New Study From Adjust Shows App Economy Resilient In The Face Of COVID-19

New Study From Adjust Shows App Economy Resilient In The Face Of COVID-19

The outbreak of COVID-19 has upended economies throughout the world, including the App Economy. A multitude of government measures aimed at halting the spread of the COVID-19 virus, from social distancing and shelter-in-place to lockdowns and travel restrictions, have caused major disruption as countries around the world rally to halt the virus’ impact.

While the App Trends 2020 Report focuses on long-term trends based on data from 2019, we have included an analysis here from data gathered in Q1 2020 to provide some perspective of how COVID-19 has affected the App Economy so far.

Report also sheds light on differences between paid and organic installs, noting that app marketing is fast becoming a pay-to-play game as marketers build up paid activities

The outbreak of COVID-19 has upended economies throughout the world, but one in particular has shown extraordinary resilience: The App Economy. Global SaaS company Adjust’s annual App Trends 2020 report, which looks at long-term trends based on data from 2019, includes valuable insights into how COVID-19 has affected the app economy by comparing Q1 2019 and Q1 2020 figures.

The data shows that many app verticals are seeing increases in sessions and installs in 2020, most notably in the Business, Food & Drink, and Gaming verticals:

With the pandemic forcing the majority of employees to work remotely, it’s no surprise that Business apps have seen a huge rise in sessions (up 105% from Q1 2019) and installs (up 70%). Revenue events are also up 75%, as users opt for premium versions to help ease the transition to working from home.

As many restaurants are forced to turn to takeout-only, Food & Drink apps also saw a significant increase in sessions — up 73% on this time last year, while installs increased by 21%.

Gaming has also seen a large uptick in installs, as those sheltering-in-place seek entertainment. In the last week of March, the vertical saw an 132% increase in the number of installs compared to last year. In total, Gaming apps saw a 47% increase in sessions and 75% increase in installs in Q1 2020 compared to Q1 2019.

“Beyond these increases in installs and sessions, the report shows little evidence to suggest that there’s been a fundamental shift in user behavior post-install,” said Paul H. Müller, co-founder and CTO of Adjust. “Users are still taking the same actions in-app, such as averaging a little above two sessions a day, to churning at predictable points in the customer journey.”

The report also sheds light on differences between paid and organic installs, noting that app marketing is fast becoming a pay-to-play game — as the market becomes increasingly competitive. The number of installs from paid sources amounted to 30% of total installs in 2019, up from 24% in 2018.

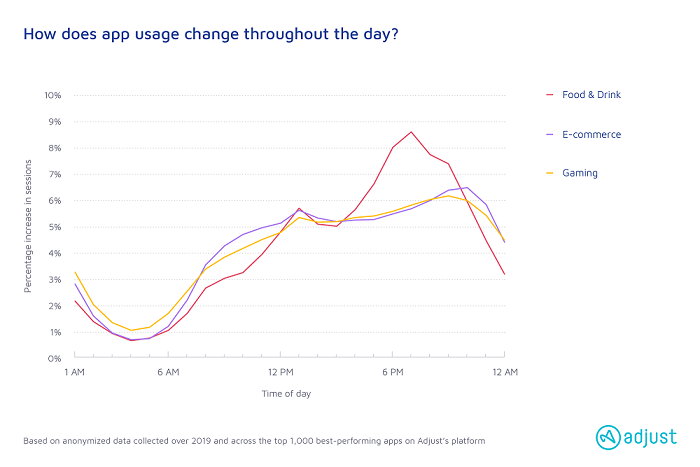

Additionally, the report explores when users typically engage with app verticals throughout the day, offering insights into peak times and the windows of opportunity for reactivation campaigns:

E-commerce apps see a peak of sessions both at lunchtime, between noon and 2 p.m., and again in the evening, with sessions between 7 and 10 p.m. accounting for a quarter of their daily total. Similarly, Food & Drink apps see a spike in use between 5 and 8 p.m., accounting for 31% of their total daily sessions.

On the other hand, many Gaming apps don’t see significant shifts in use throughout the day. Casual game activity increases between 12 and 4 p.m., but it’s a modest jump of only 15%. Meanwhile, Mid-core games rise from very early in the morning (5 a.m.) to peak at 1 p.m.

Post-install trends

Users are becoming more app-focused. According to eMarketer’s Mobile Trends 2020 report, “time spent on mobile web is gradually declining, while time spent in apps is steadily increasing.” The report found that in 2019, 90% of time spent on smartphone devices was in-app.

This represents a consumer shift marketers must be aware of, and capitalize on. This section focuses on the post-install metrics that matter: sessions and time spent, to see how different verticals compare.

Key Findings-

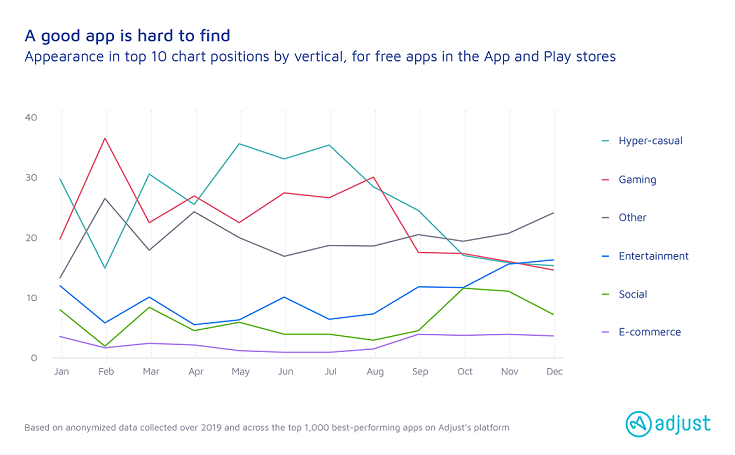

• Gaming receives high scores throughout the year. The average Growth Score hovers around 40.3. But it’s not a high-flyer for the entire year — the Growth Score for Gaming decreases by an average of 15% around December, a typical phenomenon for the vertical. Though Gaming is a constant pastime, users are always trying out new titles. For this reason, Gaming is a high-churn category, and this drop (despite high scores throughout the period) is a reflection of this changing dynamic.

• E-commerce apps have a relatively low Growth Score in 2019, holding at just 18.22. But there are strong differences depending on the type of e-commerce. The Growth Score for Shopping, for example, dropped 13% over the year, while Marketplaces (apps that allow users to sell to each other) increased by 4%. It may be that the steady MAU and lower churn is linked to the social nature of Marketplace apps, and the wider assortment of goods on offer, keeps users interested and coming back.

• Streaming apps were the growth winners in 2019. Video streaming saw its Growth Score jump 74% from January to December. By comparison, Music apps grew by only 4%.

The top three takeaways from the report-

1.The current state of the market means newcomers have a difficult time in breaking through. As such, marketers are advised to build up their paid activities and focus less on organic. One tip to improve paid? Marketers have to make sure that campaigns are tied to the seasons and the contexts that allow you to engage and retain valued customers.

2.App marketers are looking to a broader range of networks to find new audiences. Our findings show that across the board, there is more experimentation with networks. So open the aperture of your view, but don’t go all in — the more you succeed, the more you have to handle. Alongside fraud prevention, marketing automation promises to unlock this potential, giving marketers more time to manage even more campaigns.

3. The importance of re-engagement differs depending on your vertical, but many app marketers agree that not enough emphasis is placed on retargeting. In 2020 this activation technique could take more of the spotlight — Shopping leads the pack, but others could follow.