, the IMF raised its 2024 GDP growth forecast for the world (from +2.9% to +3.2%), for the US (from +1.5% to +2.7%), for China, India, and Brazil. The forecast was lowered, however, for France and Germany, but as it happens these two markets will benefit from hosting major sports events to support marketing and advertising activity. Meanwhile inflation is slowing down everywhere and expected to hover between +2% and +3% in most large markets, which is still above the long-term target of monetary institutions but low enough to no longer hurt the sales and marketing efforts of CPG/FMCG brands.

Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experience economic difficulties and slower-than-average advertising spending (both +8%).

In the US, media owners ad revenue will increase by +10.7% to $374 billion. The US remains the largest and most intense ad market in the world with advertisers spending $1,100 per consumer in 2024; it’s 8 times more than the global average ($160), ten times more than China ($110) and a hundred times more than India ($10).

ADVERTISERS: AUTO AND CPG BRANDS OUTPERFORM

Automotive, Food, and Drinks will be among the fastest-growing industry verticals in 2024. Finance/Insurance re-accelerates. Government ad spending explodes due to the many elections taking place this year (India, Mexico, UK, and the US elections expected to generate more than $9 billion of extra ad sales this year)

Automotive brands were very dynamic in 2023 due to the increased levels of competition brought about by the electric transition, and the return of normal supply following the supply chain issues of 2021-2022 that inhibited car sales. After the 2023 rebound, car sales are slowing down in 2024 (Jan-May was still +7% in Europe, but only +2% in the US) but a continued push towards more EV releases, heightened competition (between traditional brands, EV pure players, and now Chinese newcomer brands), and major sports events will fuel above-average marketing and advertising activity this year.

Food and Drink brands were the main victims of the high levels of inflation in 2022 and 2023, as marketers were forced to increase retail prices to meet rising cost, making them increasingly vulnerable to consumer downtrading and retailer brands. Food, Drinks and other CPG/FMCG categories chose to concentrate on retail media at the expense of traditional media during that period. Now that inflation in commodity costs and consumer prices is under control, marketers are comfortable returning to normal levels of brand advertising budgets and taking advantage of the marketing opportunities offered by major sports events, while still developing retail media by re-allocating in-store marketing budgets to support ecommerce.

Among industry verticals expected to be dynamic, Finance/Insurance is strong as the industry is finally recovering from several headwinds in recent years: COVID, the Crypto rise and burst (and now rising again), and high interest rates that hurt segments like mortgages, loans, and credit cards.

The Retail industry will show moderate advertising activity overall, as an average between traditional brick-and-mortar brands slowing down from mature levels of marketing spending, and new ecommerce brands like Temu and Shein developing their share of voice aggressively.

MAGNA is expecting below-average advertising growth from several large verticals. Technology and Telecoms will continue to show subdued marketing and advertising activity as tech innovation slows down and tech brands focus on profitability rather than growth. Media/Entertainment brands also focus on the bottom line and have fewer-than-usual new movies and shows to advertise in 2024 due to the 6 months hiatus in Hollywood production in 2023. Finally, after a spectacular post-COVID rebound in 2021-2023, the Travel industry is slowing down this year, and so will the pace advertising spending. Some segments are still growing however, including business travel and cruise ships, with additional capacities to fill in 2024.

MEDIA OWNERS: DIGITAL CONCENTRATION GROWS AGAIN

The MAGNA report also provides estimates on media owners ad revenues, based on media companies’ financial reports. It reveals that global media vendor concentration grew again in 2023. After stagnating in 2022 and the first half of 2023, the global advertising sales of digital media giants re-accelerated in the second half of 2023. The main factor behind the revenue slowdown between mid-2022 and mid-2023 was the rapid rise of short vertical videos in social and video apps, and the weaker advertising monetization that initially ensued for vendors like Meta and YouTube. Monetization finally improved from 3Q23, and quarterly growth rates have been strong for all major vendors ever since.

Full-year 2023, Google, Meta, and Amazon organic ad revenues increased by +6%, +16% and +24% respectively. The big three now attract a combined 60% of total advertising revenues outside China ($417 billion out of $698 billion), up from 57% in 2021-2022. Including China – where they don’t operate – they control 49% of global ad sales.

Among the world’s top 20 vendors, Amazon (+24%), Bytedance/TikTok (+18%) and Apple (+23%) posted the strongest growth in advertising revenues in 2023 while most traditional media companies reported declines in global ad sales: Comcast (-16%), Disney (-9%), Warner (-12%) and RTL (-4%). JCDecaux was the only top traditional media owner to grow ad sales in 2023 (+3%).

In the first quarter of 2024, the leading global digital vendors reported the strongest growth rates in more than two years. Based on MAGNA’s analysis of financial report, global Search ad sales grew by +16% year-over-year, pure-play video by +21% and Social Media by +28% year-over-year. Quarterly growth rates are bound to slow down as comps will gradually get tougher, but MAGNA anticipates double-digit growth for all key digital formats and vendors this year.

FOCUS ON THE US

Media owners advertising revenues are forecast to reach an all-time high of $374 billion this year, growing +10.7% over 2023. This is 1.5 percentage points above our previous full-year forecast (+9.2% in our March 2024 update), following a stronger-than-expected start of the year (+12% in the first quarter) and an improvement in the macro-economic outlook – with the latest GDP growth forecasts raised to a robust +2.5%. The macro-economic factor offsets slightly lower cyclical expectations, as our political advertising forecast is reduced following by weaker-than-expected fundraising in the first few months of the year. We still expect the 2024 election campaigns to generate $9 billion dollars of incremental advertising revenues for US media owners this year, an increase of +10% vs 2020.

The +11% increase in ad spend will disproportionately benefit digital pure players this year (+13.5% to $263bn), with Search and Retail media ad revenues growing +13%, Social Media and Short-Form digital video up +16%.

Traditional media owners ad revenues will reach $111 billion (+4.4%). Non-cyclical revenues, however, will shrink by -2%. Local TV will capture more than 60% of the $9 billion of incremental ad sales driven by political advertising, directly through campaign spending at high media rates, and indirectly through the airtime cost inflation caused by the extra demand in battleground states. Full year ad revenue will grow by +25% for local TV stations and local cable, while non-political ad sales would be down by -4% this year. Other traditional media will not benefit from such a massive boost. National TV, Audio Media, and Publishing will be flat or down this year, and OOH will be the only other traditional media to grow ad revenues.