YouGov’s FMCG Report 2021 offers a high-level overview of changing shopping behavior during the pandemic in 17 global markets

In the UAE, online delivery was more popular for grocery shopping during the pandemic than click and collect services, and is likely to remain popular in the future

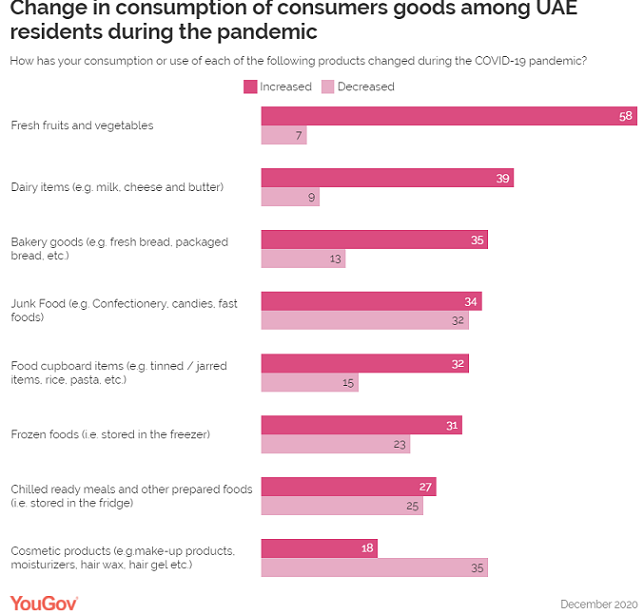

Consumption of fresh fruits and vegetables increased while usage of cosmetics decreased among UAE residents during this time

A large proportion intend to support local businesses and buy sustainable products once the pandemic has ended

YouGov’s FMCG Report 2021 reveals over half of UAE residents (54%) intend to use online shopping and delivery services in the future, once the pandemic is over.

YouGov’s ‘International FMCG Report 2021: Consumer goods in a crisis’ provides a high-level analysis of consumers’ attitudes to fast-moving/consumer packaged goods across 17 global markets. The white paper is based on more than 18,000 interviews and explores how the COVID-19 crisis has affected the FMCG/CPG sector worldwide across a range of categories.

In all the 17 surveyed markets, a plurality of consumers said their shopping habits have changed during the pandemic. In the UAE, three-quarters of residents made this claim.

Our research shows Covid-19 has not stopped people from visiting supermarkets. An average of 81% of consumers across the 17 markets in our study bought groceries or household essentials in-store in the month prior to being asked. Having said that, a large proportion used the online medium to buy household items.

In the UAE, three-quarters (75%) bought items in-store amidst the pandemic, while nearly half made purchases online: either through delivery or click & collect services.

Online delivery was much more popular than click-and-collect services in all the markets, except France. In the UAE, a 27-percentage point gap exists between consumers who get their shopping delivered to their doorsteps (38%) and those who pick it up (11%).

Although supermarkets remained a strong format during the pandemic, many people have pledged to support local retailers, perhaps due to the impact of the pandemic on the local businesses.

Across all 17 markets, three in five consumers (60%) said they intend to support local businesses and buy local products more once the pandemic has subsided. Beyond supporting local businesses, many global consumers are also considering doing more to help the planet.

Consumers in the UAE have good intentions in this regard. Nearly two-thirds claim to support local businesses (64%) and buy more sustainable products (66%) once the pandemic ends.

Impact on FMCG categories

Our data shows that during the pandemic consumers have responded in different ways to different FMCG/CPG categories.

Across all 17 markets, 35% said they eat more fresh fruit and vegetables, while just 6% said they eat less.

In the UAE, people were eating more fresh food (58%), but consumption of junk food and chilled meals remained static.

Consumption of dairy items increased for two in five (39%) consumers (decreasing by 9%), while more people ate baked goods (35% increase vs. 13% decrease), food cupboard items (32% vs 15%), and frozen foods (31% vs 23%).

Globally, cosmetics appears to have particularly struggled during the crisis: 27% of respondents across the 17 markets said they are buying fewer products in this category. In the UAE, the consumption decreased for 35% consumers, and only 18% increased their use of cosmetics.

Talking about the whitepaper, Imran Ahmed of YouGov said, “The COVID-19 pandemic has created both challenges and opportunities for brands operating within the broad FMCG sector. What they are consuming and how they are purchasing it have both seen shifts as a direct result of the ongoing pandemic with a clear focus on healthier options being consumed and a notable shift towards more remote purchasing options being opted for in the UAE. Whether these changes will be long-lasting or short-termed remains to be seen, as we enter the second year of the crisis but what is clear is that FMCG players would benefit from a better understanding of consumer sentiment in the categories they operate within, to be better prepared to address changing customer preferences.