Spend rising across all product sectors

Spend rising across all product sectors

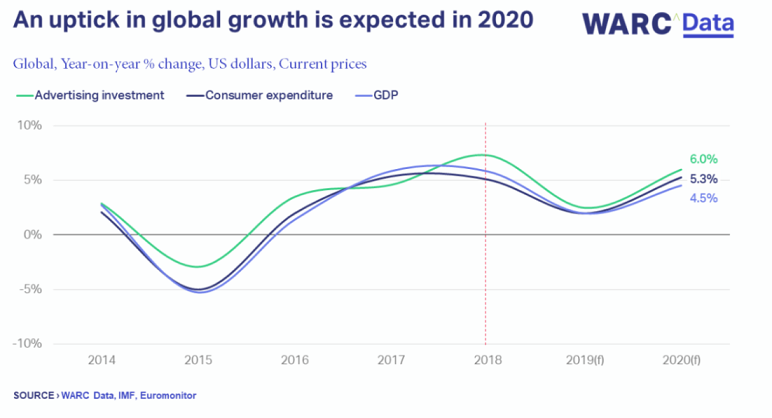

An uptick in growth is expected next year – buoyed by rising adspend on Google, Facebook and Amazon – but a global recession may loom

WARC, the international marketing intelligence service, has found that advertising spend is set to rise next year across all 19 product categories monitored by WARC, culminating in global growth of 6.0% to $656bn. This is a marked uptick from the 2.5% rise estimated for 2019 but is down on the 7.3% growth recorded last year.

Eight product categories are set to increase advertising investment ahead of the global rate next year: financial services (+11.8%), household & domestic (+10.5%), transport & tourism (+9.0%), telecoms & utilities (+8.5%), technology & electronics (+8.4%), alcoholic drinks (+6.9%), automotive (+6.8%) and soft drinks (+6.5%). Internet is the fastest growing ad medium in each sector except technology & electronics, where out of home (OOH) is set to rise fastest at 11.4%.

Globally, internet formats will account for over half of advertiser investment for the first time in 2020, with a combined value of $336bn. Investment in performance marketing, online video and social media is driving total market growth; advertiser investment excluding money spent on Facebook, Google and Amazon is flat or falling globally.

Global ad investment is flat without the Triopoly

Internet formats, combined, will account for over half of global ad investment for the first time in 2020, and social media, search and online video – the largest of these – are effectively shorthand for Facebook, Google and (Google-owned) YouTube. Google and Facebook, known as the ‘Duopoly’ drew two-thirds of online ad investment in 2018 before traffic acquisition costs (TAC) were paid out to Google’s partners, and WARC expects this share to rise closer to three quarters next year.

Amazon is small by comparison but is becoming increasingly important to advertisers looking to connect with consumers close to the point of purchase. Amazon’s share of global ad investment is forecast to rise to 2.5% next year, Alphabet (Google and YouTube) 23.1%, and Facebook 12.9% (38.5% combined). The central role these three companies – known collectively as the ‘Triopoly’ – play in advertising is stark: advertiser investment beyond them has been flat since 2012.

All product categories are expected to see growth in 2020

Growth in advertising investment is expected to be recorded within all 19 product categories monitored by WARC next year, although rates vary substantially.

The financial services category leads with a projected 11.8% rise in spend to $53.4bn next year, as brands, particularly in the banking sector, are looking to connect with younger consumers on social media to inform often lifelong choices over their account provider. More than half of sector investment is directed towards online formats.

The retail sector – the largest in this analysis – is expected to post the lowest growth next year, though a 2.6% rise would still be the strongest since 2013. Competition is fierce, from supermarkets to restaurants, and incremental dollars are mostly spent online, with TV, radio and print down over recent years.

Elsewhere, consumer packaged goods (CPG) sectors such as soft drinks (+6.5%), food (+4.9%), and toiletries & cosmetics (+2.9%), are all expected to increase advertising investment in line with rising consumer spend.

James McDonald, Managing Editor, WARC Data, and author of the research, says:

“Weak macroeconomic indices, waning business confidence and rising geopolitical tensions have increased the possibility of a recession in 2020. Within this climate, our forecast of six percent growth in global advertising investment may seem optimistic, but these projections are in line with those from the IMF and Euromonitor for GDP and consumer spend, respectively.

“Incremental adspend during quadrennial events – the Tokyo Olympics and US presidential campaigns – may be muted next year but will still have a positive net contribution to global growth, as would a stronger yuan and a business-favourable ‘Brexit’. Advertisers also intend to increase spend on Google, Facebook and Amazon properties, with global media spend ultimately flat elsewhere.”